Furniture retailers need a revamp to keep up with changing housing decor tastes

Furniture sales have resembled a well-used couch over the past five years. Trading conditions across the furniture market have been affected by volatile demand across the housing industry along with fluctuations in disposable income, consumer sentiment and consumer tastes and preferences.

These factors created mixed results for furniture retailers, which culminated in sales falling by 1.7% per annum in the five years through 2011-12. Sales were also affected by increasing levels of competition from department stores and online shopping websites. Despite this, the overall furniture market remained resilient, offering consumers the latest trends in furniture fashion displayed in clever store layouts, eye-catching catalogues and through offering flexible terms of payment.

Industry revenue is set to rise by 1.5% to $7.3 billion in 2011-12. Consumer demand for furniture goods will be driven by growth in disposable income levels of 4.4% and a more stable trading environment evidenced by a rise across the domestic economy. However, sales will be affected by a decline in house construction and almost static change in interest rates. Sporadic shifts in consumer spending patterns along with continued demand for heavily discounted and promotional products will also characterise industry sales for the year.

The industry will remain subject to intense competition from department stores and, in particular, online shopping sites, which have become a real threat to the future viability of the industry. In terms of total market size, merchandise retailed by furniture stores may also be purchased from department stores, fabric retailers, and online shopping and auction websites. IBISWorld estimates that the industry accounts for about 60% of total furniture retailing sales, with the remaining 40% of revenue derived from sales by other retailers. Hence, the total retail market for furniture items is estimated to average about $12.2 billion.

Furniture retailers will experience a steady trading environment over the next five years, with sales rising 2.1% per annum to reach $8.1 billion in 2016-17. Demand will primarily be driven by solid growth in disposable income levels, which will influence the quantity and quality of merchandise purchased by consumers. As a result, retailers may experience a shift in consumer preferences toward middle-market furniture. Sales will also be boosted by a recovery in consumer sentiment, which is expected to fuel growth in consumer spending power. Despite the positive trading conditions expected during the next five years, furniture retailers will continue to experience intense competition from external players, such as department stores and online shopping sites eager to attract a larger share of the market.

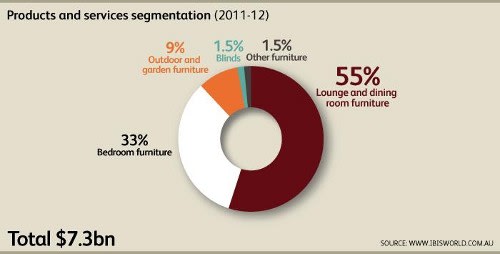

Product segmentation across the furniture retail market is largely guided by function and form. The relative share of each product segment has experienced modest change over the past five years. Changes in consumer tastes and furniture trends provided much of the impetus for growth across various product segments.

Lounge and dining room

Lounge and dining room goods dominate furniture retailing and account for about 55% of total industry sales. Items classified under this segment include lounge suites (single-seater, two-seater and three-seater couches and modular suites), coffee tables, lamp tables, dining tables and chairs, buffets and hutches. This segment experienced significant change over the past five years with regard to design and functionality. Key trends include the use of glass, chrome and steel to create a modern, sleek and at times futuristic look. While traditionally shaped furniture continued to fill showroom floors, consumers increasingly sought individual designs and colours to transform their homes into modern living spaces.

Bedroom

Bedroom furniture is the second-largest product segment for the industry, accounting for about 33% of total industry sales. Items classified under this segment include bedheads and footboards, side tables, tallboys, dressers and mattresses. Changing trends and fads also affected the range of bedroom furniture stocked by industry retailers over the past five years. International markets and seasonal colours significantly influenced product lines. Advances in technology notably affected the range and functionality of mattresses on the market.

Outdoor and garden

Outdoor and garden furniture experienced strong growth over the past five years, due to the increased popularity of outdoor entertaining, the importance of garden design and the trend toward incorporating the garden settings as part of a home living area. The industry thus experienced a rise in the range of outdoor and garden furniture available to suit all household budgets and garden spaces.

Blinds

Blinds experienced growing popularity, driven by growth in the residential building construction cycle and a change in tastes and trends. While blind styles such as Holland and Roman maintained a constant share of the total blind market, the industry experienced growth in demand for timber blinds.

Other

Other furniture, such as coat stands and consoles, remained a relatively small product segment for the industry. Demand generally stemmed from a limited consumer group, often consisting of older consumers or those with a higher level of disposable income who are able to afford additional furniture pieces.

Major Players

Harvey Norman Holdings Ltd accounts for 9% market share followed by Super A-Mart Holdco Pty Limited (5.8%) and Steinhoff Asia Pacific Holdings Pty Ltd (4.5%)

Industry Outlook

Furniture retailers will bounce back over the five years through 2016-17, with sales expected to rise 2.1% per annum. Intense competition from external operators, namely department stores and online shopping and auction sites will remain a real threat to the viability of operators across the industry over the next five years. However, the industry will rebound by offering consumers specialised service and a differentiated product range, and by ensuring that products on the floor match consumer demand and expectations. Consumer demand will also be driven by trends in the level of real household disposable income, the consumer sentiment index, housing construction, household formation and interest rates.

To purchase IBISWorld’s full report on Australia’s Furniture Retailing Industry click here.

This article originally appeared on SmartCompany.