RBA cuts make overshoot more certain: ANZ's Daniel Been

GUEST OBSERVER

A shift in the balance of risks in Australia has prompted us to forecast that the RBA will ease rates twice more, in H1 2016.

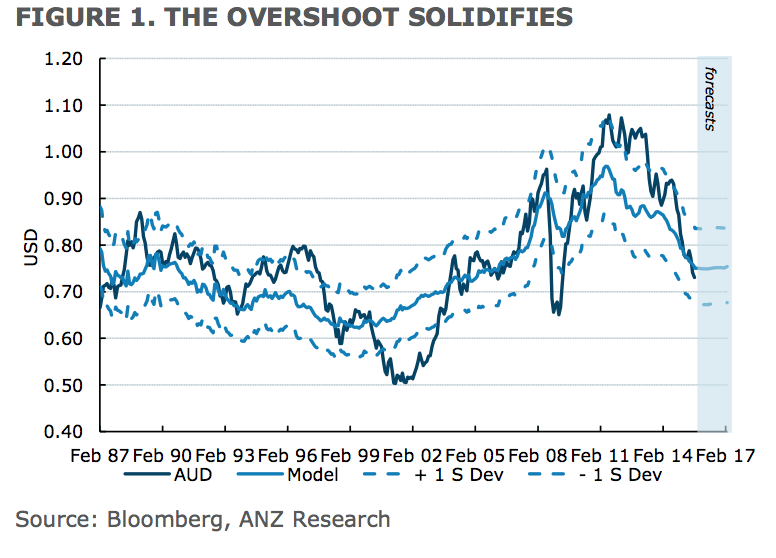

This shift in tact means that the probability that the AUD overshoots its fundamental fair value has risen and we revise our forecasts lower. The AUD will now trough at USD0.64.

This means that we are now expecting the AUD/NZD to depreciate modestly. We look for the cross to ease towards 1.0850 by the middle of 2016.

The AUD has continued to trade in a fashion consistent with an overshooting framework for the currency (as outlined in our FX Insight published on 14 September). That is to say, global investors have diverted their collective attention away from events in both the domestic economy and broader commodity markets, and have been more focused on financial market volatility.

In the period ahead, the focus is set to shift back to the domestic economy. ANZ is expecting the RBA to ease rates by a further 50 basis points next year. While we do not expect growth to deteriorate drastically, we do think that growth will not be sufficient over 2016 and 2017 to eat into spare capacity in the economy.

Hence, extra policy support will be needed. Risks to global growth remain to the downside, while housing market activity and the weakness in the AUD will have a diminishing impact on the domestic economy as they start to slow.

For some time we have highlighted the fact that we expected an overshoot in the AUD and that risks remain tilted to the downside. This shift in our RBA call makes those risks more tangible, and as such prompts us to further reduce our forecasts, with the expectation of a move deeper into overshoot territory.

We take a further 3 cents off of our terminal AUD forecast and expect the AUD to be at USD0.64 by the middle of 2016.

This will have more serious consequences for our expectations for the AUD/NZD cross. A large portion of our previous bullishness on the cross was driven by a divergence in the biases of central banks, where we expected the RBNZ to maintain it easing track, while the RBA to have remained cautiously optimistic.

With the RBA’s bias now matching that of the RBNZ, we see some near term downside in this cross. That said, this is not a shift that will justify a large move – we simply expect the cross to trade back down towards the bottom of its recent range at 1.0850.

Daniel Been is senior FX strategist, ANZ.