No surprise in the RBA’s August decision: Gareth Aird

GUEST OBSERVER

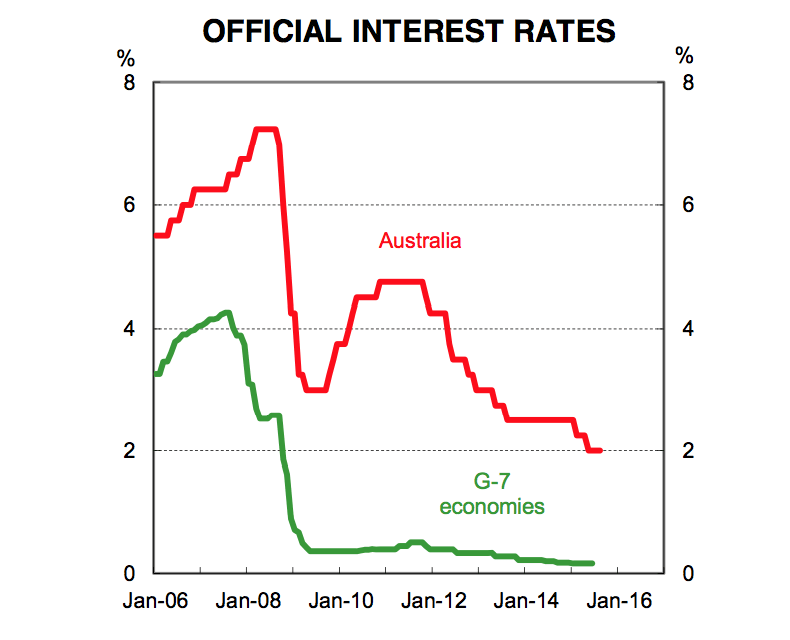

Going in to today’s meeting, economists and market participants were in agreement that rates would be left unchanged. As such, there was no surprise in the RBA’s decision to leave the cash rate unchanged at 2.0%.

There were a number of familiar themes in the Governor’s accompanying Statement. Indeed, a large chunk of the Statement was left unchanged from the July Statement (see page 2 for a comparison).

There was a distinct lack of forward guidance with the Bank noting, like last month, that “information on economic and financial conditions to be received over the period ahead will inform the Board's assessment of the outlook and hence whether the current stance of policy will most effectively foster sustainable growth and inflation consistent with the target”. In other words, another rate cut has not been ruled out. But equally, the RBA doesn’t have an explicit easing bias. What we previously described as a soft implicit easing bias has been further watered down by a change in narrative around the labour market and AUD.

The Bank has clearly become more comfortable with conditions in the labour market. After refraining from commenting on the labour market in last month’s statement, Governor Stevens stated that below trend growth, “has been associated with somewhat stronger growth of employment and a steady rate of unemployment over the past year.”

The previous mantra around AUD depreciation seeming likely and necessary to foster growth was noticeable in its absence. Instead, the Governor simply noted that, “the Australian dollar is adjusting to the significant declines in key commodity prices.” In our view, the change in rhetoric on the exchange rate is likely to reflect the Bank’s assessment that the AUD is trading in the ‘sweet spot’. That is, it’s now low enough to help the Australian economy rebalance, but not so low that is poses a risk to the inflation outlook.

The outlook

We have had a 2% terminal cash rate target for a while now and that remains our base case. Steven’s declaration two weeks ago that further rate cuts remain, “on the table” was hosed down when he said that, “it is not quite good enough simply to say that evidence of continuing softness should necessarily result in further cuts in rates, without considering the longer-term risks involved.”

The change in language today on the AUD and labour market was telling. The RBA would need to see conditions deviate from where they are now to pull the interest rate trigger again. Our take is that further monetary policy easing will be data dependent. This means that the recent strength in the labour market, coupled with a lift in a range of leading indicators, makes a near term rate cut look unlikely.

The focus now turns to Thursday’s employment report and the August Statement on Monetary Policy (SMP), published on Friday. In our view, the RBA is likely to leave its growth and inflation forecasts unchanged. Mechanically a lower AUD means some upside risk to growth and inflation forecasts. But these are likely to be tempered by a bigger than expected fall in the terms of trade. These opposing forces are likely to cancel each other out.

The RBA left the cash rate unchanged at a record low of 2.0% at the August meeting.