What is an ‘auction clearance rate’? Investment terms explained

Auction clearance rates (ACR) are reported at the start of the week, expressed as a percentage. They have been recorded since the early 1980s and have since cemented themselves as a leading indicator of market sentiment.

There are a number of providers of auction clearance rates, however the two most often relied upon are Australian Property Monitors (APM) and RP Data. The Real Estate Institutes often present their own clearance rate data as well. These data sets are regularly different to each other, making auction clearance rates particularly confusing.

In a nutshell, a low auction clearance rate usually indicates a buyer’s market, while a high auction clearance rate indicates a seller’s market, or a hot market. A neutral market is around the 50% mark, however it’s worth knowing the norm for the city you’re considering.

So what exactly are they counting?

The percentage of the ‘clearance’ rate is those that cleared or, in other words, those that sold. However, different companies have slightly nuanced ways of collecting this data.

Auction clearance rates tend to include the sold at auction results, as well as those sold directly before or after. Passed in and withdrawn auctions are also collected. APM considers withdrawn properties to be ‘no sale’, just as those that are passed in are considered ‘no sale’.

Their calculation is:

Clearance Rate = (Sold at auction + Sold prior to auction)/(All reported + withdrawn)

However, they collect their data on Saturday, for publication in the Sunday papers, and their process of collecting results will still continue after this time. Unsurprisingly, the revised figures later in the week may moderately differ.

APM refers to their figures as the “most conservative” of any source presented in mainstream media. However, they have come under fire over the past year for not publishing the total auction listings and not including unreported auctions, which may make the ACR seem higher.

The Real Estate Institute of Victoria uses this equation:

Auction Clearance Rate = (Sold at auction + Sold before auction + Sold after auction)/(Number of reported auctions)

They opt not to include withdrawn or postponed auctions saying that they haven’t been subject to a full auction campaign. Their ‘sold after’ figures apply to those sold on Sunday, but not Monday, and still under auction conditions.

RP Data also includes the results of those sold before and after auction. ABC Fact Check notes that they only rely on the number of reported auction results for which the outcome is known.

As you can see, these statistics would vary significantly from each other. Unsurprisingly, there has been close scrutiny and questioning of auction statistics in recent times.

A research paper from Deakin University, Residential auction clearance rates – what do they really mean?, looks closely at the Melbourne market ACR and its limitations.

“Caution should be exercised when interpreting what it actually means and its limitations are rarely discussed in real estate circles; for example there is no consideration given to the number of bidders at the auction, how much [%] the property exceeded the vendor’s reserve, the number of bids or the number of competing auctions in the surrounding area at the same time,” the report explains.

“At times the auction clearance rate is sourced from a narrow segment of the market with few sales and therefore cannot directly applied in across greater Melbourne.”

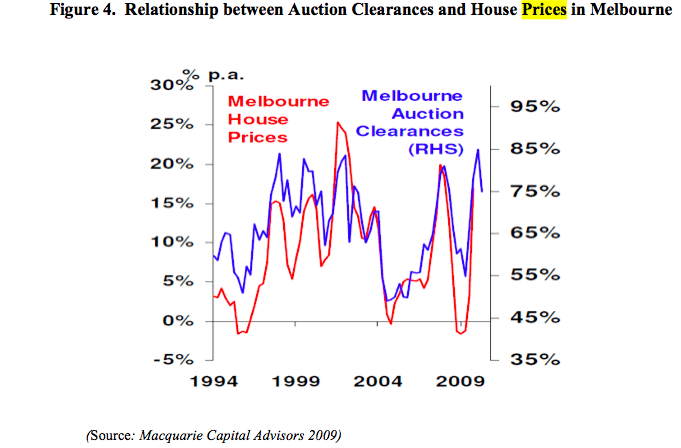

The study did, however, note that there is a correlation between house prices and the ACR.

Usually, real estate agents report the results of an auction to a data house (by phone, or by an online portal), which the Deakin study explains is as a result of agents’ requirement to appear competitive in the market. However, at present this reporting is voluntary, not mandatory, and so can cause only impartial results if agents opt to not report over a weekend. There has been some suggestion that when clearance rates are low, real estate agents are less inclined to report.

When reported, newspapers and media outlets look for records, or six-month highs or lows, or anything to provide the ACR a newsworthy hook. Despite this making for interesting reading, clearance rates are best used when looking at longer time periods of data, and trends, as a result of how easily affected each weekend can be by events or poor data collection.

They are also an indicator of the broader market’s performance. This can be useful to understand how a city is faring generally, but may not be specific enough to assist you when looking at micro markets (this is where your own research into what is selling comes in handy). Remember that while auctions are much-discussed, private treaty is by far the most common method of sale.

Similarly, markets without an auction culture will find the clearance rate statistic less useful. For instance, Sydney and Melbourne are the two largest auction cities across the country. Hobart and Adelaide investors may barely consider the ACR. Similarly, some suburbs have a higher reliance on private treaty than others (smaller areas away from the city and regional areas in particular), meaning you need to know your local market well if you want to know how much to rely on this statistic.

In summary, the statistics can be useful when considered over a lengthy period of time, and when you understand specifically what is being recorded. However, it is just one of a number of factors you must consider and should be used in concert with your own localised research.