RBA on hold, but concerned about the rising AUD: HSBC's Paul Bloxham

GUEST OBSERVER

Growth remains solid, supported by the services sectors, but it is still insufficient to lift inflation. The recent lift in the AUD could start to weigh on services exports, which have been a key source of recent growth.

We expect the RBA to be on hold, but to keep its easing bias, as it seeks to put downward pressure on the AUD.

Rising AUD is an increasing problem

The RBA is expected to be on hold next week. Domestic growth is solid, commodity prices have lifted, and global markets have stabilised. There is no pressing need to cut. The more interesting question is whether the easing phase is done?

On the one hand, the rebalancing act is well underway, demand in the non-mining sectors is solid and the unemployment rate appears to be past its peak. This argues for the RBA to remain on hold. On the other hand, underlying inflation is at the bottom edge of the RBA’s 2-3 percent target band and, although demand has lifted, so far, the pickup is insufficient to drive a rise in inflation. At the same time, lower global inflation and interest rates have been driving the AUD higher, which is set to weigh further on local inflation and potentially on growth. This argues for a further cut at some point.

Given HSBC’s view that global inflation and rates will stay low for some time yet, our central case is that the RBA will cut further. Otherwise, the AUD could rise further, putting more downward pressure on inflation and local growth. Our central case has the RBA delivering a 25bp cut in Q2, following the next CPI print, which we expect will show underlying inflation dropping below the bottom edge of the RBA’s 2-3 percent target band. Importantly, the RBA’s reaction function has historically been very much driven by the quarterly CPI prints. Combine this with a labour market where spare capacity is still weighing on wages growth and an AUD that is rising and we expect the central bank may need to cut further to keep inflation on target.

However, there is a clear risk that the RBA has a higher tolerance for low inflation than we expect. It is also possible that near-term domestic indicators will lift, following the apparent end of the recent bout of financial turbulence. In addition, the timing of a potential cut is complicated by local political developments. Prime Minister Malcolm Turnbull’s recent announcement that the federal budget will be a week earlier than usual, on 3 May, means that it will be on the RBA’s May meeting day, making a cut on that day less likely. There is also a possibility (not yet confirmed) of an early election, on 2 July, which could make a Q2 cut less likely. We stick by our view that a further cut will be needed, but acknowledge that the likelihood of a Q2 cut is about 50:50, in our view.

Growth has been solid as the ‘rebalancing act’ continues

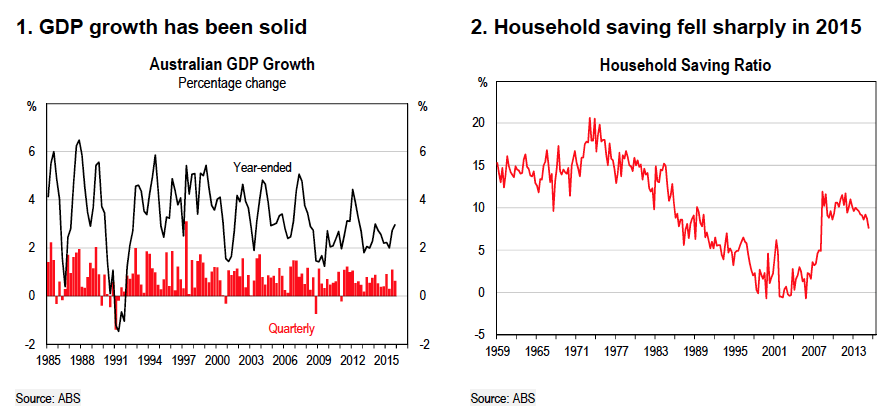

The domestic indicators continue to suggest that the rebalancing of growth towards the non mining sectors is underway. Although the fall in mining investment has been massive drag on GDP growth, it has been more than offset by a strong pick-up in other factors. The significant fall in mining investment weighed on the economy over 2015, such that overall business investment subtracted around 2ppts from GDP over the year. However, the lift in other factors, including exports of resources and services, and household consumption, was sufficient to see GDP growth running at 3.0 percent y-o-y (an upside surprise to the market and RBA) (Chart 1).

The upside surprise to GDP growth was mostly driven by stronger-than-expected growth in household consumption, as the household saving rate dropped by a sharp 1.5ppts over the past year (Chart 2). Given the recent levelling out in housing prices (since August 2015) and the recent financial market turbulence, we do not expect further near-term falls in the saving rate, so we see household consumption growth slowing in the first half of 2016, in line with continued weak growth in household disposable incomes.

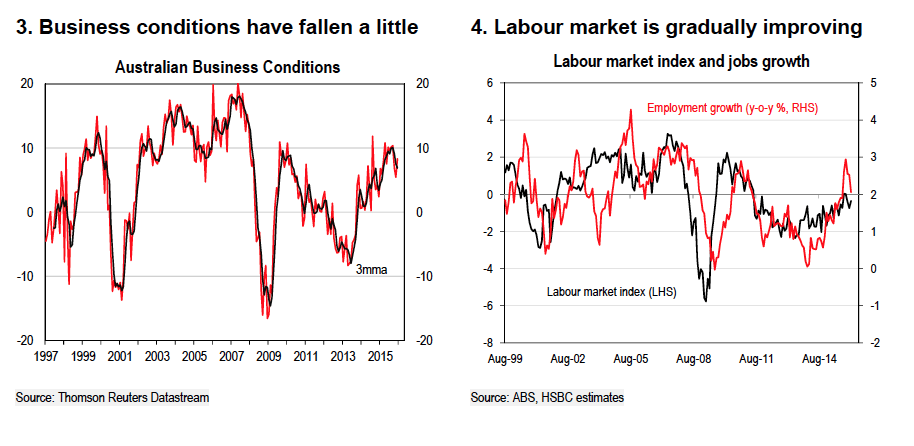

At the same time, other recent timely indicators also suggest that growth has slowed into the first quarter of 2016. Surveyed business conditions have pulled back from the high levels reached in the latter part of 2015, albeit they still imply solid growth rates (Chart 3). The official labour market numbers have also been weaker in recent months, albeit part of the retracement reflects measurement issues following exceptionally rapid reported jobs growth in late 2015 (Chart 4).

Recent lift in the AUD is worrisome

A key challenge the RBA faces is not that the domestic economy is not holding up well, but that local growth is insufficient to lift inflation and that weak conditions and lower interest rates in the rest of the world are putting upward pressure on the AUD. This is particularly important because the lower AUD has been a key driver of the rebalancing of Australia’s growth away from mining.

Exports of services, including tourism and education, have moved from being a significant drag on GDP growth (of around 0.75ppts four years ago) when the AUD was well above USD parity, to being a solid contributor to GDP growth more recently (0.5ppts over the past year) (Chart 5).

An increase in the AUD could weigh on growth in these sectors, which are expected to be the next drivers of Australia’s growth. In short, the response of the AUD to relative global interest rates may be becoming an increasing problem for the RBA. For more on this topic see Downunder Digest: Services exports and the AUD, 30 March 2016.

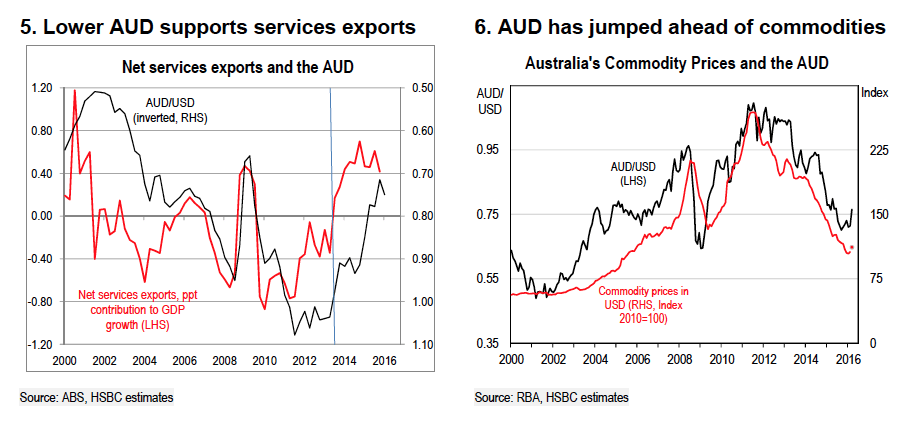

Although part of the increase in the AUD clearly reflects that commodity prices have rallied over the past month, our estimates suggest that the pick-up in the AUD has been sharper than is implied just by the rise in commodity prices (Chart 6). To a large degree, we see this as reflecting interest rate differentials, with more dovish recent commentary from the Federal Reserve’s Janet Yellen, contributing to the market’s view that the rise in US rates is likely to be slow.

The higher AUD is also set to weigh further on the inflation outlook. As at the RBA’s last set of forecasts (on 4 February 2016) the AUD was at USD0.72. The 7 percent rise since then would be expected to knock 0.1-0.2ppts off the RBA’s CPI forecasts, unless it also lifts its own domestic growth projections to offset this impact via an expected rise in domestic inflation.

To cut or not to cut, that is the question

The RBA has considerable reluctance to consider cutting further and understandably so. The cash rate is already at a record low of 2.00 percent, growth is solid and the unemployment rate appears to be past its peak. However, underlying inflation is at the bottom edge of its 2-3 percent band and the spare capacity in the labour market is keeping wages pressures subdued, which means domestic inflation is set to stay low. At the same time, the AUD has picked up, which is set to push imported inflation lower and could weigh on the new growth drivers: tourism and education exports. Much of the problem is that the rest of the world has much lower inflation and lower interest rates. If the RBA maintains its resolve, the AUD could increase further, slowing growth and weakening inflation. On balance, we expect the RBA may need to cut further.

Timing, tactics and politics

For the RBA the most common trigger for a cut is the quarterly inflation print, with the Q1 numbers due to be published on 27 April. Our central case is that the RBA’s underlying measures (the trimmed mean and weighted median) will drop below the bottom edge of the RBA’s target band in y-o-y terms. If this is the case and the unemployment rate remains well above full employment while the AUD is still higher, then the case for a cut in May would be strong.

However, the recent announcement by Prime Minister Turnbull that the annual federal budget will be handed down a week earlier than usual, on 3 May, now means that the budget will arrive on the RBA’s board meeting day. This reduces the likelihood of a cut on that day, as the central bank is unlikely to consider cutting while the government is delivering the budget.

It is also worth keeping in mind that the reason Prime Minister Turnbull has moved the budget forward is to allow him the option of calling an early election on 2 July. The prime minister is required by law to call an election before 17 January 2017 and had previously stated that an election was likely in September or October 2016. However, for political reasons, Prime Minister Turnbull is considering dissolving both houses of parliament and calling an early election on 2 July. If he were to call an early election (which is not a foregone conclusion), this could also reduce the likelihood of a further cut in rates in June or July (although it does not rule it out).

In short, irrespective of the economic numbers, a Q2 cut is looking less likely than previously for tactical reasons associated with politics. Saying this, a weak enough set of economic indicators would mean the RBA would cut anyway, despite the possible political implications.

We still expect a cut around mid-year but acknowledge that the likelihood of a cut in Q2 is now 50:50, in our view, partly due to these political possibilities.

PAUL BLOXHAM IS CHIEF ECONOMIST (AUSTRALIA AND NEW ZEALAND) FOR HSBC.