Rental yield most important in down property markets

Rental yield in the property industry is a very important thing. It can mean the difference between having a successful, thriving portfolio and holding property that is as fragile as a house of cards. The Oxford English Dictionary defines "yield" in many different ways. The direct (and most obviously relevant) to property investing, is this one:

Yield: noun; the income produced by a financial investment, usually shown as a percentage of cost.

Yield can also be defined as a submission to a greater influence:

Verb; the income to surrender or submit, as to superior power

A very different use for the word, but still appropriate in the property industry, in that, sometimes you must surrender to market conditions and reassess other ways to stay afloat during the harder times.

Yield is effectively the percentage return you get, month in, month out, when holding investment property. It is the day-to-day revenue coming in after your running expenses (mortgage, managing agency fees, repairs and maintenance, etc), are deducted. It should not be confused with capital growth. This is defined as the difference in market value of an asset from the time of acquiring it, to the time of selling it on. So in a utopian world, any investment property or portfolio of properties would achieve both; supply the owner a stream of revenue whilst holding it (yield); and then providing a lump sum of revenue in the form of return when selling it on later in life (capital growth).

The reality is this isn’t always readily achievable. Market conditions, along with a barrage of complex variables in the marketplace at any given time, can upset or confuse the degrees of yield and/or capital growth that a property can deliver. As many of you are well aware, we are facing particularly challenging times in Australia in the last couple of years, during which capital values in some markets have remained flat.

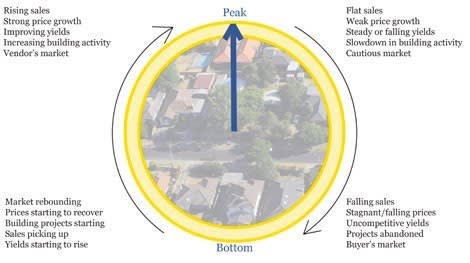

This has happened before and will happen again. Property goes through cycles, and this occurs on both micro and macro levels. This means there is a general nationwide cycle, full of peaks and troughs, grouped and classified by averaging out the record-ble figures on a national scale. But then there are micro cycles, in which specific states, cities and even individual suburbs can also go through their own peaks and toughs.

The variance of say, one particular suburb can produce seemingly contradictory and mixed messages about what stage of a cycle a market may actually be in. On average, a full property cycle, from upswing (increasing values) to peak (values at the highest possible range) to downswing (values cooling) to stagnant (values bottomed out) typically lasts around seven to 10 years.

This is where having higher yield can help to see investors through the “rough patches” of the leaner phases of any property cycle. Yes, in November 2012 we are facing some new macroeconomic challenges – a slowing local (and global) economy, a softening of international demand in the resources sector, banks going belly-up – but even under these conditions, there is always opportunity for those of us in property to better weather these storms and come out on the other side less damaged as a result.

In fact, unlike historical slow property cyclical phases, where interest rates were comparatively higher and demand for rental property (in most markets) was not as strong as it is today, I’d argue that this “rough patch” might not be so bad for savvy investors.

Interest rates are very low, which already reduces holding costs greatly. Also, demand for rental property in most markets remains strong, and this is unlikely to change any time soon. I say this after observing the slowing of construction project application approvals in several states and territories and the less-than-great state of the construction market in general (residential property and non-residential alike). Demand is unlikely to weaken for residential rental accommodation in most markets any time soon. In short; they cannot build them fast enough. Additionally, a significant portion of the property that is being built or planned to be built in the next five years is not being built in the high-demand areas where it is needed most.

So, providing you are holding well-located property in relatively high-demand areas, this can only be a good thing for demand – and thus the top dollar that your tenants are willing to pay – for your property. So when capital growth is in a paused, slow, or even negative-growth stage, within a property cycle creating better cashflow, or yield, will help see us through the tougher times.

So, here is a list of ways you can look to improve cashflow and thus increase your yield in your investment properties. Most of them appear quite logical – there are no secret recipe tips here – but I am constantly surprised to speak with other investors who have not considered some of these to improve their yield.

1. I’ll place this one first because it is the most obvious and easiest; but it must be said: Shop around for a better mortgage deal. Interest rates are at their lowest since 2008, and while there is evidence the RBA may add a further rate cut or two, now is a good time to find a better deal, or at least consider fixing say 50% of your loan(s) for the next few years.

2. Shop around for a more cost-efficient property manager, but make sure the level of service remains the same. With more investors experiencing a challenging market together, property managers effectively must work harder and better for their management fees. So if you are not happy with your current agent or feel their fee structure does not reflect the level of service they can offer, look to seek out a better deal.

3. If appropriate, consider an increase to your tenant’s rent rate. A common occurrence when markets experience stagnation in values, yet demand for residential property is high is that rental return increases. A good investor will at least annually assess a tenants’ rent rate, so whether this is upcoming, overdue, or has already been raised to market-appropriate level, now is a good time to check in on rates and plan for the next 12 months.

4. Depending on cashflow available and the nature of your property (if it’s a detached house on a large enough block) now may be the time to do up a cost-analysis spreadsheet to consider adding a granny flat. I am by no means suggesting that granny flat additions will be relevant for many, but for a few, taking advantage of aforementioned cheap finance and easier-than-ever council approvals may make a granny flat addition add to your gross yield significantly. Now may indeed be the best time to finance one.

5. Another less extreme way to add some more value but improve rental return is to do a cost-analysis for any improvements to the property. If your property is new or has been recently renovated, then this one is probably not relevant to you, but if your property is older and there is scope for mild renovation at a low cost (“cosmetic” renovation such as changing the wall paint, tiles, or adding built-in wardrobes, etc.) then now is a good time to assess how much this work would reward you with in terms of additional weekly rental revenue.

6. Hit that offset account harder than ever. Most investors use an offset account to park their savings and revenue, to make sure the amount of interest they are charged on their loan is minimised as much as possible at any given time. For those who don’t have an offset account set up, get one. For those who do, look for ways to economise your personal life and spending so that you can park more revenue against it and reduce your interest payments further. This will bring your holding costs down that extra notch and improve your yield. It may only add up to a saved $10 to $20 extra, per week, but every little bit helps.

Cameron McEvoy is a NSW-based property investor and maintains a blog, Property Spectator.