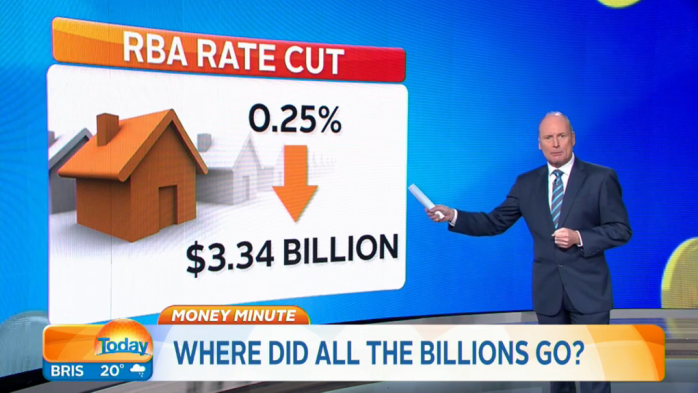

Full rate cut was worth $3.34 billion in potential stimulus: Ross Greenwood

With some $1.33 trillion in home owner and investor home loans, Greenwood calculated that on all banks passing the rate cut on in full.

However the Commonwealth Bank is only passing on part of Tuesday's cut in official rates to its home loan customers, but has interestingly also taken the step of raising some deposit interest rates.

The country's biggest bank has lowered its standard variable mortgage rates by 0.20 percentage points to 5.45%.

CBA's group executive for retail banking, Matt Comyn, said the bank had considered the needs of deposit customers as well as borrowers in its decision.

"Lifting the rates for our deposit customers at a time when the cash rate is decreasing recognises the importance of savings income, particularly for retirees and young people."

The CBA move comes after ANZ earlier said it would lower its standard variable home loan rate by 0.25 percentage points to 5.38%, effective Friday.

NAB has copied Commonwealth Bank's move to keep some of the Reserve Bank's 0.25 per cent cut to the cash rate.

NAB will cut its standard variable rate to 5.43 per cent, with its lowest fixed rate at 4.49 per cent for one year and 4.59 per cent for five years.