Lower property prices help WA first time buyers to housing ladder: Bankwest

The end of the mining boom has impacted Western Australia’s economy, but the resulting affordability has brought in more first time buyers who are injecting life into the state’s property market.

There are more first time buyers (FTBs) as a proportion of total buyers in WA than anywhere else in the country, reveals a new report from Bankwest.

It has been fuelled by a drop in house prices and the attraction of buying rather than renting.

The 2017 Bankwest First Time Buyers Report shows WA FTBs made 21.7% of all purchases in the year to June 2017 – the highest proportion in the country.

More recent ABS data (which falls out of the report’s catchment period) shows further growth of 5.1% in the three months to August 2017 – making a total of 15,849 first time purchases in the year to August 2017.

First time buyers also need less time to get their foot on the housing ladder – the only mainland state to experience such a decrease.

The average WA FTB has dropped to 3.6 years to save the necessary $94,651 for a 20% deposit, down from 3.8 years last year, says the report.

Bankwest general manager personal and small business banking, Donna Dalby said WA’s first time buyers are taking advantage of a number of factors at play.

“The main reason for this shorter savings time is the fact that house prices declined by 4.5% in the state, the largest decline nationwide. Even though wages only grew by 1.4% during the same period the effect is tangible,” she added.

The drop in prices has also had a knock-on effect on how much people in WA are having to borrow to buy their first home. Western Australia was the only state in mainland Australia to see the average loan size for FTB couples decline (by 4.2%) in the year to June 2017.

Perth remains one of Australia’s most accessible capital cities for FTBs, taking the average WA FTB couple just 3.9 years to save the $103,046 deposit required on their first house (three months less than in 2016 (4.2 years) and one whole year below the capital city average of 4.9 years).

“Perth and Darwin as cities buck the national trend, being the two places where the saving times for first time buyers has dropped year on year. Perth’s house prices have dropped by 4.3% which means the saving time to get the 20% deposit of $103,046 (down $4,627 from 2016) has dropped by three months to 3.9 years,” said Dalby.

The report also shows that Perth FTB couples could do well to consider opting for a unit rather than a house as a first home. The average saving time for a unit across Australia is 4.2 years, five months less than the saving time for a house.

In Perth the saving time for a unit is 3.2 years, down from 3.5 years in 2016, the biggest drop of any city in the country.

On a state level it now takes just 3.1 years for a WA FTB couple to save a $80,283 deposit on their first unit, three months less than in 2016, a reduction driven by unit prices declining by 7.4% in WA in the year to June 2017.

“Everyone dreams of having their own house but medium and high density housing is on the increase across the country and can offer a noticeably quicker route to home ownership than aiming at a house purchase,” said Donna.

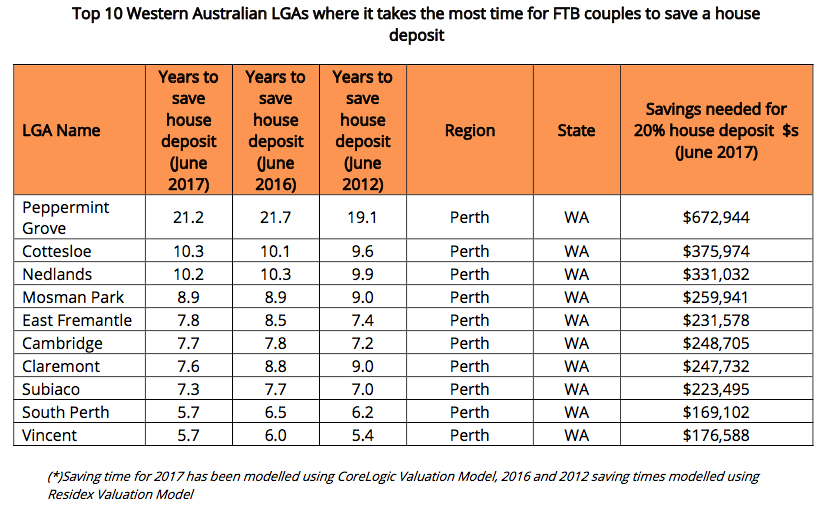

And while units can offer a quicker route to a first home, those in no hurry could look to try to buy in Perth’s Peppermint Grove, the local government area (LGA) with the longest savings time in the whole nation.

The salubrious suburb takes this unenviable title with a saving time of 21.2 years to save the $672,944 deposit need to put down a deposit (down from 21.7 years a year ago).

At the other end of the scale the LGA of Dundas in south eastern WA is the area with the shortest saving time – just 0.7 years are needed to save the necessary 20 per cent deposit of $16,346.

A three-bedroom house at 64 King Street, Coolgardie (picture above) is on the market for $119,000, indicating the affordability of the region.

A three-bedroom unit at 4/37 Sylvester Street, Coolgardie (pictured below) sold recently for $62,500.