First-home buyer numbers fall to near eight year low despite improving housing affordability: REIA

Improving housing affordability is failing to encourage first-home buyers to step onto the property ladder – in fact the exact opposite is happening.

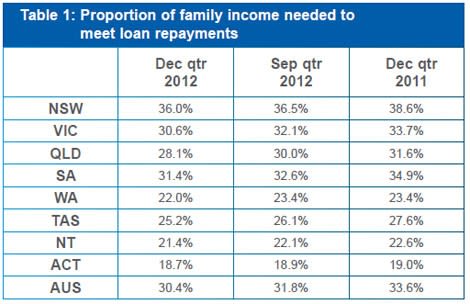

Despite the proportion of income required to meet loan repayments decreasing 1.4 percentage points to 30.4% over the December quarter, the number of new finance commitments to first-home buyers decreased 9.1% over the quarter and 17.4% over the year to be at their lowest level since the March quarter of 2005, according to the latest Adelaide Bank/REIA Housing Affordability Report.

The report found that first-home buyers made up just 16.5% of the market over the December quarter compared to 19% in the September quarter.

This trend looks set to continue with mortgage broker AFG recording first-home buyers as accounting for just 12.9% of home loans arranged by the group over February, down from 13.2% in January.

First-home buyer numbers fell dramatically in NSW from 11,117 in the December quarter of 2011 to just 4,459 in the December quarter of 2012, according to the REIA.

In comparison first-home buyer numbers increased in Victoria over the same time frame from 6,528 to 7,169 and also increased in WA from 3,699 to 5,014.

REIA president Peter Bushby says that largely due to a higher average income, the ACT remains the most affordable state or territory in which to buy a home, with the proportion of income required to meet loan repayments at 18.7%.

“Though the proportion of income required to meet loan repayments decreased to 36.0%, New South Wales remained the least affordable state or territory in which to buy a home,” he adds.

“Compared to the 2011 December quarter, all states and territories recorded improvements in housing affordability, the largest in Queensland and South Australia.”