Little relief in housing finance could trigger rate cuts: RBA March chart pack

The RBA held the cash rate firm at 1.5 percent at the March meeting, making it 28 consecutive meetings since the rates last moved.

There is growing expectation from economists, and pressure from housing markets, for the RBA to cut rates.

In February Westpac's Bill Evans was the first to forecast two rate cuts, one in August and one in November.

He was joined earlier this month by NAB's Alan Oster, who said cuts may come sooner, in July, and November.

The RBA March chart pack has given the central bank little relief from the expected looming rate cut by commentators.

The RBA's biggest concern will be to growing gap between the declining house prices and housing debt.

The pair have continued to go in opposite directions, and as far as the RBA is concerned, the wrong direction, for well over a year.

Household continues to hit record highs month after month, with no sign of debt, nor the house price decline, slowing down.

Click here to enlarge.

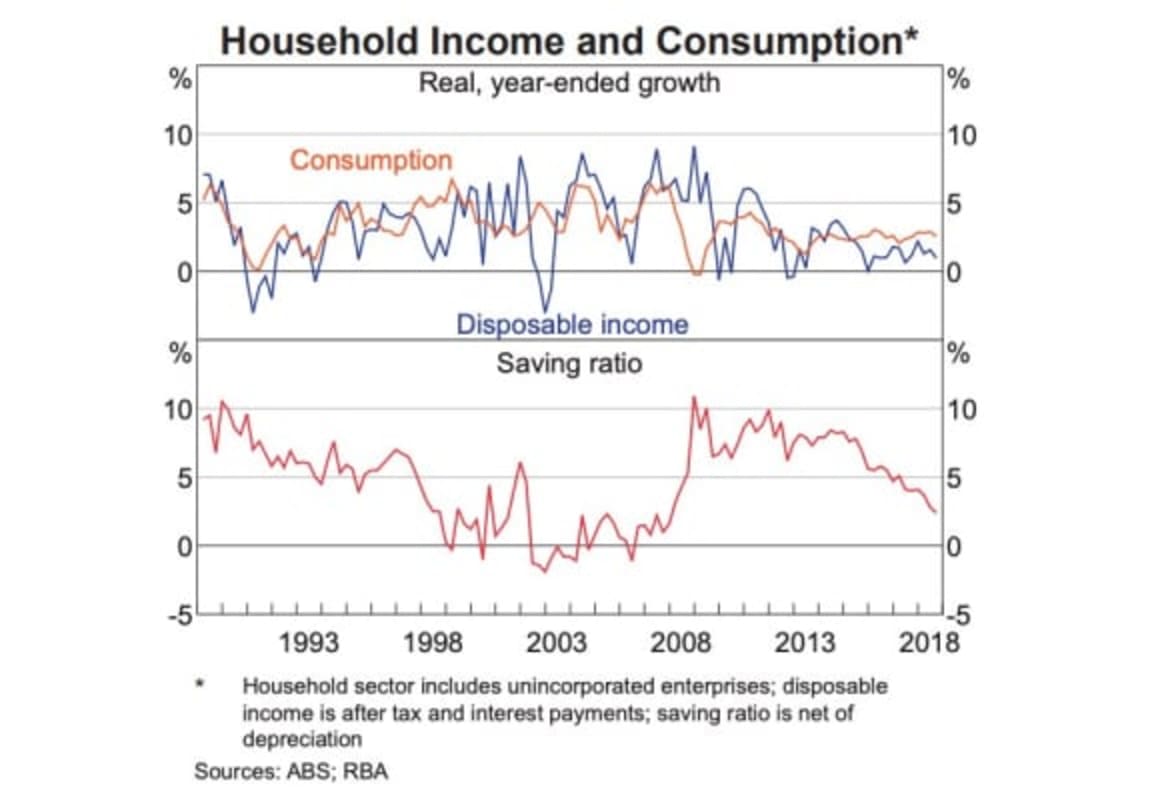

With house prices declining, home owners are cautious.

They're not wanting to spend money on unnecessary items until house prices have stopped declining.

Growth in consumption has been slow, but it is somewhat holding firm, unlike a households disposable income.

The average household's disposable income is declining toward levels not seen since half way through 2016.

Click here to enlarge.

Home loan approvals are continuing to decline across the board.

When house prices started declining and investors were hit with higher home loan rates, first home buyers were back in the driving seat.

But due to the continued declines, first home buyers are in no hurry to enter the market just yet.

Back in late 2018 Finder's RBA survey suggested tightened lending could affect the economy negatively.

However in February the RBA stressed that the tightening of lending was not the cause for the house price falls.

Click here to enlarge.

To see the full chart pack click here.