A-REITs slow but steady investments: Moody's

Steadily improving but far from spectacular - that’s the verdict from Moody’s on what investors should expect from their listed property trust investments over the next 12 months.

The rating agency has issued a “stable” rating for A-REITs.

Its analysts expect portfolio valuations to gradually improve in 2011 and into 2012, with “capitalisation rates tightening incrementally and net effective rents continuing to rise but at a modestly lower trajectory than in the past year”.

For the year to date, the S&P/ASX 200 A-REIT is down 4.73%.

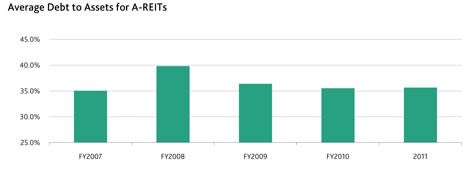

Moody’s September 2011 Australian Corporate Sector Outlook highlights the more conservative nature of A-REITs, with gearing levels well below 2008 borrowing ratios when the GFC crippled the sector.

“Liquidity has declined from traditionally high levels but should remain manageable at current ratings. Many issuers in the sector have taken steps to improve debt tenors and diversification,” the report says.

It also highlights the strength of A-REIT balance sheets, but warns that while there may be limited acquisition opportunities, ratings could come under pressure if trusts adopt a more aggressive capital management approach and raise gearings levels above “historically conservative levels”.

Source: Moody's

Retail and office A-REITS will face headwinds in trying to generate above-inflation returns due to poor retail spending and “a new, cautious outlook within the finance sector is affecting demand for office space, particularly in Sydney”.

“As a consequence, vacancy levels in Sydney’s central business district may not decline as quickly as previously expected although other Australian states’ capital cities continue to enjoy healthy demand,” the report says.

Gearing levels will remain relatively conservative, and valuations should continue to firm as net operating income continues to rise. These factors support the ratings and outlooks that we have on issuers in the sector.

Moody’s is forecasting that solid employment numbers (less than 5%) and GDP growth of between 3% and 4% will support demand for industrial and retail space, while a solid outlook for white-collar employment will underpin the office market.

It also forecasts more share buybacks due to most A-REITS trading at about a 25% discount to net tangible assets which could impact on leverage and risk levels.