RBA's neutral bias reaffirmed: Gareth Aird

GUEST OBSERVER

The RBA left the cash rate unchanged at 1.5 percent at today’s meeting.

The recent data flow, coupled with RBA commentary, suggests the decision to leave policy unchanged was straight forward.

We have the RBA on hold at 1.5 percent throughout 2017 and well into 2018.

The RBA’s decision to leave policy unchanged today was no surprise. Governor Philip Lowe has made it crystal clear that concerns around rapid dwelling price growth and the level of household debt mean that the cash rate is unlikely go lower unless there is a sustained loss of momentum in job creation.

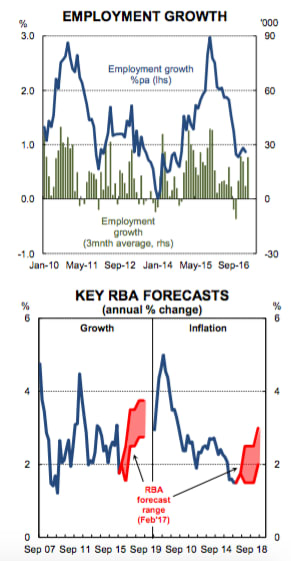

The strong, albeit questionable, March employment report has allayed fears at the RBA that the labour market was softening given the weakness in the February data.

There was very little to gain in the way of new insights in today’s Statement. In our view, the most noteworthy change was around the outlook for wages growth. Lowe expanded on last month’s assessment that “wage growth remains slow,” and added that, “this is likely to remain the case for a while yet.” We agree given the significant amount of slack in the labour market (see here).

The Governor commented on recent developments in the labour market and noted that although, “the unemployment rate has moved a little higher over recent months, employment growth has been a little stronger.” He also added that, “the unemployment rate is expected to decline gradually over time.” In other words, the Governor views the recent lift in the unemployment rate as temporary. We agree and would add that it was driven higher by rising participation.

On inflation, the Governor noted that the headline QI CPI, published last week, was “in line with the Bank’s expectations”. And that, “a gradual further increase in underlying inflation is expected as the economy strengthens”.

The rest of today’s Statement contained only cosmetic changes compared with the April Statement.

The outlook

Our monetary policy call has the RBA on the sidelines in 2017 and well into 2018. We see jobs growth sufficient enough for policy to remain on hold. But the risk lies with another cut given very weak wages growth, below target core inflation and an expected further downturn in hard commodity prices. In our view, the recent additional measures announced by APRA to address risks in the housing market marginally lower the hurdle for another rate cut. In that context, market pricing, which implies a 13 percent chance that policy is eased again, is a fair assessment of the balance of risks.

The near term focus for the monetary policy outlook turns to Thursday when Governor Lowe will speak at a luncheon. The title of his speech, “Household Debt, Housing Prices and Resilience” – suggests the Governor will once again emphasise the RBA’s reluctance to cut the cash rate from here.

On Friday the RBA publishes its quarterly Statement on Monetary Policy (SMP). The Bank’s near-term GDP forecasts may be nudged up a little, but underlying CPI projections are expected to remain unchanged.

Gareth Aird is economist at Commonwealth Bank and can be contacted here.