Dysfunction in overall economy, but property could be heading into boom mode

Surprise, surprise – Australians increasingly disillusioned with federal system and national tier of government, Newspoll finds. According to the third biennial constitutional values survey, two-thirds of Australians do not believe state and federal governments are working well together, with confidence in the federal government as the most effective level of government falling from 50% in 2008 to 29% in 2012.

Griffin University’s Professor AJ Brown, the survey’s lead researcher, said “the declining faith in governments suggested Australia was headed for a 'crisis of confidence' unless greater political priority was again given to issues of federal co-operation and longer-term reform”.

Alas, we constantly hear the buzzword “reform”. For those closely watching the Independent Commission Against Corruption (ICAC) NSW politics’ ugliest years, the allegations of corruption are the most frightening in Australia’s political history. The allegations of greed are incomprehensible although not surprising, as suspicion has always overshadowed NSW Labor.

NSW is not alone, and the federal ALP has more than a few pending court cases to defend, with the latest (the one where four files conveniently went missing) being bank letter links PM to house mortgage. It has started to get very ugly for the declining ALP support machine. Australia’s Prime Minister will have to deliver a plethora of explanations to convince the Parliament that statements she has made previously were not misleading. Much speculation that her days in the top gig are numbered, and I predict a resignation over another knifing.

Funding crisis looms, super could be the answer: Clyne an interesting proposition given a restriction on lending is assured of sending an economy into recession. Australia needs to be investing in new markets although the costs of doing business within Australia is or should be of enormous concern. Blame CEOs for national cost explosion, which points out that it is three times more expensive to build a mining plant in Australia than in the United States. This is further evidenced within the declining manufacturing industry, which is constantly in decline and propped up by taxpayers. I doubt that within 10 years, Australia will have a manufacturing industry. Australia will become an import, not export economy, which means that unions won’t survive either.

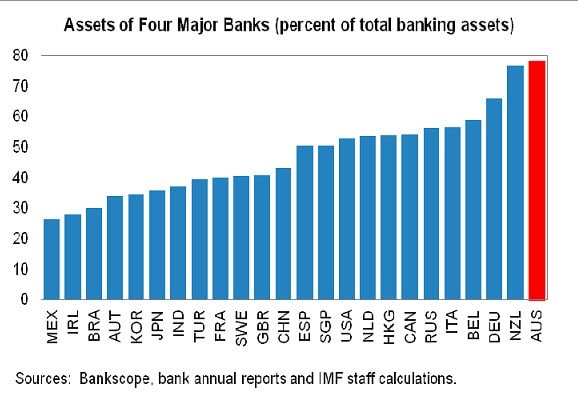

The good news for consumers is that the big four banks are now under increasing pressure given China’s biggest bank, ICBC, moves on Australian expansion plans and is now increasing and opening branches all over Australia. According to Wikipedia, Australian residents identified as having Chinese ancestry make up 4% of Australia’s population or approximately 865,000 people as at 2011. Throw in Macquarie Bank doubles loans in first nine months of 2012: APRA figures, so we are seeing a change within the banking landscape.

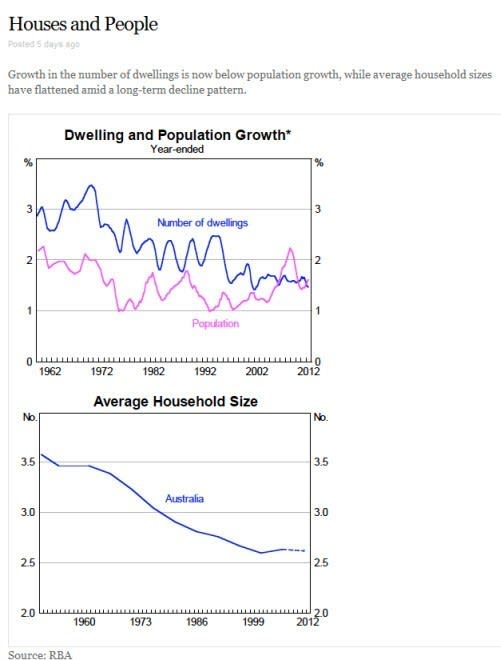

Sydney is Australia’s most densely populated city – its established inner and middle suburbs averaged 3,244 persons per square kilometre in 2010, up 13% from 2001. Just like our manufacturing decline, it is the cost of living that is determining our economy.

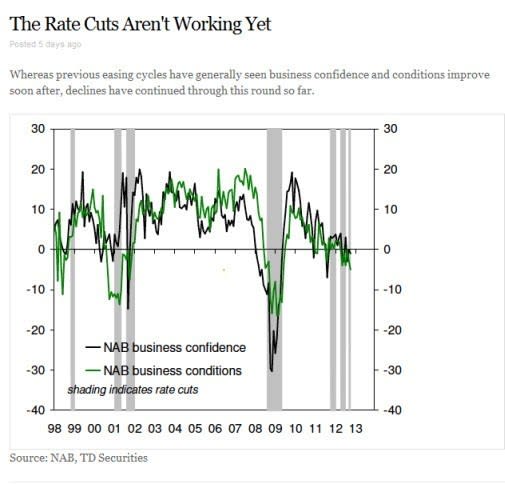

The best example (I love graphs) is this:

Which brings us back to the Newspoll findings – modern-day governments just don’t get it. Australia needs to quickly adjust to the enlightenments of the modern world. Just look at the dumb and dumber Click Frenzy launch this week where the servers crashed. Only an incompetent wouldn’t know that this website needs its own dedicated servers to cope with the demand – not shared servers.

The Mosman housing markets continues to contract much faster than we witnessed last year – which is more to do with the state of the economy than anything else. Although it was pleasing to see that yesterday, Australian stocks jumped through the 4,400 point barrier. One should bear in mind that when it breaks 5,000, house prices go into boom mode. This is a scary proposition (even for a real estate agent) given my belief that the last thing our property markets need is a property boom when, at best, we see so many dysfunctions in our overall economy.

Robert Simeon is a director of Richardson Wrench Mosman and Neutral Bay and has been selling residential real estate in Sydney since 1985. He has also been writing real estate blog Virtual Realty News since 2000. The RWM real estate model has sold in excess of $1 billion in database sales globally.