Mortgage arrears decline to seven year lows... so where are the risks?

The Reserve Bank has stated on more than one occasion that mortgage repayments are on average some 15% ahead of schedule, the equivalent of some two years worth of monthly payments.

If this is true then despite endless talk of stretched household budgets, then we should actually see mortgage arrears declining to levels not seen in years.

The latest Fitch Ratings Dinkum Index, which records 30 and 90 day mortgage arrears, showed that arrears have declined to seven year lows (30 day) and fiveyear lows (90 day) respectively.

From Banking Day:

"The strong housing market is suppressing home loan arrears.

"Fitch Ratings, in its latest Dinkum Index analysing the September 2014 quarter, put loans 30 days or more past due at their lowest level since late 2007.

"Fitch said delinquencies dropped by 14 basis point to 1.08%.

"Serious arrears also benefited, with loans 90 days or more in arrears sitting at 0.47%, the lowest level since December 2009.

"Arrears are expected to remain largely stable in fourth quarter 2014, Fitch said, due to low, stable interest rates, a strong housing market and lending, and relatively low (albeit rising) levels of unemployment."

Great to hear.

While other developed countries have seen serious 90+ day arrears on up to 10 to 15 or more in every 200 mortgages in the period following the financial crisis, the equivalent figure for Australia is incredibly now below 1, which is wonderful news.

The reasons are clear enough, being a combination of very low interest rates and the unique structuring of so many loans in Australia which maintain repayments at the same level when interest rates fall, thus allowing borrowers to build up sizeable repayment buffers when variable mortgage rates have been declining over a period of years.

This mirrors what has been reported by Genworth (ASX: GMA) in Q3, that delinquency rates have been cascading lower by book year since FY2008.

That's great to see, with foreclosures in Australia now considered to be "vanishingly rare".

Arrears to Rise from Exceptionally Low Levels?

One would think almost certainly, yes.

There is realistically only one direction in which mortgage arrears can head over the medium term from such a pleasingly low base.

Relatively low interest rates are more or less a 'shoo-in' for most of the remainder of this decade, but the other major factor which can cause mortgage arrears - unemployment - is rising in eminence across many regions of Australia.

Where are the Risk Areas?

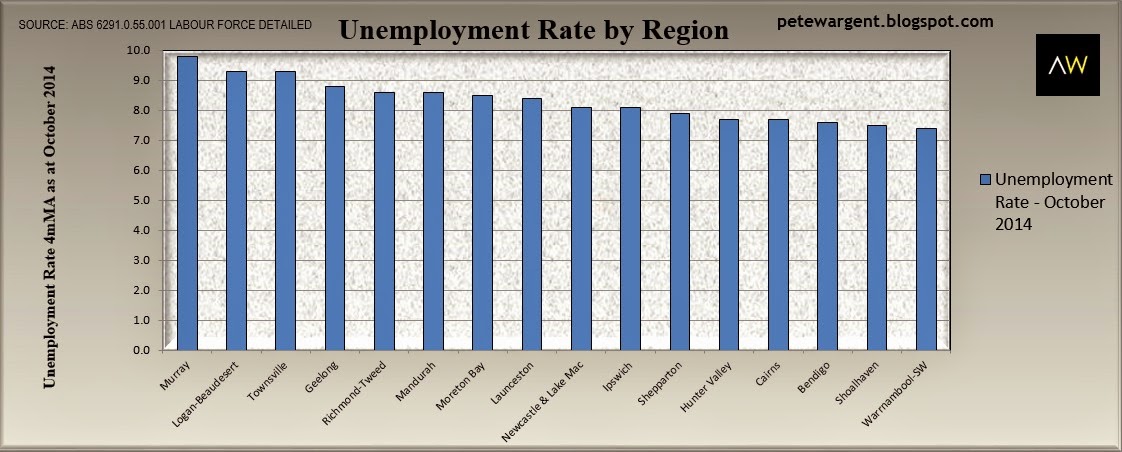

We will take an updated look at the latest unemployment rates by region data on Thursday of this week, but here are a few of the regions where unemployment rates have increased concerningly.

Recent reports have also highlighted the elevated risk of credit default in a number of Queensland regions as the unemployment rate rises.

We'd add to this list of potential risk areas parts of South Australia where a weak labour market and consumer confidence have contributed to 5 year declines in median house prices in a number of outer suburbs such as Davoren Park, Elizabeth North, Elizabeth East, Craigmore, and so on.

Fair Warning - Industry Closure Risk

Some on the chat forums have chosen to highlight that withdrawal of Holden may only directly result in a relatively small number of jobs and they have therefore dismissed the risk as insignificant.

That's one way to look at it, but a market is made up by the full range of views, and in this case we'll take the sell side of the equation.

As pointed out here previously, when one considers the total number of jobs which are likely to be lost from the shuttering of the car manufacture industry over the next few years - including from suppliers and support industries - in concert with flow-through impacts of rescinded business investment, consumer spending and so on - the potential impact on economic output of some $29 billion and up to 200,000 jobs nationwide could be prodigious.

It's easy to dismiss the closure of the Holden plant as overblown, and to state that those who do lose their jobs can be redeployed.

Indeed so, but whether or not they can be redeployed within South Australia is another matter entirely.

If the forecast 24,000 jobs are lost in the state, note that the economy has taken fully seven years to add 24,000 jobs, and has added a net total of zero over the last four.

A similar point stands for Geelong (and I own property in Geelong, so this is not merely the viewpoint of vested interest).

Article continues on the next page. Please click below.

Positive Investment Decisions

Buying a home to live in is one thing, of course, but the primary advantage that a property investor has is that they are not compelled to buy property anywhere or at any time, so the shuttering of an entire industry should act as an automatic red flag.

"It might not be that bad" is not a compelling case for an investment decision.

Anyway, that's our view - that you should look for thriving economies, not those about to be sideswiped by a king-hit - so fair warning.

We'll provide an updated report on trends in elevated unemployment rates by region on Thursday of this week, so stay tuned for that.

In the meantime if there is one phrase to look out for which should always make property investors wince it is that "prices can't fall further in this region", which is another alarm bell which has so often foreshadowed financial loss.

MYEFO Impacts - The "Shock Absorber"

In the forthcoming MYEFO Treasurer Hockey will announce that the budget will be used as a "shock absorber" to shield the downside to the Australian economy from its declining terms of trade, driven by falls in key commodity prices, in particular that of iron ore.

What will this "shock absorber" mean? We will have to wait for the details, but one might expect to hear announcements concerning the following:

- heavy government expenditure of infrastructure projects; and

- thousands of jobs to be cut from the merger of closure of scores of government agencies, particularly in Canberra.

Potentially thousands of job cuts does not bode at all well for Canberra or the ACT housing markets in 2015, with rents already declining and now dwelling prices looking set to follow suit.

Pass.

"Busting Labour Market Myths"

Our chart packs have consistently revealed a worrying trend in Australia in recent years, that with the honourable exception of Queensland, regional Australia is not creating jobs in aggregate and unemployment is therefore rising worryingly in many regional centres and net population growth must in turn slow.

One of Australia's leading economic journalists Peter Martin takes aim at another of the great labour market myths in his piece 'Busting Labour Market Myths' in The Age:

"Of course we'll tell our children that they'll be doing more telework – working from home, cafes, etc.

"Everyone knows that's true. The last government said it enough while spruiking the NBN.

"It isn't true - at least not so far.

"Only 5% of us describe home as our main place of work, and nearly all of them are self-employed.

"Only around 1.5% of workers for employers describe home as their main place of work, and if anything the proportion has slipped in the past decade.

"All up, the labour market is changing (fewer of us are employed in manufacturing for instance) but it isn't changing in many of the ways that we think.".

Quite so.

Working from Home has Declined

The short report which Peter Martin is referencing here is the enlightening Two Decades of Change document, which is well worth a read.

The report reveals some interesting trends, highlighting for example how the southern states have fallen way behind in terms of their economies and labour market growth, with employment growth in Tasmania and now South Australia in particular having tanked and unemployment now rising, trends which have been highlighted here previously.

The Working from Home 'Phenomenon'?

On the working from home phenomenon, the Two Decades of Change report is quite conclusive:

"Yet another often-heard claim is that, facilitated by changes and advances in information and communication technology, work is increasingly being undertaken away from conventional workplaces, and more specifically in the homes of workers.

"However, the available survey evidence provides little support for such a claim. Analysis of data from the HILDA Survey by Wooden and Fok (2013), for example, shows:

"While taking work home is relatively common (with almost 23% of Australian workers reporting doing at least some paid work at home each week), for relatively few workers (just 5%) could home be described as their main location of work.

"The majority of this small group of home workers is self-employed—only a little over 1% of employees spend the majority of their work hours at home.

"If anything, the incidence of working at home fell over the course of the last decade.

"Such conclusions are broadly consistent with survey data periodically collected by the ABS as part of its Locations of Work Survey (ABS Cat. no. 6275.0).

"Notably, the incidence of employed persons who report that their home is their main place of employment fell slightly between 2000 and 2008 (from 7.1% to 6.4%)."

This is indeed commensurate with what was concluded by the ABS Locations of Work survey as reported here previously.

In fact, the principal reason given by survey respondents for working from home was that they had become "snowed under" and fallen way behind on their workloads in the their main workplace.

All available studies and reports have shown that, quite apart from undertaking a sea-change and heading en masse for the regions, Australia's capital cities are in fact becoming increasingly centrally focused in terms of population growth, dwelling price growth, economic growth and employment growth.

You can visit AllenWargent property buyers (London, Sydney) or Pete's blog.

His latest book is 'Four Green Houses and a Red Hotel' .