Interest only loans in decline: APRA quarterly stats

Interest-only lending from Australian authorised deposit-taking institutions (ADIs) fell sharply in the June quarter.

“In flow terms, interest-only lending slowed to 30% of total new loans in the June quarter, down from 36% in Q1,” Tom Kennedy, economist at JP Morgan noted.

“As a result, the stock of interest-only lending contracted for the first time since 2009, with aggregate interest-only lending values slumping by $2.3 billion.”

Along with a slowdown in new interest-only lending and the outright decline in the total value of interest-only loans, Kennedy said that there was also evidence banks are becoming more selective in their loan criteria, particularly in regard to high loan-to-valuation (LVR) lending.

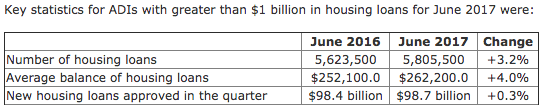

The number of housing loans by banks whose exposure to the residential market is more than $1 billion was up 3.2 percent in the June quarter compared with a year ago, according to the prudential regulator’s latest statistics.

The Australian Prudential Regulation Authority’s Quarterly Authorised Deposit-taking Institution (ADI) Property Exposures for the June 2017 quarter showed the number of housing loans for ADIs with greater than $1 billion in housing loans grew to more than 5.8 million compared with 5.6 million in the June 2016 quarter.

The new housing loans approved in the quarter edged up slightly at $98.7 billion from $98.4 billion in the year-ago quarter.

Similarly, the average balance of housing loans also rose to $262,200 from $252,100, a rise of 4 percent for the comparable period.