Interest rates to fall again - and investors set to dominate: Pete Wargent

A very interesting inflation release last week.

The headline inflation figure of 0.2% for the quarter was very soft, taking the December 2013 to December 2014 reading down to only 1.7%, below the bottom end of the target range.

As expected, the plummeting oil price played a key role in that.

- The most significant price rises this quarter were for domestic holiday travel and accommodation (+5.8%), tobacco (+4.8%) and new dwelling purchase by owner-occupiers (+1.1%).

- The most significant offsetting price falls this quarter were for automotive fuel (-6.8%), audio, visual and computing equipment (-5.2%) and audio, visual and computing media and services (-3.8%).

Despite this very soft headline print, the figures reported for the less volatile and preferred trimmed mean/weighted median for the December quarter came in stronger than expected at 0.7 and 0.7 respectively.

With downward revisions to earlier quarter figures the annualised underlying figures for these two key underlying measures came in at 2.2% and 2.3% respectively.

These readings are obviously at the lower end of the 2 to 3% range but the twin 0.7 prints for the quarter might just be enough to keep interest rates on hold in February.

Rents grow at 2.4%

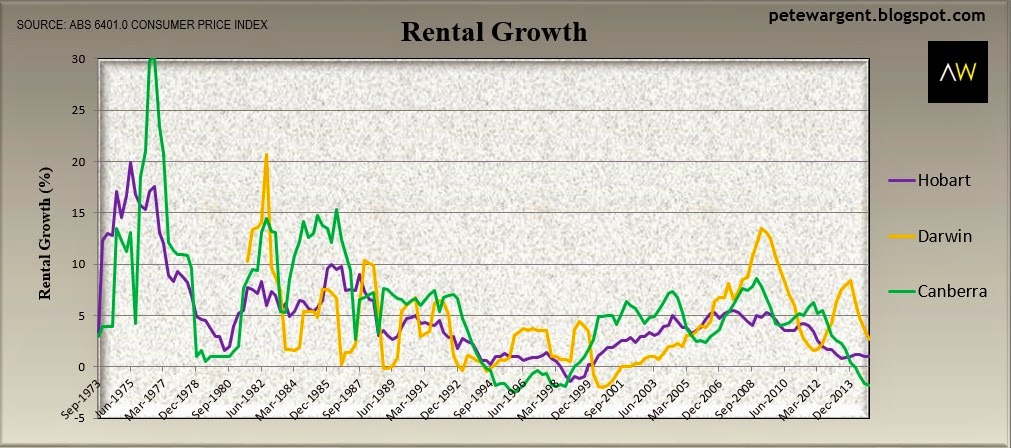

An interesting data series hidden within the inflation data is to be found in the sub-indices for rents.

Rental growth seems to have stabilised nationally at 2.4% growth over the past year.

However this 2.4% reading masks significant variations in fortunes by capital city.

Rental growth remains robust in Sydney (+3.0%), Melbourne (+2.4%) and Brisbane (+2.0%).

Rental growth is, however, softer in Adelaide (+1.7%) and falling sharply in Perth (+1.5%).

In the smaller capital cities rental growth is also looking very soft.

The rate of rental growth continues to nosedive in Darwin (still +2.7%, but down from above +8% in 2013), remains soft in Hobart (+1.0%) and has turned sharply negative in Canberra (-1.8% and still declining).

It is probably worth noting here that despite rental growth being "softer" than it has been, in nominal terms - which is what matters to property investors who own property - the rental index continues to climb to record highs by the quarter.

Mixed bag for inflation figures

A bit of a mixed bag here for the inflation figures, then, and a data series which might easily be interpreted either way.

A very soft headline inflation reading of 1.7% suggests that the next move in interest rates is still likely to be down, particularly given that we have weak GDP growth, uncertain business confidence and low wages growth (hardly a recipe for persistent inflation, one would have thought!).

But trimmed mean and weighted median readings of 0.7% in the quarter will probablyconvince the Reserve Bank to keep interest rates on hold in February.

Nevertheless, annualised core inflation of 2.25% seems unlikely to preclude another interest rate cut should one be deemed necessary.

Currency markets weren't entirely convinced about how to interpret the figures either, with the Australian dollar first shooting up and then dribbling back down a bit, then stabilising around 79.9 cents.

Tough to call.

If I was a betting man I'd take a punt on a cut in the official cash rate in March to 2.25%.

Article continues on the next page. Please click below.

Fastest credit growth in six years

The Reserve Bank today released its Financial Aggregates data for the month of December 2014.

The figures showed credit growth ticking up to 5.9% over the past year, which is the strongest rate of credit growth since the start of the 2009 calendar year.

Housing credit once again lead the way with another 0.6% growth in the month of December to notch up 7.1% growth over the past year.

Business credit also recorded an improved 0.5% growth to grow by 4.8% over the past 12 months.

Personal credit grew by only a paltry 0.9% year-on-year.

Part one - Business credit growth improves

An improved month for business credit with a slack 0.3% growth in November 2014 being bettered by 0.5% growth in December.

The 4.8% year on year growth in business credit growth is the strongest annualised result since March 2009, although clearly we are coming from a low base.

The chart below shows that while Australia may have avoided a technical recession through the financial crisis, some Australian businesses may have experienced recession-like conditions for a couple of years from the middle of 2009.

With housing credit growing faster than business credit this will lead to further debate as to whether property investors are somehow "crowding out" small business lending.

It seems a dubious conclusion, since lending is said to be available for ventures with a sound business case, while it is simpler for many of us as small business owners to use lines of credit secured against housing for the purposes of business expansion.

Moreover it's a great deal cheaper, since banks tend to lend at a materially lower rate against an immovable asset such as a house.

I looked at this conundrum in much more detail previously here.

The latest stock exchange (ASX) Market Statistics shows that there is a bit happening in terms of both initial and secondary capital raisings.

In terms of what businesses at the upper end of town are up to, $29 billion of IPO capital has been raised on the ASX in the past year, which as high as we have seen.

There is also plenty of volume in terms of secondary capital raisings - $35 billion through 2014 - although nothing like the almighty flood of capital raised in 2009 as listed companies licking their wounds looked to shore up their balance sheets.

Article continues on the next page. Please click below.

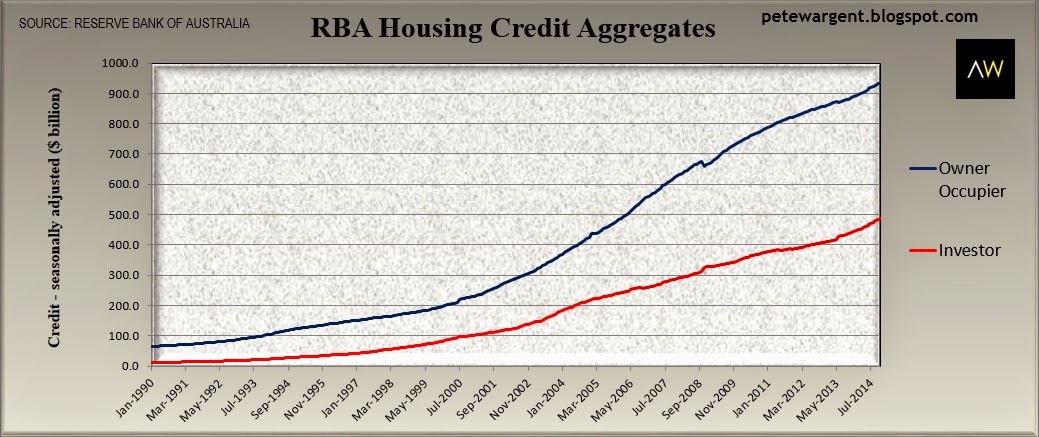

Part two - Property investors dominate

On to housing credit growth, and the month's data once again showed investor credit (+0.8% seasonally adjusted) continuing to rise at a significantly faster pace than owner-occupier credit (+0.4%).

In fact the rate of owner-occupier credit growth slowed a touch in seasonally adjusted terms in December, while investor credit has simply kept humming along.

In terms of rolling annual credit growth, we naturally expect that these figures will remain lower than in decades past, since we are of course starting from a much higher base.

Below we can see the daylight between the growth in owner-occupier credit and investor credit which has grown by 10% over the past year, and nearly as quickly in rolling annual terms.

The will raise the interest of APRA, with the regulator having stated that it will be monitoring lenders which are growing their investor loan books at "materially above" a double digit pace.

What "materially above" actually means is another matter, and the general view seems that APRA is keen to wait until it has more data before considering stepping up its role any further.

Unsurprisingly low interest rates have led to investors taking a new record share of total housing credit at 34.3%.

With Australia continuing to pump relatively high levels of net overseas immigration heavily focussed upon our four largest capital cities, I expect this trend to continue towards a 40% share over time, although this will take a long time to play out.

There is growing evidence to suggest that younger Australians are increasingly choosing to buy an investment property as their first step onto the housing ladder (in fact, it's long been obvious to those in the industry).

While unconventional this may not be entirely irrational if the duration of the average employment contract is to shorten - particularly given the high frictional costs associated with trading property (most notably stamp duty, but also other acquisition and disposal costs).

The wrap

With interest rates appearing likely to be cut again in the months ahead - and perhaps more than once - 2015 is surely going to be another big year for property investors.

It will be interesting to see whether the slowing pace of owner-occupier lending continues.

This suggests that the property types and locations which will outperform are, quite simply, those favoured by investors, which typically means inner- and middle-ring properties in the capital cities.

The data shows Sydney absolutely miles out in front in terms of investor lending growth, although investor finance in Queensland has been steadily increasing now in rolling annual terms since August 2011, and significantly is more than 20% higher over the past year.

The housing finance data suggests that Brisbane will have a strong 2015, although there is likely to be a very significant variance across property types given the mismatch between the new supply and what is in demand by the market.

Business credit growth is now at it highest level in nearly six years, but uncertainty abounds in this sphere and surveys suggest that progress is at best likely to be tentative.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His new book 'Four Green Houses and a Red Hotel' is out now.