Has the RBA's plan to stimulate dwelling construction "failed"? Pete Wargent

Time and again we're hearing people say that the Reserve Bank's plan to stimulate dwelling construction has "failed", and that due to high land prices, very little residential construction will take place. These are often the same voices who have consistently called the end of the world, and they've largely been wrong to date.

Anyway, more importantly, is it actually true?

The Australian Bureau of Statistics (ABS) showed that in the year to June 2013, residential construction work done increased by a seasonally adjusted 4.3%.

Source: ABS

For sure, this is not a major increase, but nevertheless it is an increase. Moreover, it makes no sense to judge the results to date without considering the prospects for the future.

The current interest rate easing cycle started on November 1 in 2011 - so the downwards trend in interest rates is not even two years old yet. The most recent interest rate cut only took place on August 6 2013, so how can you write off residential construction when rates can take a couple of years to impact the economy in full?

It's worth remembering that as recently as three months ago people were saying that dwelling prices were falling, yet just a matter of weeks later, they've now reverted to talking about overheating markets and price bubbles.

Again, the key point is that interest rate cuts do not instantaneously impact the economy and markets - monetary policy takes time to work. This is particularly so with regards to construction - projects can take a good deal of time to be approved and financed, they do not simply appear overnight.

If construction levels haven't picked up by August 2015, then I would have to concede that the RBA's plan may be doomed to failure, but it's too early to write it off given that rates have still been falling.

This week Commsec undertook an analysis of the ABS quarterly employment report for the three months to August 2013. Unfortunately, the manufacturing and retail sectors remain weak, yet take a look at the incredible boom in construction jobs - up by 55,800 workers in three months - that's the greatest increase in over a decade of data.I don't know about you, but that rather looks to me as though residential construction is likely to take off (although it's true that ABS labour force numbers could sometimes be accused of being 'volatile').

Reported Sydney Morning Herald:

"Interestingly the construction sector was the biggest driver of jobs growth in the three months to August, creating almost 56,000 jobs. The strength in housing activity seems to be translating through to additional demand for construction workers. The fundamentals for housing remains strong."

The ABS housing finance data for dwelling construction provides another clue, ticking up for eight consecutive months:

"The number of finance commitments for the construction of dwellings for owner occupation (trend) rose 0.2% in July 2013, following a rise of 0.4% in June 2013. This is the eighth consecutive rise since December 2012. "

And the ABS residential building approvals data shows very large year on year seasonally adjusted increases:

Source: ABS

The building approvals trend is clearly up for both residential units...

Source: ABS

And for privates sector houses...

Source: ABS

The Reserve Bank felt that some upturn in dwelling prices was a necessary precursor to dwelling construction.

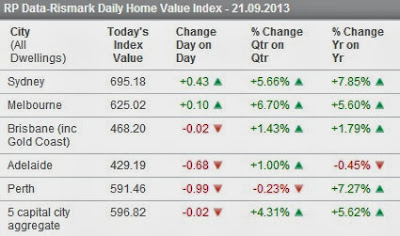

Source: RP Data

We've now had a little over a year of dwelling price increases pretty much everywhere except for Adelaide and perhaps Tasmania. It makes sense that construction activity would typically now follow. Those who say that the RBA's plan has "failed" therefore, have concluded prematurely.

Pete Wargent is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.His latest book 'Four Green Houses and a Red Hotel' was released on 1 September 2013.