CBD hotels deliver return of 18%: Report

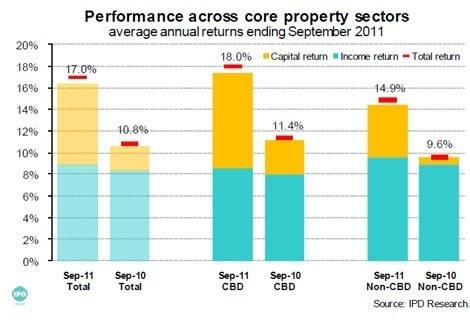

CBD hotels recorded a total return of 18% for the year ending September 2011, according to the Property Council of Australia/IPD Hotel Property Index, which provides a measure of investment market performance for the hotel sector.

The total CBD hotels return comprised a positive 8.5% income return and positive 8.8% capital growth.

Returns for investors in hotels outside of the CBD were less stellar, delivering a total return of 14.9% and underperforming the broader hotel market, which rose 17% for the year on the back of strong capital growth of 7.5%.

The stronger returns generated by CBD hotels was the result of them benefiting from higher occupancy rates than hotels in non-CBD locations.

The high demand for CBD hotels reflected strong business from corporate travellers and an undersupply of quality hotels rooms in major CBD markets, the report says.

Commenting on the report, Tony Ryan, principal of Ryan Lawyers, says that despite the high Aussie dollar and uncertainty in the traditional source market of US and Europe, CBD hotels, in particular, have enjoyed very strong total returns of 18% based equally on income and capital growth.

“With domestic corporate demand still robust, CBD hotels are hard to beat,” he says.

Anthony De Francesco, managing director of IPD in Australia and New Zealand, says the hotel sector has shown strong investment performance over the year to September 2011.

“This is in stark comparison to other asset markets which are suffering from soft returns due to adverse capital market conditions and an unfavourable economic climate.”

“Growth in occupancy rates has placed upward pressure on room rates and has resulted in strong investment returns.”

“We expect the hotel property sector to outperform the other competing core property sectors over the next few quarters.”