Room for Debate: Jo Chivers and Terry Ryder evaluate the importance of crunching the stats

Crunching ABS data can be key to investment success: Jo Chivers

Ok, you can call me a nerd if you like, but I love checking out the Australian Bureau of Statistics (ABS) website, there is some really cool stuff on there.

Tick-tock...it’s the population clock. This is fun, you can see each hour the population clock tick over with real population data. On 9 July 2013 at 05:24:38 PM (Canberra time), the resident population of Australia was projected to be: 23,110,108.

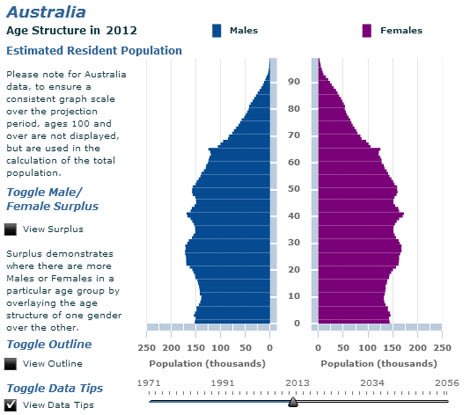

Another fab thing is the animated population pyramid. This shows a cool graph of male and female populations by age group. You can click on the ‘view surplus’ button to see surpluses of ladies or gentlemen, by age, by state, so if you’re looking for a partner, perhaps start your research here!

There is a button you can click that animates the graph; you can see the population by gender from 1971 – 2056. It’s interesting to watch the shape of the graph change as you move through the years. This is agood tool to check out when thinking about population demand for housing.

What I actually went to the ABS website for, before being distracted by clocks and animated graphs, was to check out the latest population growth data for the Hunter Region of NSW.

You see the ABS recently released its small area population estimates for the year ended June 2012. This is the first insight into population change at smaller areas of geography since the 2011 Census. Here are my key findings:

STATE SUMMARY

At June 2012, the estimated resident population of New South Wales was 7.29 million people. Between 2011 and 2012, the NSW population increased by 78,900 people (or 1.1%). This was the third largest growth of all states and territories, behind Victoria and Queensland.

At June 2012, just over one-third of NSW residents lived outside Greater Sydney and this increased by 17,600 people in the year to 2012, to reach 2.62 million.

The Hunter Valley (excluding Newcastle) had the largest and fastest population increase in the remainder of NSW (up 4,500 people or 1.8%) in 2011-12. The next largest increase was in adjacent Newcastle and Lake Macquarie (up 3,100 people), followed by Central West (2,100) and Capital Region (1,600). The only area to decline was Coffs Harbour - Grafton on the mid-north coast, down 90 people.

Maitland – West had the fifth largest growth after four Sydney areas. Thank you, we’ve been developing here for some time.

Large growth was recorded near the Australian Capital Territory, in the Hunter Valley and in the Central West.

The ABS is full of important information, at a click of a key I found some industry data for one town Property Bloom works in. It was interesting to see the breakdown by industry by employment. The top employer in this town was manufacturing, closely followed by retail. Now if I asked someone on the street, they may have said tourism as number one and mining close behind. So what sometimes seems obvious is not always the reality.

It’s important to take a ‘big picture’ look at the areas you invest in. That’s what Property Bloom does; we research populations, vacancy, median sales price, and long term sales data and combine it with what we hear on the street and from talking to our agents. From this, we work out the best locations for our client’s developments.

Whilst it may not seem immediately relative, if you cross check the statistical data with qualitative research i.e. what you find going on in the market, it all makes for some good, solid backing to why you should be investing in that location.

Jo Chivers is director of Property Bloom, which manages property development.

Differing interpretations of building approvals data shows it's best to stick to a longer-term view: Terry Ryder

Building approvals are up 7% - or down 3%. It’s all a question of attitude.

Figures from the Australian Bureau of Statistics on residential building approvals in May give different perceptions depending on which set of numbers you prefer: in trend terms, the number of dwelling units approved rose 1.0% compared to April, but in seasonally-adjusted terms they fell 1.1%.

Annually, they rose 7.1% in trend terms but fell 3.2% in seasonally-adjusted terms.

Media being media, many outlets focused on the negative numbers – such as: “Building approvals fell more than expected in May, according to the ABS.”

But some emphasized the positive. AAP, for example, reported: “A recovery in the home building sector seems to be taking hold, with approvals for houses gaining for the fifth month in the row. Approvals for detached houses rose 2.5% in May. HSBC chief economist Paul Bloxham said the gain was a positive sign for the housing sector. It shows that other part of the economy, beside mining, are getting stronger.”

Master Builders Australia took a generally balanced view: “Building approvals figures released by the Australian Bureau of Statistics show mixed signals, some positive … Peter Jones, Master Builders Australia's chief economist, said the positive is that approvals are up 9.9% in the five months to May from the corresponding period a year ago.”

We take a similar view at Hotspotting, believing that the long-term trends are the most significant factor with statistics, rather than month-to-month fluctuations.

The trend graph from the ABS shows approvals of new dwellings rising strongly since the beginning of last year – from less than 12,000 per month to around 13,500 now.

The ABS graphs also show how much the numbers jump around month to month. The longer-term view is always the most informed.

CommSec chief economist Craig James said there have been clear signs of an improvement in housing construction activity in recent months.

"Low interest rates, strong population growth, healthy employment and pent-up housing demand is starting to see the housing sector shake off the shackles and begin a much-needed resurgence," he said.

"Granted it is early days, but the sector is certainly on a recovery path.

"An ongoing lift in approvals would be beneficial for the broader economy, given it is a key forward-looking indicator."

Terry Ryder is the founder of hotspotting.com.au