Lenders slash rates for property spring season

With the Springtime property season starting, lenders are going all the way to woo potential borrowers and grow their market share.

The latest to join the trend is HSBC, following moves by major banks such as Westpac and NAB.

Westpac recently announced it was cutting mortgage interest rates by up to 85 basis points and waiving fees on other products.

Comparison website Mozo too announced its list of the best home loans in the market, with the lowest product being Loans 3.64 percent variable rate.

The Essentials Variable 80 also didn’t have any ongoing fees, though it had an upfront fee.

In second place on Mozo’s list was the Newcastle Permanent Discounted Variable Home Loan product.

It too had a 3.64 percent variable interest rate, no upfront fees and allows a borrower to get a loan with just 5 percent deposit.

Close on its heels was UBank’s UHomeLoan which offered a 3.74 percent variable rate. It also has no ongoing or upfront fees.

Mozo said the product won in categories including best Low Cost, Split Home Loan and both Fixed and Variable Investor Loans.

Interestingly, the only lender that had two products in the top seven list from Mozo was Loans.

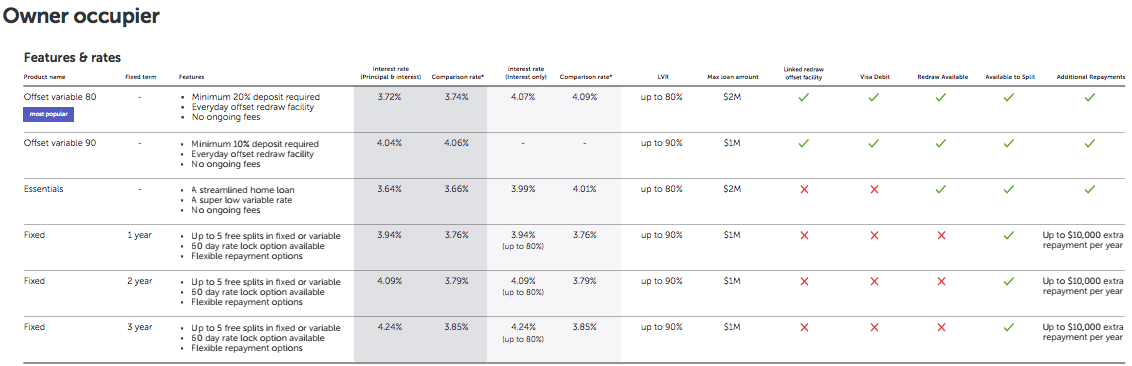

Its second product was the Offset Variable 80 which had a 3.72 percent variable rate. Again, the product has no ongoing fees though there is an upfront fee of $250.

Below is a table of offers for owner occupiers and investors from Loans.

According to Mozo, the product is well suited to borrowers looking for an offset home loan to help pay less interest and repay their loan faster. It's available to owner occupiers borrowing up to 80% of a property's value.

None of the Big Four banks were on the list.

On lower interest rate products, HSBC Australia’s head of mortgages and third party distribution, Alice Del Vecchio, said “lower rates in the market are encouraging customers to refinance their loans, but 25% of mortgage holders don’t know what their home loan rate is, making it harder for them to recognise the financial benefit of switching their loan”.

Del Vecchio added that its 3.65% p.a. rate can “make a huge impact on the savings over the life of the loan, not to mention freeing up money in the short-term with potentially lower repayments”.

A home owner with a $700,000 variable rate loan at 4.00% p.a. will save more than $40,000 over the life of the loan by switching to HSBC’s lower rate.

The bank also ran a survey, along with RFi Group, on 2,000 mortgage holders in Australia to get a feel for home owner attitudes and motivations.

Of those polled, 30% said speaking to a mortgage broker was one of the first steps towards refinancing a mortgage while 25% said they researched loans online.