Melbourne notches up strongest quarterly growth: CoreLogic RP Data October index

Despite some cooling, Melbourne was the hottest housing market in the nation, with Sydney in second place over the past quarter, according to CoreLogic RP Data.

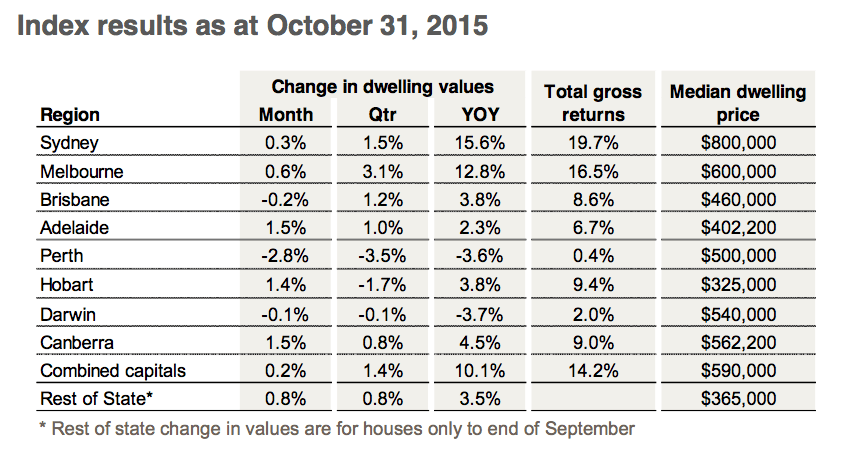

Melbourne and Sydney saw continued easing in the rate of capital gain during October, as values rose modestly by 0.3%, and 0.6% respectively over the month, according to the CoreLogic RP Data Hedonic Home Value Index.

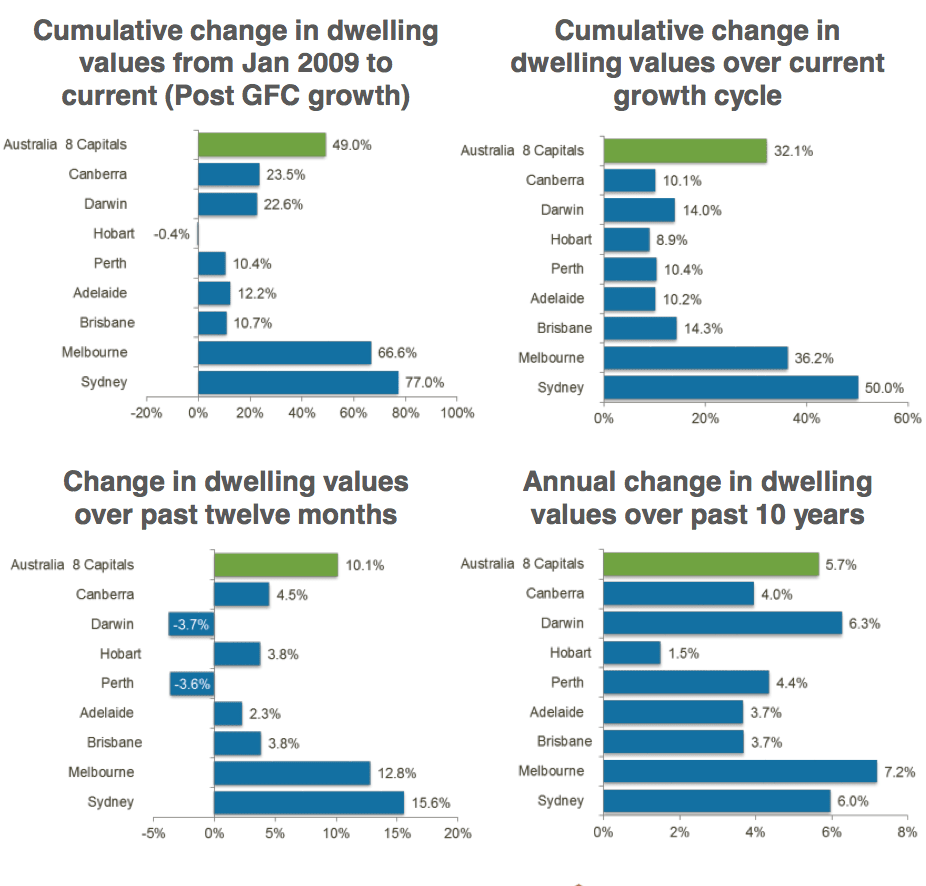

But over the three months Melbourne's 3.1% growth outperformed Sydney's 1.5%, taking their annual growth to 12.8% for Melbourne and 15.6% for Sydney.

National dwelling values across the combined capital city index rose 0.2% over the month of October, were up by 1.4% over the quarter, and 10.1% higher over the year.

The annual rate of growth across the combined capitals index has been easing since July when the index was rising at 11.1% per annum.

Adelaide and Hobart, the perennial laggards, led the nation in monthly growth during October.

According to CoreLogic RP Data head of research, Tim Lawless, a range of factors are contributing to the big capital city slowdown.

“It’s not just the fact that mortgage rates have recently risen outside of any lift in the cash rate.

"We are also seeing approximately a 30% premium on investment-related mortgage rates, tighter lending standards and borrowers generally requiring a larger deposit.

“Gross rental yields at record lows and affordability constraints are acting as a further disincentive, particularly in Sydney where the median unit price is equal to, or higher than the median house price in every other capital city.

"Additionally, new housing supply is moving through record levels which should help to ease the upwards trajectory of home values.”

Lawless said since the end of 2008, the Sydney housing market has recorded a cumulative capital gain of 77%, while Melbourne values have moved a cumulative 66.6% higher.

"Based on the median selling price at the end of 2008, Sydney home owners have made a gain of about $316,000 from the housing market compared with around $246,000 in Melbourne.”

“While the rate of growth is significant, it is important to remember that this growth is across two cycles; dwelling values were broadly tracking backwards during both the 2008 calendar year and between late 2010 through to mid-2012.”

“The only capital city where home owners have seen the value of their homes move lower since the end of 2008 is Hobart where the CoreLogic RP Data index is down 0.4% (approximately $1,155) since the end of the GFC,” Lawless said.

The weakest housing market conditions are found in Darwin and Perth where dwelling values are down 3.7% and 3.6% respectively over the past year.

The slowdown in resources-related infrastructure spending has hurt the economy and is likely to persist for some time, he said.

“Capital expenditure relating to the mining and resources sector has fallen substantially which means tougher labour conditions and little in the way of migration which has previously fueled housing demand in these areas.”