Falling population growth beats Queensland

In a speech yesterday the governor of the RBA, Glenn Stevens, has touched on the apparent paradox of falling house prices in

According to RP Data-Rismark’s house price index, which the RBA publishes in its quarterly Statement on Monetary Policy, dwelling values in

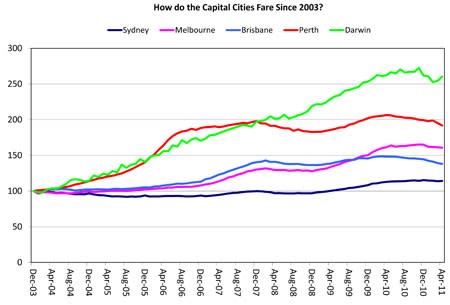

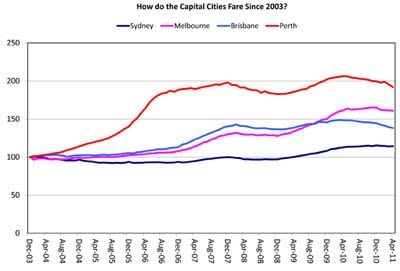

The chart below shows the performance of

It demonstrates that Perth and Brisbane house prices have actually outperformed their Sydney and Melbourne counterparts for most of the past seven years. It was only in the middle of 2009 that Brisbane capital growth was overtaken by Melbourne’s surging market.

Stevens argues that the striking differences in house price movements across Australia reflect the underlying demand and supply dynamics, which is a point we have also emphasised for years.

Stevens says: “It is hard to avoid the conclusion that changes in relative housing costs between states, while certainly not the only factor at work, have played an important role. Relative costs are affected by interstate population flows, but those costs then in turn have a feedback effect on population flows. This is particularly so for Queensland.”

“Queensland has had faster population growth than the southern states, as it has seen a slightly higher natural increase, a rate of net international migration on par with other states and a very substantial net positive flow of interstate migrants. Net interstate migration to Queensland peaked around 2003 – not long after Sydney dwelling prices had reached a new high relative to other cities.

“Interstate migration at that time was contributing a full percentage point a year to Queensland's population growth. By 2008 this flow had slowed a bit, but international migration had picked up and Queensland's population growth increased, peaking at nearly 3%. Western Australia's population growth was even higher, peaking at almost 3½%” Stevens says.

In 2002, house prices in Brisbane were just over half the level of equivalent homes in Sydney and Melbourne. Many people presumably decided to move up north to capitalise on the cheaper accommodation and strong labour market.

A similar pattern asserted itself in Perth.

Since the GFC, however, population growth rates in Queensland and Western Australia have slowed while the cost of housing converged back towards Sydney and Melbourne levels.

Today the median dwelling price in Sydney is $515,000, followed by Melbourne ($485,000), Perth ($468,250) and Brisbane ($430,000).

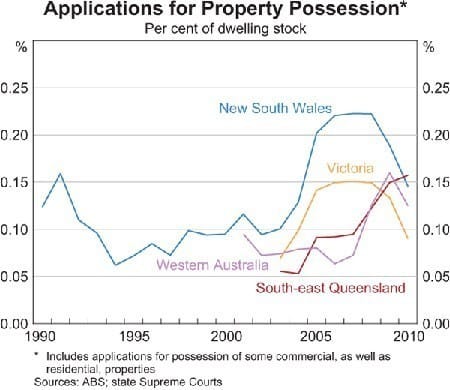

As the next chart from the RBA shows, there has also been a spike in repossessions of homes in Western Australia and South-East Queensland following the GFC, which is presumably another part of the story explaining the resources states’ relative underperformance in house price terms.

Another city that has clearly undergone a Perth-like structural change in housing costs is Darwin. I have added RP Data-Rismark’s Darwin dwelling value index to the first chart above, and the results are striking (see below).

Housing costs in Darwin have grown by more than 160% over the last seven years, which is well in excess of any other major city.

This too has been driven by a combination of soaring economic prospects, population growth, robust labour demand, and the fact that in December 2003 the median dwelling price in Darwin was just $190,000, or only 60% of the national capital city price.

Yet by April 2011, the median price of a Darwin home had risen to $442,500 or 94.5% of the national capital city median. That is, there has been a rapid convergence in the relative cost of housing across the country.