Real estate records set in 2019 with markets likely in recovery mode in 2020: CoreLogic's 2019 wrap

EXPERT OBSERVERS

2020 is likely to see markets in recovery mode as housing prices catch up and then overtake their previous record highs, however the rapid rate of capital gains seen over the second half of 2019 is expected to lose steam as stock levels rise and affordability deteriorates, according to CoreLogic's Head of Research, Tim Lawless.

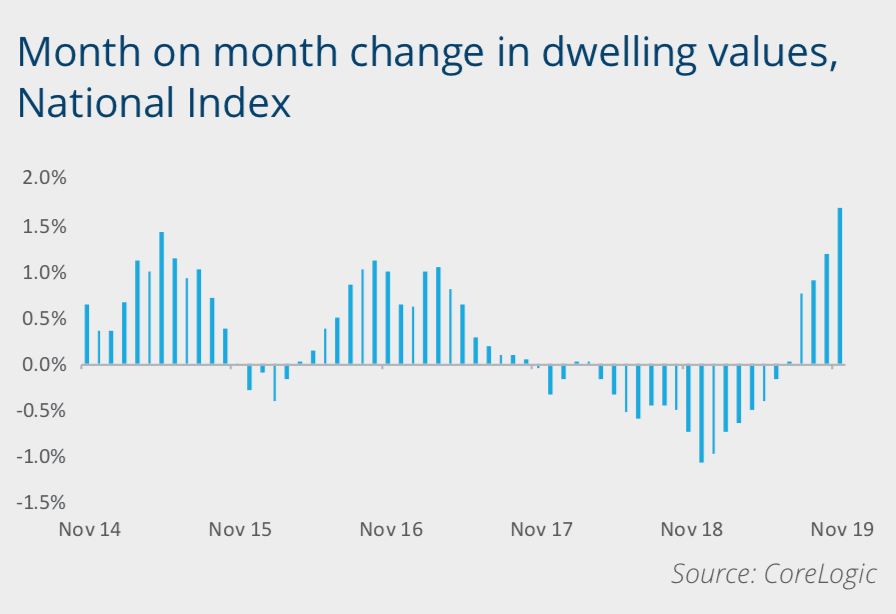

In 2019 the housing market moved through the largest and longest correction on record, followed by a fast-paced rebound in values through the second half of the year.

Housing turnover fell to record lows in 2019, as did new advertised stock levels.

Interest rates reduced to levels previously unseen, while the concentration of investors in the market also plumbed new depths.

At a national level, housing values were trending lower through the first half of the year, continuing a downturn spiral that commenced in October 2017.

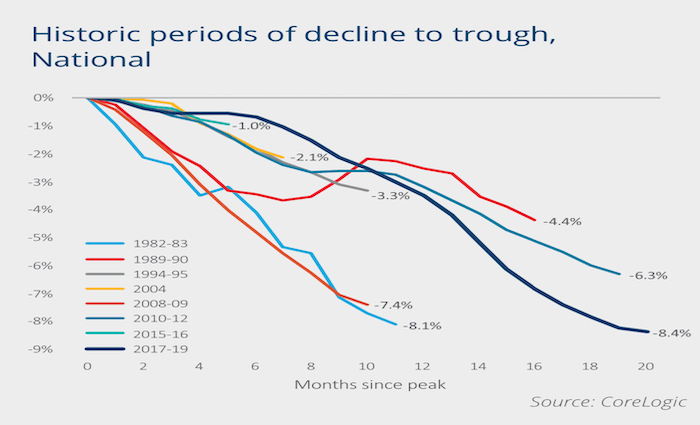

June saw CoreLogic’s national housing market index reach a floor after posting the longest and largest correction in housing values on record.

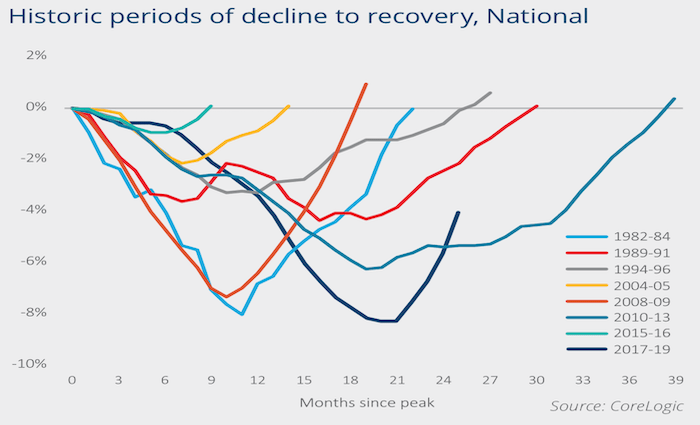

Between the market peak in October 2017, and the trough in June 2019, the national index fell by 8.4%. The previous record decline in national housing values was an 8.1% drop through the early 1980’s as the economy moved through a recession and unemployment peaked slightly above 10%.

"Larger peak-to-trough falls were recorded in Sydney (-14.9%) and Melbourne (-11.1%), where housing conditions had previously been the strongest. Of course not all the capitals found a floor in housing values through the year, with data through to the end of November showing that Darwin values were still trending lower, down a cumulative 31.5%, while Perth values posted a rare rise in November, but remained 21.6% below the 2014 peak," mr Lawless added.

Since reaching a floor in June, CoreLogic’s national index has rebounded by 4.7%, with the monthly growth rate in November the highest since 2003. Despite the recent recovery trend, housing values nationally remain 4.1% below their 2017 peak.

A variety of factors contributed to the housing values recovery over the second half of the year. Earlier in the year, a reduction in the rate of decline was supported by higher first home buyer activity and brought about by improvements in housing affordability and stamp duty exemptions in NSW and Victoria. However, the main contributors to a rebound in housing conditions were:

The positive effect of the federal government retaining power at the May federal election which removed the uncertainty around tax reform relating to negative gearing and capital gains discounts.

Cuts to the cash rate in June, July and October

And an easing in lending policy as APRA adjusted its rules around minimum interest rate serviceability tests; a move which acknowledged interest rates were likely to remain low for an extended period of time.

Tim Lawless is the head of research at CoreLogic.