No need for rates to go lower after last month’s cut: RBA Shadow Board

GUEST OBSERVER

After the RBA’s decision in August to cut the cash rate to a historic low of 1.5 percent, there is good reason to pause.

Unemployment fell slightly, but only because of a large increase in part-time employment. With consumer price inflation equalling 1.0 percent year-on-year, well below the RBA’s 2-3 percent target band, and wage growth a modest 2.1 percent year-on-year, there exist little immediate inflationary pressures.

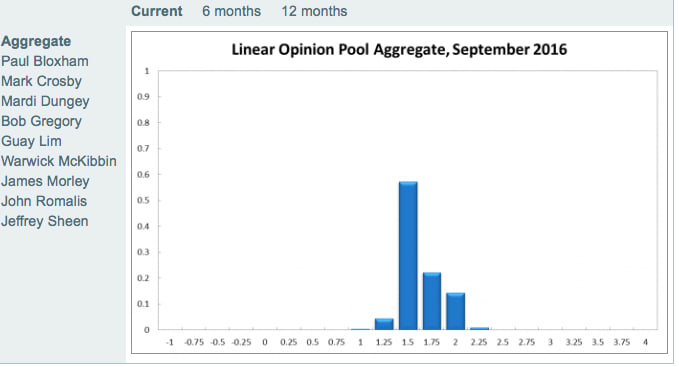

The CAMA RBA Shadow Board clearly believes that the cash rate should not be cut any further. The Shadow Board attaches a 57 percent probability to a rate hold being the appropriate policy setting. The confidence attached to a required rate cut equals a mere 5 percent, while the confidence in a required rate hike equals 38 percent.

Australia’s unemployment rate fell ever so slightly, to 5.7 percent, according to the Australian Bureau of Statistics, as did the participation rate, which stands at 64.88 percent. June’s (revised) increase in full time employment of 44,000, was completely reversed in July.

Furthermore, part-time employment, after falling by 33,200 in June, increased by a whopping 71,590 in July. The overall increase in part-time employment, relative to full-time employment, may be cause for concern. While it may reflect a flexible, nimble labour market, it could also be a sign that the labour market is softening, capturing a degree of underemployment. The seasonally adjusted wage price index increased by 2.1 percent year-on-year in the second quarter of 2016, unchanged from the previous quarter.

For the last month the Aussie dollar, relative to the US dollar, has been range-bound, trading between 75 US¢ and 77 US¢. Yields on Australian 10-year government bonds rarely budged, remaining at their historic lows below 2 percent.

Domestic share prices peaked on 1 August and have retreated slightly since then. Worldwide, after the three-week rally in July, most stocks have been going sideways, confirming the old adage that August is a slow month for the share market.

Absent any major surprises in the world economy, prospects for economic growth in the major economic regions continue to be modest. Jobs growth in the US has been solid in June (292,000) and July (255,000), but predictions for the August statistic, to be announced on 2 September, are smaller. US investment numbers continue to be relatively weak and these are unlikely to improve significantly prior to the US election in November.

Brazil’s economic fortunes, after the recent deposition of its President, Dilma Rousseff, remain highly uncertain. Germany’s fiscal surplus of 1.2 percent of GDP for the first half of 2016 is not matched by the periphery’s economies. The imbalances between Germany and its Eurozone partners will generate further pressure for Germany to increase spending and provide stimulus for the region.

Consumer confidence, as measured by the Westpac-Melbourne Institute Consumer Sentiment Index, rose slightly. The manufacturing PMI, which measures the performance of the manufacturing sector based on surveys of 200 industrial companies, fell dramatically last month, from 56.40 to 46.90, the lowest reading since June 2015. Numbers for this month’s Services PMI have yet to be released. Capacity utilization remains just above 81 percent; after a big gain in June, the AIG Construction Performance Index receded slightly, from 53.2 to 51.6 in July.

The Shadow Board attaches a 57 percent probability (54 percent last month) that “no change” is the appropriate policy, a 5 percent probability (28 v last month) that a rate cut is appropriate and a 38 percent probability (18 percent in the previous month) that a rate rise, to 1.75 percent or higher, is appropriate. The substantial increase in the confidence attached to a rate rise (and the corresponding fall in the probability confidence attached to a rate cut) reflect the Shadow Board’s mild disagreement with the RBA’s decision to cut the cash rate in August.

The probabilities at longer horizons are as follows: 6 months out, the estimated probability that the cash rate should remain at 1.50 percent is virtually unchanged at 24 percent, one percentage point up from the previous month. The estimated need for an interest rate decrease equals 11 percent (29 percent in August), while the need for a rate increase equals 65 percent (48 percent in August).

A year out, the Shadow Board members’ confidence that the cash rate should be held steady equals 18 percent (16 percent in August), while the confidence in a required cash rate decrease equals 10 percent (26 percent in August) and in a required cash rate increase 72 percent (58 percent in August).

For more information, click here.