Auction clearance rates still low, but consumer confidence picking up

Sydney’s September auction clearance rate sits at 54% from the 850 auctions held so far among the month’s 2,350 scheduled auctions, but the latest week’s success rate was under 50%.

There are 440 Sydney auctions this weekend, which is 20% fewer than the same Saturday last year, but the same number as in 2009.

There were 300 auctions on the third Saturday in 2008, according to Australian Property Monitors, as the global financial crisis triggered inactivity.

By comparison since 2008 the same Melbourne weekends had 600, 850, 750 and this weekend 650 scheduled auctions, according to APM research analyst Clinton McNabb.

There are 13 weekends remaining for auctions this year and, unless there is a substantial improvement or deterioration, it looks reasonably certain that the year will end with a clearance rate in the 50s.

“For Melbourne the last time this occurred was in 2004, when a clearance rate of 57% was recorded,” says the Real Estate Institute of Victoria’s Enzo Raimondo.

“This is the only similarity with that year, as there will be about 40% more auctions this year.”

Three years ago, in 2008, the clearance rate was marginally higher at 63%, and the volume of auctions similar to what is expected this year, according to the REIV.

The REIV says last weekend Melbourne had 616 auctions and a 54% clearance rate.

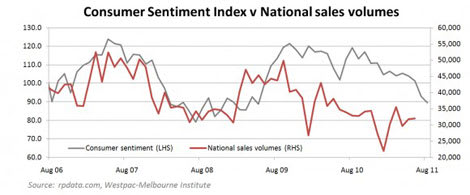

There was a close correlation between consumer confidence and housing market activity, according RP Data head of research Tim Lawless.

“The importance of a positive consumer mindset is simple: for a prospective buyer to make a high commitment purchase decision like buying a home they need to have a base line level of optimism about their job security, their ability to service a mortgage and the prospects for the housing market.

“The trend in consumer confidence and national sales volumes has shown an 84% correlation since the start of 2008,” Lawless suggests.

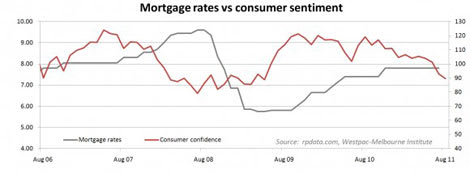

He says there is also a lagging correlation between mortgage rates and consumer confidence (see graph below) as generally when interest rates are falling consumer confidence will show an improvement and vice versa.

Lawless notes the August Westpac and the Melbourne Institute Index is getting close to the lows seen back in late 2008 when the GFC was in full swing.

“The September figure, which came through earlier this week, showed an 8.1% improvement in the confidence index, perhaps marking the turning point for this important indicator,” Lawless says.

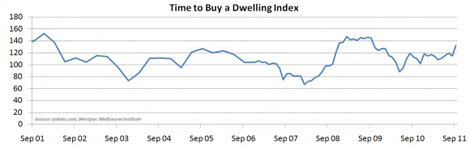

“The ‘Time to Buy a Dwelling’ Index, which is a subset of the Consumer Sentiment Index showed a strong bounce over September, improving 14.3% over the quarter and 16.4% over the year.

“This component of the index has bounced back to levels not seen since September 2009, the month prior to interest rates commencing their tightening cycle.

Lawless suggests interest rate stability and the prospect of rates potentially falling may cause confidence to continue to improve.

“If the cash rate does actually come down, as the financial markets and a growing number of economists are expecting may be the case, we may see a more significant improvement in the consumer sentiment data when it is released each month.”

But he warns on balance any significant or swift rise in consumer optimism was likely to be tempered by any further softening in labour market conditions or deterioration in global/local economic conditions.

“Uncertainty surrounding both these factors is likely to continue to provide some counter balance to improvements in the consumer mindset.”