RBA Governor talks debt, house prices and monetary policy: Gareth Aird

GUEST OBSERVER

RBA Governor Lowe delivered a speech in Sydney titled “Australia and Canada – Shared Experiences”. It could have easily been titled, “Household debt, inflation targeting and monetary policy”.

The Governor’s remarks reaffirmed the increased importance that the RBA is placing on financial stability. And they were another strong hint that the hurdle for policy easing under Dr Lowe is higher than it was under former Governor Glenn Stevens.

A significant chuck of the speech was devoted to recent trends in housing and borrowing. While some policymakers have chosen to focus only on supply, Dr Lowe pointed to the impact that both demand and supply factors have had on price growth.

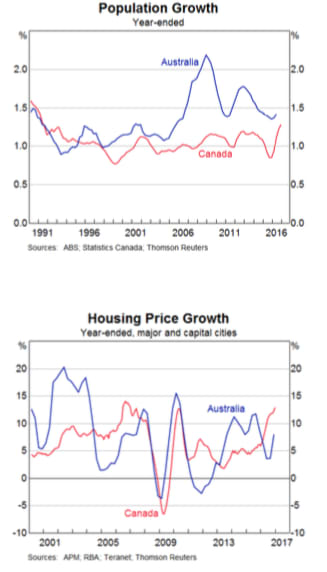

Specifically, the Governor put forward three explanations for high demand: (i) a population growing quickly for an advanced industrialised country (i.e. high immigration); (ii) “strong” demand from overseas residents; and (iii) the global monetary environment (i.e. low rates). On the supply side, Lowe noted that there has been, “underinvestment in transport infrastructure, which has limited the supply of well- located land at a time when demand for such land has been growing quickly”.

This is a call from the Governor to further lift public investment. And he noted in the Q&A that governments should not be afraid to borrow more to fund it.

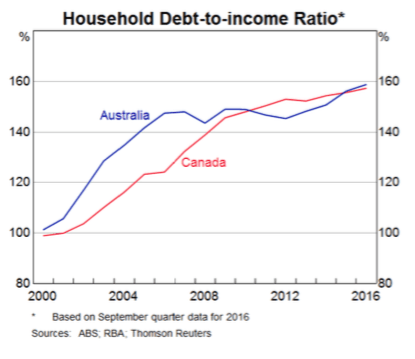

Dr Lowe then went on to say that dwelling price rises have “gone hand in hand with a further pick-up in household indebtedness”. In other words, Australia has blown up the household balance sheet. This has been facilitated by rate cuts which have reduced the debt-servicing burden. As we argued recently, we think that this has brought down the neutral interest rate in Australia to just 3 percent. The Governor noted the “sobering” combination of households carrying more debt than ever before and multi-decade low nominal income growth. Basically Lowe does not want to see household indebtedness rise further.

Dr Lowe then went on to talk about inflation targeting and more specifically, how the RBA is dealing with, “sustained low inflation and rapid increases in borrowing and housing prices”. The Governor explicitly stated that choosing the right path back to target inflation is the one that “best promotes the welfare of the Australian people”. This statement is yet another indication that the Governor is willing to take a more flexible approach to the inflation target if it reduces the further build-up of household debt and risks to financial stability. One wonders whether the RBA would have eased policy in May and August last year if Lowe had been Governor.

From a monetary policy perspective, the overriding message from the Governor is that he is very reluctant to cut the cash rate from here. Lowe basically stated that it would take the unemployment rate to rise from here for policy to be eased again. As we have argued more recently, trends in the labour market are the one to watch in 2017 rather than the inflation prints. We expect core inflation to continue to print below the Bank’s target but that won’t be enough for Lowe to cut the cash rate.

Finally, in the Q&A session the Governor expressed concerns that wages growth is too slow. And he suggested that “some pickup in wages growth would be welcome”. We’d agree and would add that it is desirable that the fruits of rising commodity prices spill over to higher wages growth as has historically been the case.

Gareth Aird is economist at Commonwealth Bank and can be contacted here.