Ratio of household debt to income at record highs in Canada and Australia: RBA Governor Lowe

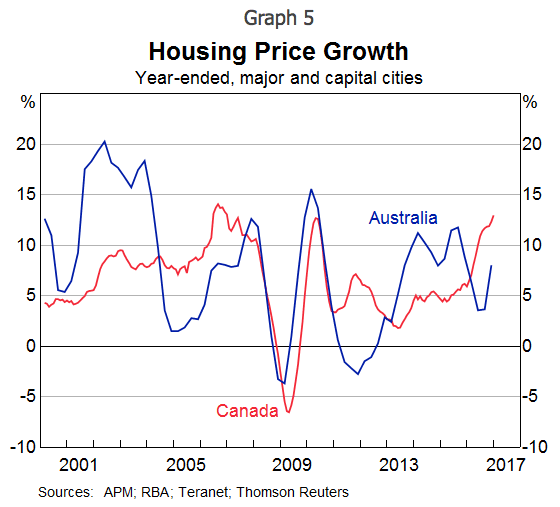

Housing markets in Australia and Canada have many similarities such as large increases in home prices in cities, high household debt levels and strong investor interest in property, says RBA Governor Philip Lowe.

He put his views across at the recent Australia-Canada Leadership Forum, saying, “We are both attractive places for non-residents to invest their savings. We both have growing populations. And we both have had to deal with very large increases in housing prices in some of our cities. With all this in common, it is not surprising that we find much to talk about and experiences to share.”

The 13th Annual Demographia International Housing Affordability Survey ranked Sydney as the second least affordable housing market behind Hong Kong. Canada’s Vancouver was ranked third.

Sydney’s “median multiple”, or the median house price divided by the median household income is 12.2 while Vancouver had a score of 11.8.

Other major Australian cities such as Melbourne, Adelaide and Canada’s Toronto too are not too far behind in unaffordability.

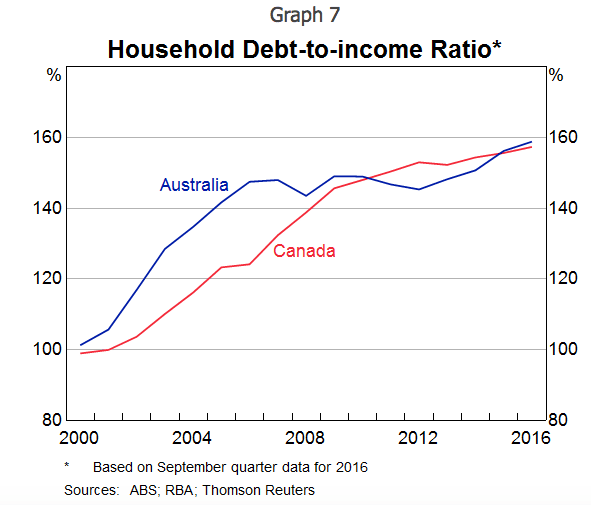

He also drew similarities on high household debt to income ratio, saying, “The increase in overall housing prices in both our countries has gone hand in hand with a further pick-up in household indebtedness (Graph 7).

“In both countries the ratio of household debt to income is at a record high, although the low level of interest rates means that the debt-servicing burdens are not that high at the moment.”

Another commonality was addressing the supply side of the housing market equation, with low investment in infrastructure contributing to high prices.

“Another characteristic that we have in common is that at a time of strong demand from both residents and non-residents, there are challenges on the supply side,” Lowe said.

“I understand that zoning is an issue in Canada, just as in Australia. In some parts of Australia, there has also been underinvestment in transport infrastructure, which has limited the supply of well-located land at a time when demand for such land has been growing quickly. The result is higher prices.”

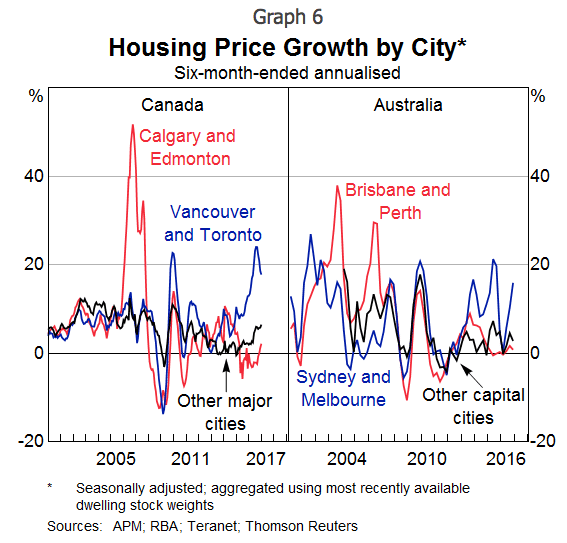

He said both countries had large differences across the various sub-markets.

“The strength in housing markets in our major cities contrasts with marked weakness in the mining regions following the end of the mining investment boom (Graph 6).”