Australia's newest bank passes on RBA rate cut

Australia's newest bank, Greater Bank, has announced it will reduce interest rates on all variable homes loans by 0.25 percent.

It has also introduced a new special offer home loan at under four percent.

Greater Bank's CEO Scott Morgan said the cut would hit the companies bottom line but it was putting customers first by passing on the cut and ahead of profits.

He said that unlike the major banks and many other lenders, Greater Bank didn't increase variable owner occupied home loan rates for existing customers late last year.

“This customer first approach is one of the reasons DBM’s latest Consumer Atlas study shows Greater Bank is Australia’s most recommended financial institution,” Mr Morgan said.

The cut will be effective for existing customers from May 16.

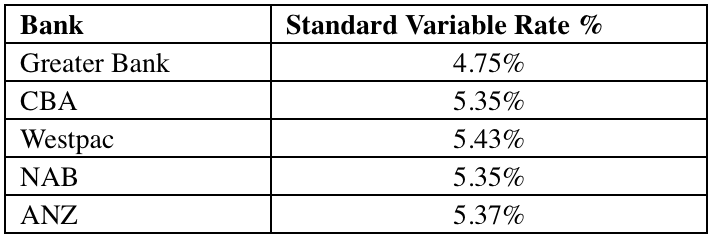

The banks Standard Variable Home Loan rate will drop to 4.75 percent, the lower rate of comparable loans offered by the big four.

Their special variable owner occupied home loan for new customers borrowing more than $150,000 will have a comparison rate of 3.99 percent.

The cut in rates will save a Greater Bank customer with a $300,000 loan around $44 a month.

Greater Bank is customer-owned and provides home loans and other banking services to around 250,000 in New South Wales and South East Queensland.