Brisbane property set for price peak in late 2016: Residex

Most Australian property markets saw modest growth in 2015, according to Residex.

Sydney was again the exception – given houses and units achieved annual growth of 18.36% and 13.48% respectively.

Melbourne houses also recorded strong annual growth of 13%.

Perth houses saw an unexpected surge of 2.30% in the month of December, while Adelaide, Hobart and ACT houses showed steady capital growth over the last 12 months.

"The end of 2015 marked the end of the Sydney housing boom," Residex advised.

The upswing in the current cycle lasted almost two years and, in real dollar terms, the median house increased by approximately $375,000.

Historically, Sydney has been the leader of growth with the Melbourne and Brisbane markets following.

Given this, the Melbourne house market could peak sometime in the first quarter of 2016 while Brisbane could follow later in the year. However, global economic trends and a national crackdown on speculative buying may hamper growth for these other east coast cities.

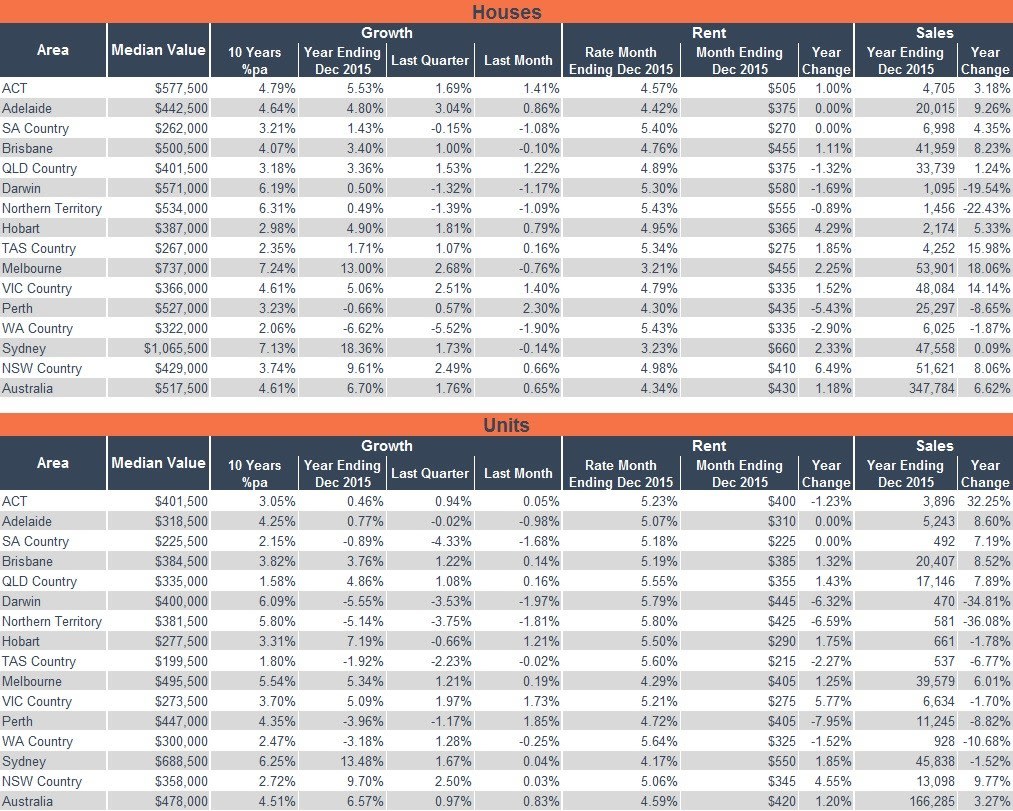

Table 1 shows the capital growth, rent and sales summary for December 2015.

Table 1: December 2015 Summary

Source: Residex

Graph 1 shows the monthly capital growth trend of Sydney and Melbourne. The graph depicts Melbourne’s peak growth in houses following Sydney.

Graph 1: Monthly Capital Growth Trend: Sydney and Melbourne

Source: Residex

Residex suggested it was difficult to say what exacerbated the last upswing in Sydney and whether similar factors will impact other major dwelling markets.

"Many have speculated and reported anecdotes of Chinese foreign investment pushing up real estate values," Eliza Owen, the market analyst for Residex/onthehouse.com.au said.

"There is currently no reliable dataset in existence that documents foreign investment in Australian residential real estate, so it is not rigorously sound to say that this contributed to the enormous value increases.

"In any case, the People’s Bank of China has placed restrictions upon citizens taking capital out of China to encourage investment within their own country (citizens are permitted to take just US$50,000 out of the country each year. This action could limit the growth experienced in other Australian cities.

"It is also not necessarily true to say that speculative domestic investment bid up the market.

"However, there is some evidence suggesting that investors became more active than owner occupiers in the latest housing boom."

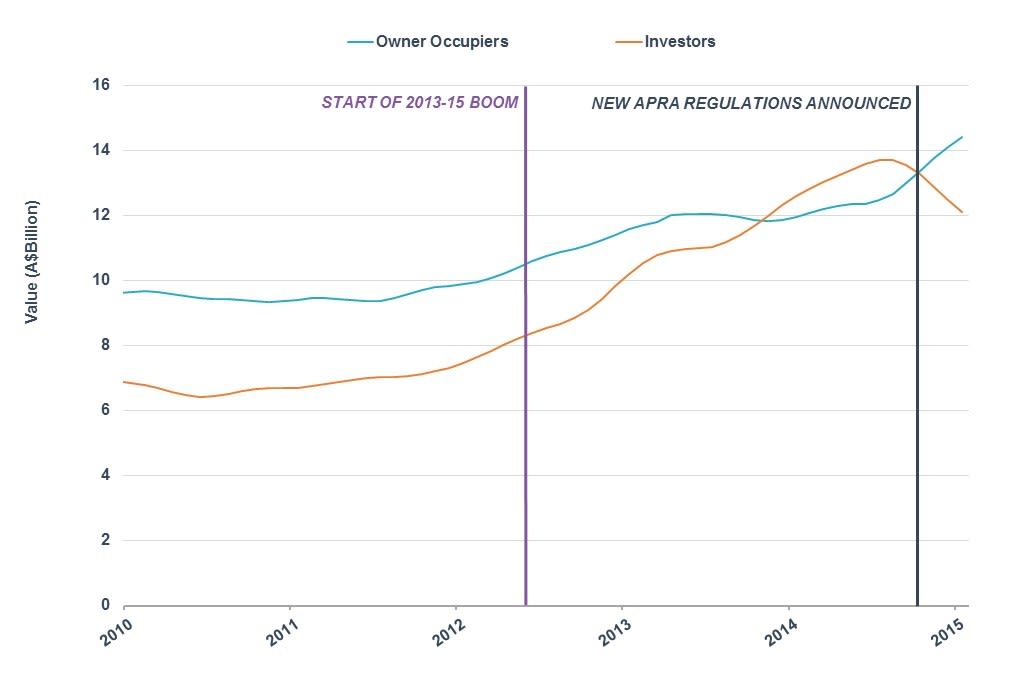

The ABS collects data on the amount of money lent for the purposes of owner occupation versus investment. In recorded history, 2014 was the first time investor loans overtook owner occupier loans. Graph 2 presents this dataset over the last 5 years. It is worth noting that the figures in Graph 2 are for Australia wide lending, so the phenomena of investors overtaking owner occupiers may not be specific to the Sydney market.

Graph 2: Significant Lender’s Finance Commitments to Investors vs. Owner Occupiers

Source: ABS Catalogue Number 5609.0 – Housing Finance, Australia

Note: Excluded refinancing for owner occupiers

The graph suggests that either investors were paying more money for dwellings or investors were buying a higher volume of dwellings at this time.

Theoretically, investors who owned property in Sydney could have continued to bid up prices in the market while interest rates were low. The ability to borrow equity against property facilitates this – the higher property prices go, the more equity investors have to purchase new dwellings.

In July 2015, the Australian Prudential Regulation Authority (APRA) announced regulations[3] that would require lenders to hold more capital against home loans. By the beginning of July 2015, a downswing in the Sydney market had begun. Sydney house values fell 0.14% in the month of December, the first fall in the aggregate market since January 2014.

One of the criticisms of APRA’s decision was that it was not specific to the rapidly growing markets of Sydney and Melbourne.

However, of the 514,066 sales Residex recorded across Australia for 2015, approximately 20% were in the Sydney metropolitan region and a further 20% were concentrated in the Melbourne metropolitan.

"If anything, high home loan rates may have caused investors to spread their wealth among more affordable cities across the country."

Property developers Stockland and Mirvac have reported that there are Sydney buyers interested in Brisbane apartments.

Private developers have also recorded Sydney buyers making up as much as 40% of investment in new developments.