Consumers far more hawkish than banks on interest rates: Westpac Redbook

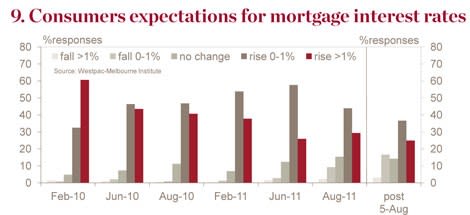

Westpac’s regular pronouncements of a rate cut have failed to sway consumers, with more than two-thirds expecting rates to rise.

The bank has backed up its rate cut expectations by lowering its three-year fixed rate product by 0.2% to 6.59% on home loans above $150,000

According to the latest Westpac Red Book, written by senior economist Matthew Hassan, the bank expects a 100 basis point rate cut by September 2012.

However, despite an easing of late rise fears following the global turmoil, 61% of consumers still expect rates to rise over the next 12 months.

Two out five consumers expect a 1% increase in the cash rate over the next year.

Consumers in WA and Queensland are the least hawkish, while those in South Australia, NSW and Victoria have the highest expectation of a rate rise over the coming year.

“The spread of consumer responses in August points to an average expected rise of 52 basis points over the next 12 months, in line with the consensus of economic forecasters,” says Matthew Hassan, senior economist at Westpac and author of the Red Book.

“Consumers can be excused for being in two minds on rates with a similar divergence apparent between the consensus view of economic forecasters (+50 basis points by Jun 2012), and futures markets (–150 basis points by April 2012) around the same time,” he says.

Source: Westpac Red Book

Industry bodies such as the HIA have said fears of interest rate rises are a key factor in the current stagnant housing market and drop in residential construction.

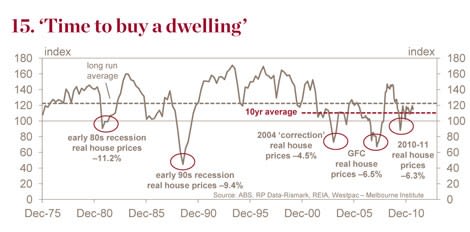

According to the Red Book, consumer sentiment about the housing market eased slightly in August, but still remains in positive territory.

Consumer views on whether now is a “good time to buy a dwelling’ fell by 4% in August following 9.8% gain over the previous three months.

Despite the fall the index remains above the 10-year average.

Housing sentiment has suffered the biggest fall in Western Australia, down 10% over the last three months and unemployment expectations up 40%.

“Although that may be surprising given the state’s resource sector exposure, the Perth housing market has been much weaker than the rest of the nation, especially price-wise,” Hassan says.

Source: Westpac Red Book

In comparison sentiment to buying a car fell 6.2% in August, with the index running slightly below its long-run average and at its lowest reading since August 2008.

Major lenders such as the CBA and ANZ have all made big cuts to their fixed rate mortgage products – often seen as an indicator that rates will fall.

Interest rates have not risen since November 2010.