Rate cuts off the table given strong growth in dwelling prices: Gareth Aird

GUEST OBSERVER

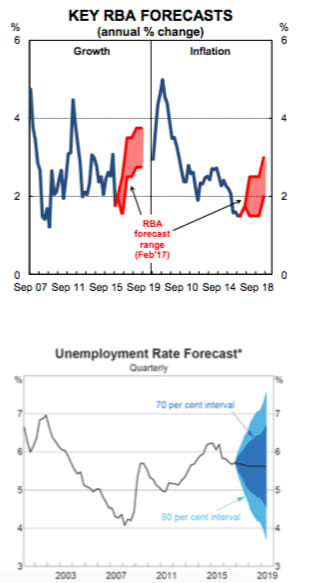

The RBA has downwardly revised its near term growth forecasts as well as shaving a bit from their medium term projections. Inflation forecasts remain intact and both headline and core inflation are expected to gradually rise from here.

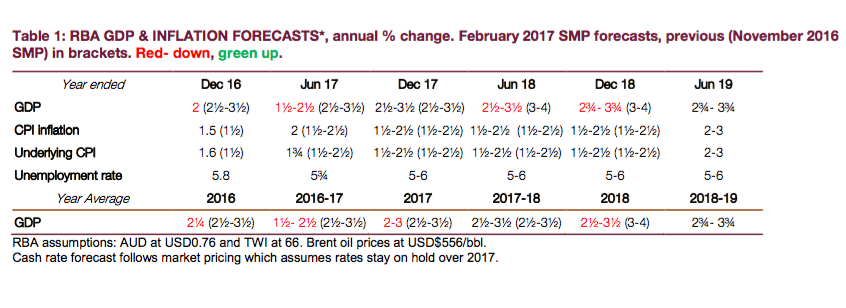

The RBA see the unemployment rate tracking sideways over 2017 at 5 3⁄4 percent.

We have the RBA cash rate on hold at 1.5 percent throughout 2017.

The RBA’s updated forecasts are further evidence that Governor Lowe doesn’t intend to take the cash rate lower. The Bank has essentially looked through the QIII contraction in the economy and has forecast decent growth outcomes over the next two years. In addition, headline inflation is forecast to return to target over 2017. As such, the Bank retains a neutral bias despite there being no forward guidance in today’s Statement on Monetary Policy (SMP).

Looking at the Bank’s through the year forecasts implies that the pace of growth picks up from 2 percent/pa mid-2017 to an above-trend 3 percent by year end. It is expected to remain above trend over the rest of the forecast period (mid-2019).

LNG production, infrastructure spend and a lift in non-mining investment are expected to push growth higher. The Australian economy would be deemed to be in good health if these outcomes can be achieved. While we think they are possible, they look a best case scenario and the risk is that growth outcomes undershoot the Bank’s forecasts. The Bank has upgraded its global growth forecasts on fiscal stimulus in the US.

Inflation is forecast to gradually rise. But core inflation is not expected to get back to target until 2018. The RBA sees headline inflation rising a little quicker because of price rises in fuel and tobacco. These forecasts look about right to us, but like the growth forecasts, the risks are skewed to the downside.

The Bank retains a temperate assessment on the labour market. Employment growth is forecast to basically run at a level that would see the unemployment rate crab sideways at 5 3⁄4 percent. Normally we would expect the unemployment rate to be falling if growth is running above trend. The GDP and unemployment rate forecasts are reconciled by the big contribution to growth that will come from LNG production which is not labour intensive and also a possible decline in underemployment.

The RBA has confused us a little with their assessment on non-mining business investment. In Lowe’s Statement on Tuesday, the Governor optimistically stated that, “some further pick-up in non-mining business investment is also expected.” The word “further” stood out to us because in our view we are yet to observe a meaningful lift in private non-mining investment. Today the RBA agreed with us by nothing that, “non- mining business investment has been weak for some time, despite the support provided by low interest rates and the earlier depreciation of the exchange rate. The outlook for non-mining business investment is relatively subdued in the near term”. We will await further clarity from Martin Place on this one.

Rate cuts look off the table for now given the strong growth in dwelling prices (largely Sydney and Melbourne) and the Bank’s relatively upbeat assessment of the economic outlook. Despite below target inflation, concerns around the further build-up of household debt and strong dwelling price growth mean that it would take a shift in the activity data for policy easing to come back onto the table. In our view, trends in the labour market are the one to watch. It would take a loss of momentum in job creation for Lowe to entertain the idea of taking the policy rate lower. We see rates on hold in 2017.

The risk, however, sits with easing while ever inflation is below target.

RBA Key Views

Terms-of-Trade. The terms of trade are expected to decline gradually over 2017, but are expected to remain above their recent trough and be higher than previously forecast.

Unemployment rate. Unemployment rate to basically trend sideways at 53⁄4% in 2017. But it is expected to edge lower over the forecast period.

World growth. Growth forecasts for 2017 and 2018 have been revised a little higher reflecting the recent better data and the prospect of more stimulatory fiscal policy in the US.

Inflation. Inflationary pressures to be benign. Forecasts remained unchanged from November SMP. Inflation to gradually rise. But core inflation not expected to get back to target until 2018. Headline inflation rising a little quicker because of price rises in fuel and tobacco

Wages. Gradual recovery in wage growth from late 2017 assumes that some of the factors that have been weighing on wages will gradually dissipate.

Housing construction. The large amount of work in the pipeline should continue to support a high level of dwelling investment for the foreseeable future.

Dwelling Prices. Conditions in the housing market in Sydney and Melbourne strengthened over the second half of 2016, but they have remained relatively subdued elsewhere. Inflation in rents has eased to multi-decade lows.

Australia’s GDP. The pace of growth picks up from 2%pa mid- 2017 to an above-trend 3% by year end. Its forecasts to remain above trend throughout the rest of the forecast period. .

Fiscal policy. Little change to the forecasts of the consolidated deficit in 2016/17 of around 3 per cent of GDP which implies a modest stimulus to growth.

Oil prices. Higher oil prices should oil are expected to contribute to inflationary pressures in the period ahead. .

CBA’s View

The terms of trade are expected to drift lower over 2017 due to a pullback in commodity prices. But we have seen the low point for the cycle.

The unemployment should grind a little lower over 2017. Some job losses still to come out of the resources sector as the last of the major projects finish. NSW and Vic to have the strongest labour markets.

Global growth to lift a little to around 3 1⁄4 percent in 2017. Advanced economies, like the US & Canada, likely to have above trend growth. China growth to firm at around 6.8 percent. UK economy to slow under Brexit impact and Eurozone growth to be similar to 2016.

Underlying CPI to remain below the RBA target band (2-3 percent) in 2017. Headline inflation to within the target band in H1 2017. Weak wages growth is keeping a lid on domestic inflation while tradables inflation is weak due the AUD holding up in the mid-USD0.70s.

Wages growth remains feeble, even with firmer commodity prices. Wages growth unlikely to materially lift labour market underutilisation falls. Job security concerns remain elevated and are also keeping a lid on wages growth.

Building approvals have peaked for the cycle and will continue to taper off over 2017. There is a significant pipeline of dwellings yet-to- commenced and completed. Commencements to be a robust 210k in 2017, slightly down from 220k in 2016. Alterations and additions spending likely to gradually rise.

Dwelling price growth is expected to moderate over 2017. Varied price growth across different regions to continue. Affordability remains a significant problem for low and middle income households. An increase in supply to stem dwelling price growth.

We expect the economy to grow by 2.4 percent in 2016 and 2.6 percent in 2017. Net exports, public investment and household spending to lift growth. This is partly offset by a drag from business investment.

Fiscal pressures to remain on Federal Budget and reform is slow and elongated. Public capex to lift. S&P have put Australia’s AAA credit rating on negative outlook due to budget deficits.

Oil prices to drift a little lower which supports consumer spending. But because Australia is a net energy exporter, lower oil prices are a negative for terms of trade.

Gareth Aird is economist at Commonwealth Bank and can be contacted here.