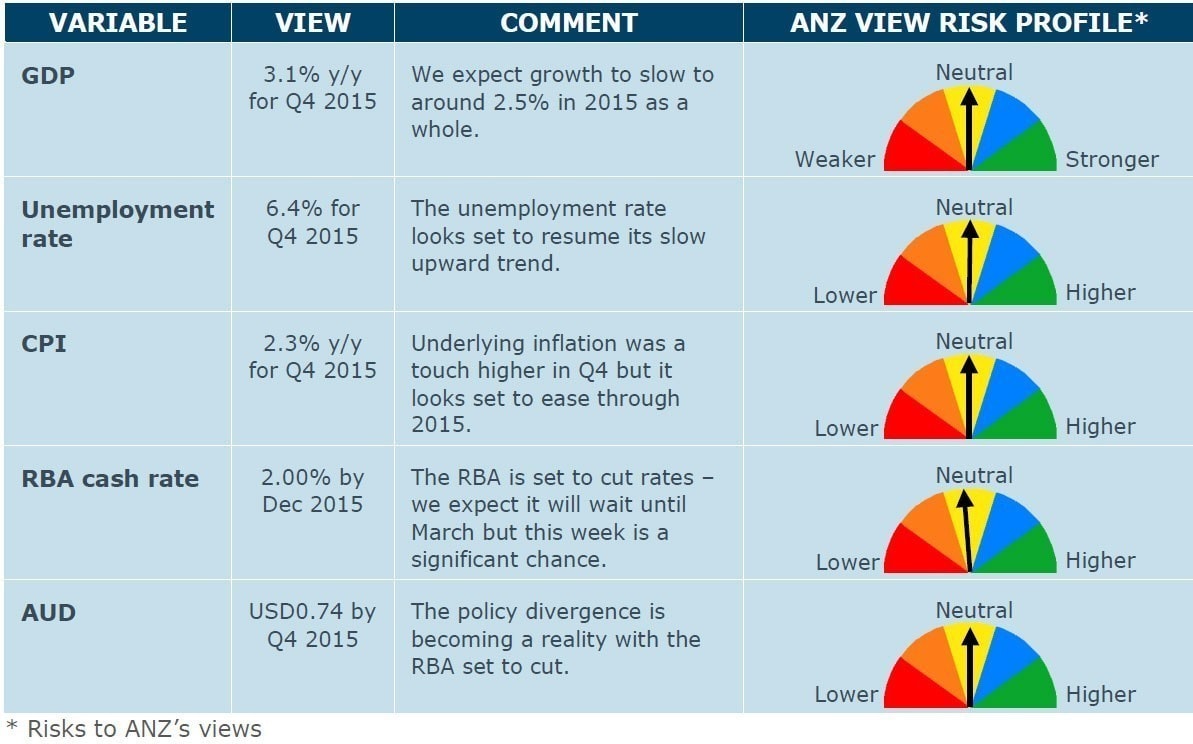

RBA 2% cash rate forecast: The ANZ heatmap

Low inflation and a still-subdued growth outlook give scope to ease policy, the ANZ Research department thinks.

They now publish The ANZ Heatmap (click to open in new window):

Source: ANZ Research

After the decision the ANZ suggested the forward guidance is not strong but with the period of stability reference now gone, we would expect further cuts in the months ahead.

The tone of the Statement is quite dovish with obvious concern for underlying growth in domestic demand. Our initial reading is the RBA could well follow up today’s move in March and it therefore does raise the possibility, at least for market expectations, of a cash rate below 2% this year.

After almost 18 months on the sidelines the shift back to easing is likely to generate more than just one 25bp cut. So March is certainly live.

We will wait for Friday’s Statement to review the RBA’s new forecasts for inflation and growth. This will be the key to gauging the extent of further monetary stimulus the RBA is currently contemplating.

In the Statement there is more emphasis on growth being weak than inflation providing the scope to ease.

The RBA notes that housing remains strong in Sydney and comment: “The Bank is working with other regulators to assess and contain economic risks that may arise from the housing market.”

The final paragraph from the Statement provides no formal guidance.

“For the past year and a half, the cash rate has been stable, as the Board has taken time to assess the effects of the substantial easing in policy that had already been put in place and monitored developments in Australia and abroad. At today's meeting, taking into account the flow of recent information and updated forecasts, the Board judged that, on balance, a further reduction in the cash rate was appropriate. This action is expected to add some further support to demand, so as to foster sustainable growth and inflation outcomes consistent with the target.“

The above is an immediate post number reaction. An economic update will be forthcoming with more detailed analysis, views, charts and tables.