The Reserve Bank Governor paints a positive picture: Craig James

The Reserve Bank Governor Philip Lowe has indicated that the current level of interest rates is low enough to support the economy.

He hasn’t ruled out further rate cuts – especially if the jobless rate were to rise. But Governor Lowe has indicated that policy is appropriate for now.

The Governor is well aware that low rates are affecting “confidence of some people”. He also recognises that low rates could encourage further borrowing to buy homes and that this could to “problems down the track”.

So for now – with the jobless rate coming down and inflation gradually lifting – the Reserve Bank is happy to remain on the interest rate sidelines.

Despite bushfires, drought and the threat of coronavirus, the Reserve Bank is tipping economic growth near 2.75 per cent this year – near the economy’s speed limit.

The bushfires may cut economic growth by 0.2 percentage points across December quarter 2019 and March quarter 2020.

Global economy

The Governor is more upbeat on the global economy: “These (US-China trade agreement and Brexit) are encouraging developments and provide a reasonable basis to expect that this year will be better than last year.”

Governor Lowe also reflected on one of the themes that CommSec has been focussing on over the past year: “we find ourselves in a world of low unemployment, low inflation and low interest rates. I expect that we are going to remain here for quite some time given the structural factors at work, although it does remain possible that a re-acceleration of growth in economies with little spare capacity could see inflation re-emerge.”

Click here to enlarge:

“Some investors are also taking on more risk as they search for higher returns in a low interest rate world. Both higher asset prices and a willingness to take more risk can be good for the global economy, especially if they lead to more investment, not just more borrowing.

"We do, though, need to remember that it is possible to have too much of a good thing. So this is also an issue that international bodies, including the Financial Stability Board, are keeping a close eye on.”

Local economy

Our central forecast is for the Australian economy to expand by 2¾ per cent over 2020 and 3 per cent the following year. These growth rates are a little above our current estimate of medium-term growth in Australia, so some inroad into spare capacity should be made.”

“The expected pick-up in world growth should help us, the resources sector is in expansion mode again and we are expecting consumer spending to pick up. The outlook is also being supported by ongoing high levels of investment in infrastructure and the likelihood that the downswing in residential construction will come to an end later this year. Further increases in resource exports and continuing solid growth in public demand will also help.”

Specific topics

Governor Lowe focussed on three issues:

Ø the ongoing adjustment in household balance sheets

Ø the bushfires, the drought and the coronavirus outbreak

Ø the importance of continuing to invest in our future.

Household balance sheets

The Governor said “we expect consumption growth to strengthen as households become more comfortable with their balance sheet positions. “Higher home prices and lower unemployment will assist in lifting spending growth.”

· “So it is reasonable to expect that things improve from here, although it is hard to be precise about how much longer this period of balance sheet adjustment will continue.”

Bushfires & coronavirus

On the bushfires, the Governor said “In assessing the impact of this on the Australian economy as a whole we have taken into account that there will be a material rebuilding effort and that government grants and insurance payments will assist many people. On this basis, our assessment is that GDP growth for 2020 as a whole will be largely unaffected.

"There is, however, likely to be a noticeable effect across the December quarter last year and the current quarter. While it is still difficult to be precise, we estimate that the effects of the bushfires will reduce GDP growth by around 0.2 percentage points across the two quarters.”

On the drought, Lowe said: “A further decline of around 10 per cent in farm output is expected in 2020, representing a drag on GDP growth of around a quarter of a percentage point.”

On the coronavirus Governor Lowe said: “It is too early to tell what the overall impact will be, but the SARS outbreak in 2003 may provide a guide. On that occasion, there was a sharp slowing in output growth in China for a few months, before a sharp bounce-back as the outbreak was controlled and economic stimulus measures were introduced.”

Investment

The Governor again stressed that Australian businesses and governments need to invest.

“As I have said on other occasions, low interest rates should make it easier for both the public and business sectors to contemplate long-term investments, given that future returns don't need to be discounted as much. They also mean that financing costs are lower. With interest rates at record lows and likely to remain low for quite some time there are plenty of opportunities here.”

Monetary Policy

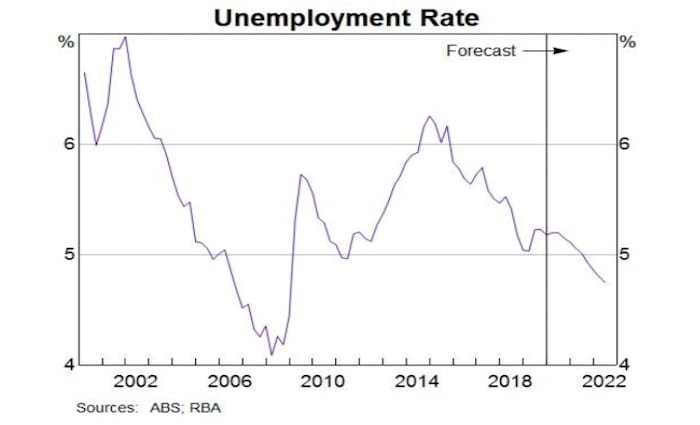

The Reserve Bank Governor said that “Over the next couple of years we expect further progress to be made towards full employment and the inflation target, although that progress is likely to remain quite slow.

Governor Lowe went on further saying that “The gradual nature of this progress reflects some significant structural shifts in the global economy related to technology and globalisation and, as I discussed earlier, a period of adjustment in household finances in Australia.”

Lowe added: “Monetary policy has already responded to this and is providing considerable support to the Australian economy.”

Click here to enlarge:

So monetary policy has acted. But what about further reductions?

Governor Lowe noted: “Given the outlook I have outlined today, the Board has, however, continued to discuss the merits of further monetary stimulus in an effort to speed the pace of progress and to make it more assured.

"On balance, though, the Board has decided to hold the cash rate steady, recognising the significant monetary stimulus already in place and the long and variable lags associated with monetary policy.”

“This decision also reflects a judgement about the benefits from a further reduction in interest rates against some of the costs and risks associated with very low interest rates.”

“It certainly remains the case that a further reduction in interest rates would help with the balance sheet adjustment by households with existing debt, which should help bring forward the day that consumption strengthens. It would also have a further effect on the exchange rate, which would boost demand for our exports and therefore support jobs growth.”

“On the other side of the equation though, there are risks in having interest rates at very low levels. Internationally, there are increased concerns about the effect of very low interest rates on resource allocation and their effect on the confidence of some people.

"Lower interest rates could also encourage more borrowing by households eager to buy residential property at a time when there is already a strong upswing in housing prices in place. If that occurs, this could increase the risk of problems down the track. So there is a balance to be struck here.”

“The Board recognises that the nature of this balance can change over time and that it depends very much upon the state of the economy. So it is continually looking at both sides of the equation.

"If the unemployment rate were to be trending in the wrong direction and there was no further progress being made towards the inflation target, the balance of arguments would change. In those circumstances, the Board would see a stronger case for further monetary easing. We will continue to monitor developments carefully, including in the labour market, as we seek to strike the right balance in the interests of the community as a whole.”

What are the implications for interest rates and investors?

Interest rates are set to remain low. But further rate cuts are ruled out for now. As a result investors will continue to favour investment in shares and property, rather than cash.

Watch the jobless rate. If it starts rising again, then the Reserve Bank may act on rates. But for now the jobless rate is falling, forward indicators are positive and housing demand is rising.

Consumer spending remains one of the big uncertainties for 2020 together with the coronavirus impact on the global economy.

Click here to enlarge:

Click here to enlarge:

CRAIG JAMES is the chief economist at CommSec.