Melbourne CBD office market faces uncertain road ahead: M3 Property report

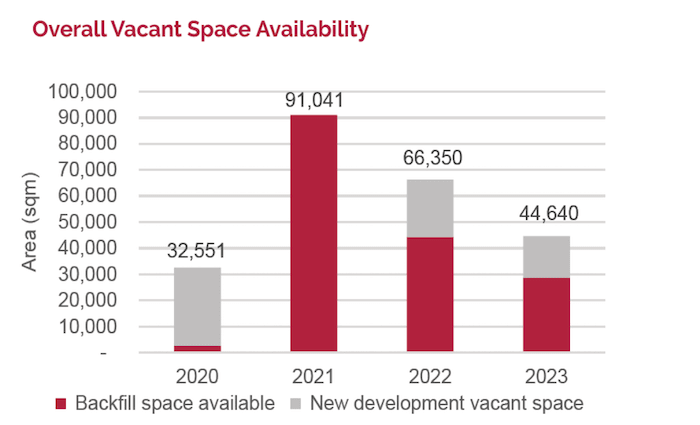

The total vacant space available for occupancy in Melbourne's CBD office market will be nearly 235,000 square metres over the next three years, however only 32,551 square metres is expected to be available in 2020.

That is according to the Melbourne CBD Office Market 2020 and Beyond report from M3 Property.

The bulk – more than 91,000 square metres - will hit the market in 2021, and a further 66,350 square metres will become available in 2022.

The report found that while the market has already been hit hard by the Coronavirus, with many tenants delaying new requirements, it is new development space already under construction that will be the key upward driver of vacancy over the next six months.

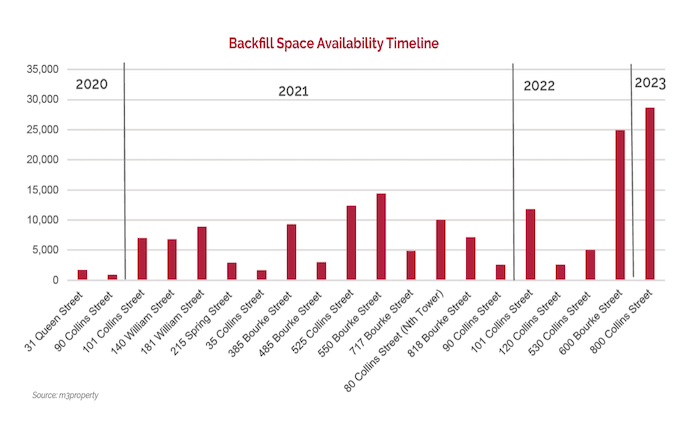

The good news, according to Director Commercial, Gary Longden, is that a potential blowout in backfill space, which may have dramatically amplified the vacancy carnage, now seems likely to have been averted by the extension of the JobKeeper program.

"There seems little doubt that employers would have faced the unenviable task of letting staff go without JobKeeper support and so the decision to prolong the package is pretty much a game changer, you might say, at least in the short term."

"In terms of vacancy it now seems more likely that we will see a much sharper upward trend over the next two years than we will see this year,'' Mr Longden added.

National Director Research, Amita Mehra, said tenants requiring space in the sub 3000 square metre range looked likely to punch above their weight in terms of their impact on the market's fortunes with the cohort responsible for the majority of tenant enquiries that had been put on hold indefinitely.

"This cohort contributed to a little more than 22 per cent of the total area required, but the indecision in that sector of the market may have a more profound short-term impact than those tenants with larger leasing requirements who, of necessity, need to plan much farther ahead"

"We expect requirements for space less than 3000sqm to be on hold for as much as 12-18 months with a potential increase in the probability of tenants exercising options over their existing leases,'' Ms Mehra said.

The report further found that the Business Services employment category - the second largest occupier of office space in the CBD - had the highest percentage of total jobs lost (7292) and that with current workspace space ratios in that sector at 17.36 square metres, the loss may result in 126,570 square metres of sublease or backfill space.

On the other hand the Finance & Insurance sector has been least affected with no jobs lost for the same March 14 to May 2 period.

Mr Longden said trend unemployment rates across employment categories and their impact on a building's tenancy profile may well have a negative result on building values.

Ms Mehra said m3property's analysis of the Coronavirus's potential impact on the Melbourne CBD vacancy rate had raised three forecast scenarios according to potential variations in tenant demand, net absorption and potential backfill space availability.

"With Scenario 1 - based on current economic and employment forecasts - vacancy would first peak at 6.51% by the end of 2021 and reach a second peak by the end of 2024 at 6.90%."

"Under Scenario 2 – based on the long-term average net absorption – we expect vacancy will rise to 6.73% by the end of 2020 and reach a second peak by the end of 2024 at 7.83%, and under Scenario 3 – based on the previous downturn net absorption averages – we see vacancy continuing to rise from the end of 2020 (7.33%) and reach a peak of 9.50% by the end of 2024,'' she concluded.