Mortgage lending up 0.2% in April with 2.1% rise in new housing loans: ABS

The number of home loans granted in April rose a seasonally adjusted 0.2% to 46,632, according to ABS estimates released today.

That compares with an upwardly revised 46,519 home loans in March.

In terms of overall value, total housing finance rose by 1.2% to $20.45 billion.

Analysts had been forecasting the number of home loans to be flat over April.

The value of owner-occupier mortgages increased by 0.9% over April to $13.6 billion and rose 0.2% in number terms to 46,632 loans.

The value of seasonally adjusted owner -occupier loans rose in Queensland (2%), Victoria (0.3%), Tasmania (1.9%) and the ACT (0.2%), while falls were recorded in NSW (0.8%), Western Australia (1.2%), the Northern Territory (18.8%) and South Australia (2%).

Fixed rate loans accounted for 14% of all loans in April, easing from the 4-year high of 14.6% in March.

The value of investment housing commitments seasonally adjusted rose 1.7% in April 2012.

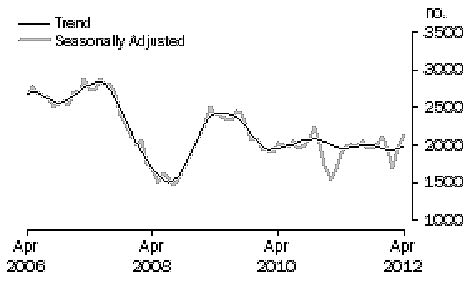

The HIA noted that the number of loans for the construction or purchase of new homes increased by an encouraging 2.1% in April following a 3.8% rise in March.

“Given contemporary weakness in new home construction activity, it is encouraging to see a second consecutive, albeit modest rise in this leading housing indicator,” says HIA chief economist Dr Harley Dale.

Number of mortgage commitments for the purchase of new dwellings

Source: ABS

Commenting on the data, CommSec economist Savanth Sebastian said it was important to highlight that this data is backward looking.

"There are modest signs of improvement on the housing front, but the gains are still miniscule in nature and follow a period of sustained weakness.

"On an encouraging note there does seem to be light at the end of the tunnel- particularly given that the substantial rate cuts should entice potential home buyers to sign on the dotted line. In addition the lift in loans for newly-erected homes should eventually lead to more building ahead," he says.

"The fundamentals for the housing sector remain sound. The lack of new residential construction has led to pent up demand, and with migration levels at 3½-year highs, demand for new and existing homes should lift. It really comes down to confidence. A substantial pick up in confidence is needed to justify a turnaround and the recent interest rate cuts and strength in employment may just be the catalyst."

In original terms, the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 16.8% in April 2012 from 16.4% in March 2012.

Between April 2012 and March 2012, the average loan size for first-home buyers rose $600 to $280,200. The average loan size for all owner-occupied housing commitments rose $4,400 to $288,900 for the same period, down 4.7% over the past year.

The value of owner-occupier refinancing rose 0.3% in April 2012, following a rise of 1.5% in March 2012.

The number of bank owner-occupier mortgages issued in April was flat following a 0.3% rise in March.

The number of mortgages for owner-occupied dwellings financed through non-banks rose 1.8% in April following a rise of 5.3% in March.

The number of permanent building societies owner occupier mortgages fell 9.6% in April 2012, after a rise of 21.5% in March 2012.