It's time for some basic property cycle 101

Given the amount of rhetoric about the housing cycle of late and the typical mudslinging that eventuates, it feels like it’s time, again, to discuss the obvious – that there is a distinct residential property cycle in Australia.

In short

Past cycles have averaged between seven and eight years in duration.

They have largely been smooth affairs – only on rare occasions have they rapidly peaked and troughed. Also, I cannot find – on an Australia-wide basis, going all the way back through more than a hundred years of data – when a current market low fell below a previous trough.

But I do think that residential cycles will get shorter and that they will become more ‘lumpy’. Future lows might even drop below past furrows. There is also likely to be less growth on an annual basis, throughout an entire cycle, than in the past.

But essentially, what drives a property cycle and how it behaves is unlikely to change.

Cycle 101

Past cycles suggest that residential property appreciates by 8.5% per annum, with five years of upswing (where values lift by 11% per annum), followed by three years of downturn (where values drop by 5% each year).

A strong upswing is often followed by a hard downturn and vice versa.

Many things drive a property cycle – most of which are cyclical (no pun intended) – such as liquidity, economic growth, rising demand, investment returns, scarcity of supply and consumer confidence.

But there is always a “factor X” which builds influence and is often the key ingredient/s that causes imbalance.

At present these X-factors include SMSFs, Chinese buying, FIRB rules and the lower Australian dollar. You can see these in operation in Sydney, Melbourne and emerging across Brisbane’s new inner city apartment market.

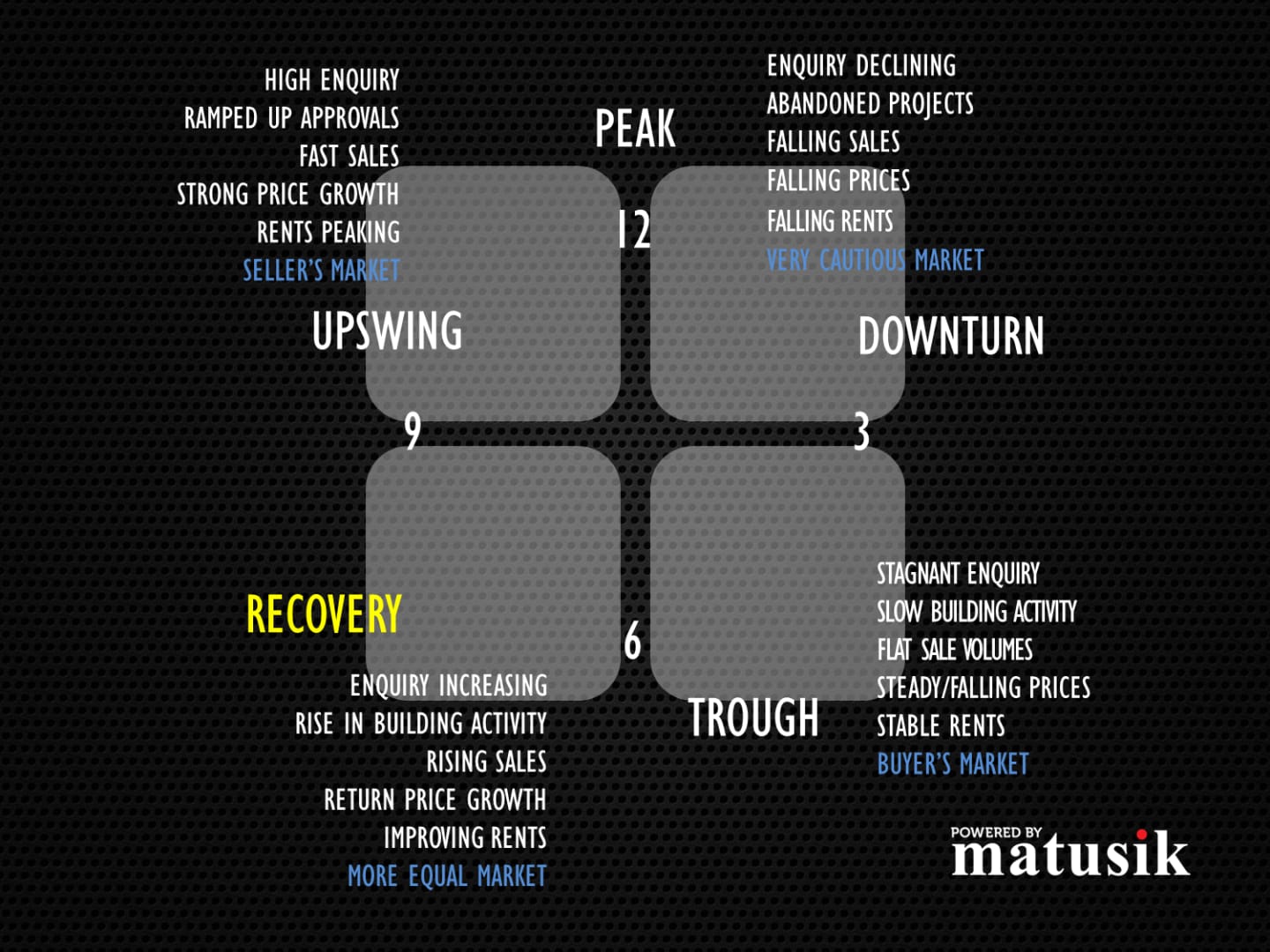

Property clock

The property clock is a simple but effective tool which outlines where certain locations are positioned in the overall property cycle.

The graphic below outlines the key measures we use to determine a location's position in the cycle.

Locations are also influenced by the position of other markets on the property clock. For example, sales activity and property values in south-east Queensland (SEQ) often increase after values rise (and become unaffordable) in Sydney and Melbourne. SEQ is an affordable alternative for investment to our two major southern capitals.

Please note – that doesn’t automatically mean – as often is suggested – that values will automatically rise in SEQ as a result of overseas or interstate buying. More sales take place; not necessarily price or rental growth. There is absolutely no statistical connection in Australia between investor origins and medium to long-term price or rental performance.

Many markets across Australia are in the recovery phase of the cycle.

Barring unforeseen major changes in the Australian and world economies, we anticipate positive market conditions to exist for the next two years with a generic market downturn – driven by those cyclical factors discussed above – in about mid-2016.

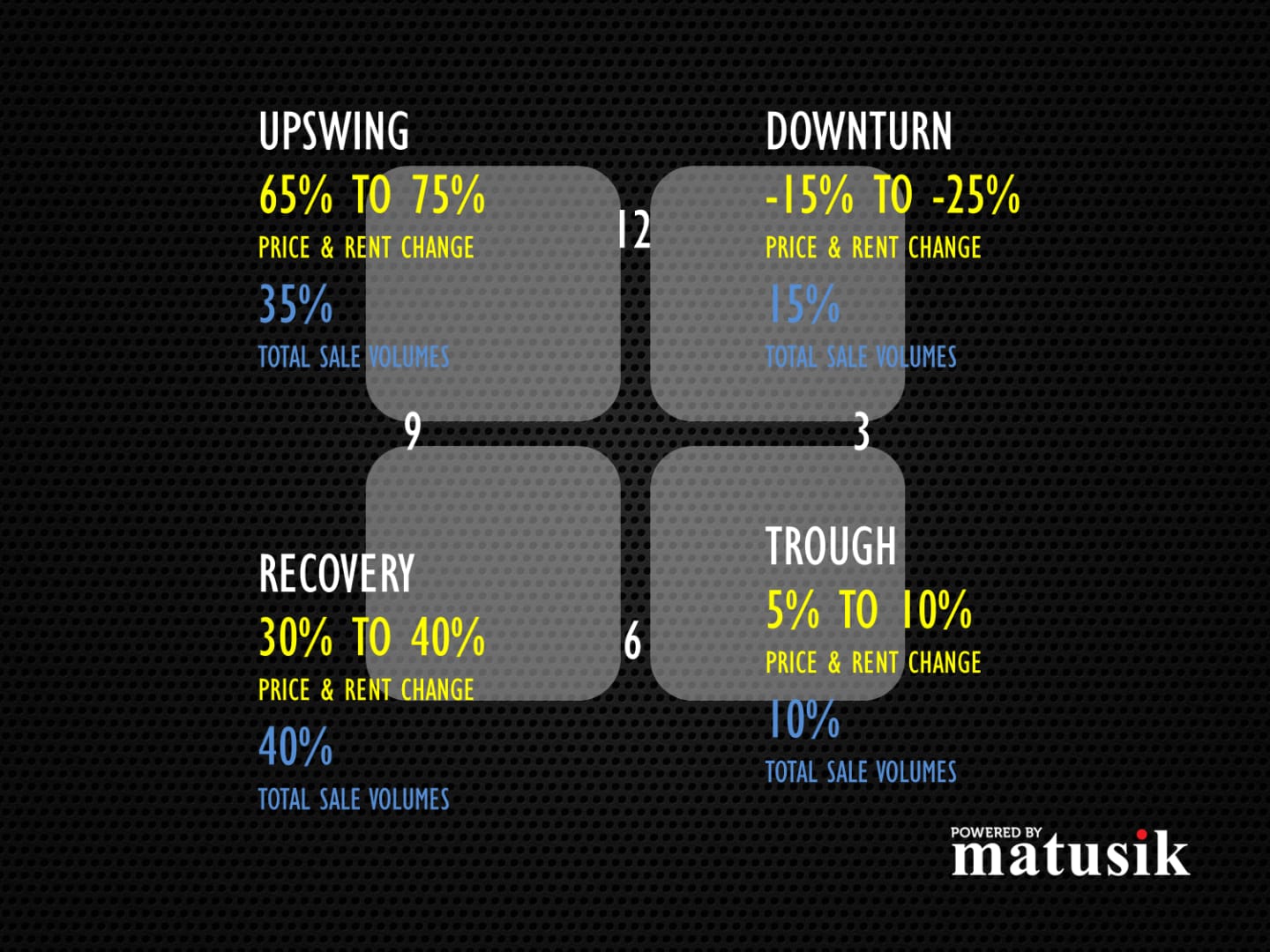

Volumes and growth

History shows that much of the price and rental growth that takes place over the life of a property cycle mostly takes place during the recovery and upswing phases.

The same applies to the volume of sales.

For example, assuming values rose $100,000, from trough to trough (i.e. over the typical past cycle of seven years), then up to 40% or $40,000 in gains would take place during the recovery and up to 75% or $75,000 during the upswing.

Rents usually show a similar trend.

40% of the sales take place during the recovery phase, with a further 35% during the upswing.

Values and rents often fall, during the downturn. Sales volumes also drop.

Typically, there is some price and rental growth during a trough – but usually much less than inflation at the time.

Sales volumes are also usually quite sluggish.

Now is the time

For many readers, now is a good time to act regarding buying an investment property.

It is also a good time to buy and sell for your own occupation.

It is really a self-fulfilling process. We largely cannot help the property market reach a tipping point. Once a market gains enough momentum, there is really no stopping it. It repeats. It cycles. Best stop, as I am starting to sound too much like Rafiki from The Lion King.

Short and bumpy and less

But keep in mind that the cycle might be getting shorter and the ride bumpier than in the past.

I think shorter, because of the way digital media and all our gadgets influence our decisions. Our confidence seems to wax and wane with far more frequency that in the past. We scare so very easily these days; buy and sell on hearsay and increasingly get side-tracked away from some basic fundamentals. Now I’ve morphed into Will McAvoy from Aaron Sorkin’s The Newsroom. Enough already!

Bumpier because of the rising proportion of apartments and townhouses in Australia’s new housing mix. This product is delivered in large chunks – not individually like detached houses. This is especially the case when it comes to mid-to-high rise apartment towers.

Investors need to understand that there will be periods where – for short periods of time – supply exceeds demand. This trend is likely to take place on a more frequent basis than in Australia’s past. And this changing scene will, in turn, make us more anxious – leading to a shorter overall cycle.

Property cycles in countries and major cities that are dominated by attached dwellings and apartments, have a wilder property cycle than those based on more traditional detached housing.

Less because of many things, including already low interest rates; relatively low housing affordability compared to past cycles (i.e. high ratio of dwelling price to disposable income); low inflation, potentially deflation; employment uncertainty (less full-time jobs); ageing baby boomers; poorer (money-wise) overseas migration intake; budget deficits; peaked mining-related capex; economic and financial restructuring …this list is a long one.

Visit Michael's website, read his blog, follow him on Facebook and Twitter, or connect via LinkedIn.