Housing affordability rises in Australia as prices continue to fall: Moody's Alena Chen

GUEST OBSERVATION

Housing affordability for new mortgage borrowers in Australia, which improved over the year to March 2019, will continue to improve over the next 12 months, because of declining housing prices, according to Moody's Investor Service.

More affordable housing reduces the credit risks of newly originated mortgages, which is positive for new residential mortgage-backed securities (RMBS) backed by such loans.

The latest report noted the proportion of household income needed to meet repayments on new Australian mortgages - our measure of housing affordability - declined to an average 26.5% in March 2019, from 28.7% a year earlier.

Affordability improved because housing prices declined, while average incomes also increased modestly. We expect housing prices to continue to decline moderately over the next year, driving further improvements in housing affordability.

It noted that housing affordability improved in most cities. Housing affordability improved in Sydney, Melbourne, Brisbane and Perth over the year to March 2019, but deteriorated in Adelaide. The biggest improvement in housing affordability was in Sydney, where housing prices declined 10.7% over the year to March.

Sydney is the most sensitive to housing price, income and interest rate changes. We tested the impact of changes to housing prices, incomes and interest rates on housing affordability. Of all Australian capital cities,

Sydney is the most sensitive to changes in the three variables.

Housing affordability for new mortgage borrowers in Australia, which improved over the year to March 2019, will continue to improve over the next 12 months, because of declining housing prices.

More affordable housing reduces the credit risks of newly originated mortgages, which is positive for new RMBS backed by such loans.

Over the year to March 2019, the proportion of household income needed to meet mortgage repayments - our measure of housing affordability - declined on average in Australia, driven in large part by declining housing prices.

Australian households with two income earners taking out an 80% loan-to-value (LTV) mortgage needed an average 26.5% of their monthly income to meet monthly mortgage repayments in March 2019, down from 28.7% in March 2018 and below the 10-year average of 28.7%.

Median housing prices declined by 6.5% over the year to March 2019, while incomes increased an average 2.8%, improving the affordability of new mortgages. Average headline mortgage interest rates increased slightly to 5.4% in March 2019 from 5.2% a year earlier, but this was outweighed by declining house prices and rising incomes.

We expect housing prices to continue to decline moderately over the next year, reflecting reduced credit supply by the banking sector and a seeming reduction in demand from households.

Accordingly, we expect housing affordability to continue to improve over the next year.

Housing affordability improved in Sydney, Melbourne, Brisbane and Perth over the year to March 2019, but deteriorated in Adelaide.

In Sydney, the proportion of household income needed to meet mortgage repayments declined 4.7 percentage points to 33.2% over the year to March 2019, the biggest improvement of any capital city, though Sydney remains the least affordable city for housing in Australia.

Median housing prices declined 10.7% in Sydney over the year to March 2019. We expect housing prices in Sydney to continue to decline and for housing affordability in the city to continue to improve over the next year.

In Melbourne, the proportion of household income needed to meet mortgage repayments declined to 29.4% in March 2019 from 31.6% a year earlier. Housing prices in Melbourne declined 5.3% over the year to March 2019, while average weekly incomes increased 3.2%. We expect housing prices in Melbourne to continue to decline over the next year, which is positive for housing affordability.

In Brisbane, the proportion of monthly income needed to meet monthly mortgage repayments declined by 1.3 percentage point to 22.5% over the year to March 2019. Housing prices declined 1.2% over the year.

In Perth, the proportion of income needed for mortgage repayments declined, albeit marginally, to 19.4% in March 2019, from 19.7% a year earlier. Perth is the most affordable capital city for housing in Australia.

In Adelaide, the proportion of household income needed to meet mortgage repayments increased moderately by 1.3 percentage point to 23.1% over the year to March 2019. Median housing prices in the city increased 4.6% over the year.

On average across Australia and in each capital city, housing affordability in March 2019 was better than the respective 10-year averages (Exhibit 1).

Click here to enlarge:

The affordability of both houses and apartments improved in all cities except Adelaide, where the affordability of both types of dwelling deteriorated over the year to March 2019 (Exhibit 2).

Click here to enlarge:

Click here to enlarge:

Sydney most sensitive to housing price, income and interest rate changes

We tested the impact of changes to housing prices, incomes and interest rates on housing affordability. Of all Australian capital cities, Sydney is the most sensitive to changes in the three variables.

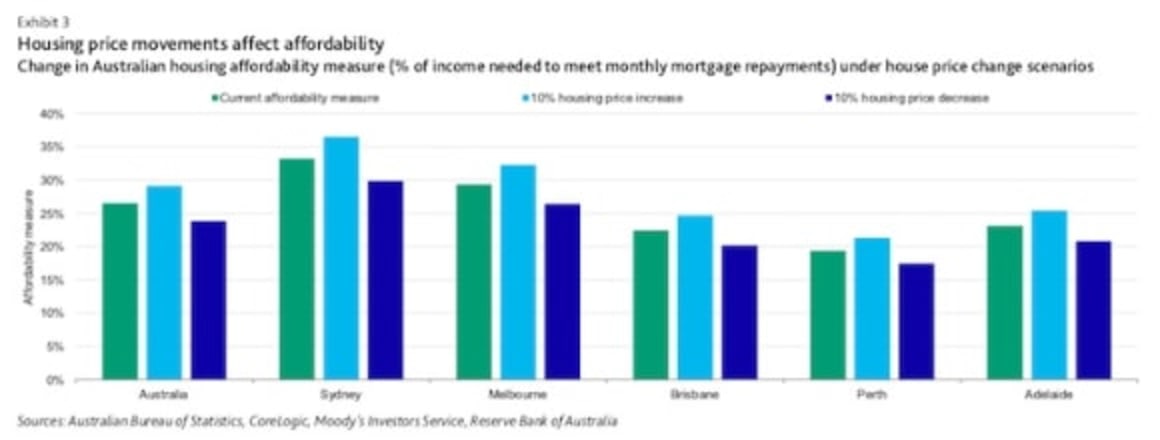

Sensitivity test 1: Housing price changes

Our sensitivity test shows that for every 10% change in housing prices, the percentage of household income needed to meet mortgage repayments changes by 2.6 percentage points on average in Australia.

In Sydney, the least affordable city, a 10% change in housing prices results in a 3.3 percentage-point change in the percentage of household income needed to meet mortgage repayments, the most of any Australian city.

Exhibit 3 shows the impact on housing affordability of (1) a 10% increase in median housing prices and (2) a 10% decrease in median housing prices.

Click here to enlarge:

Sensitivity test 2: Income changes

Our sensitivity test shows that if average household income decreases by 5%, the percentage of household income needed to meet mortgage repayments increases by 1.4 percentage point on average across Australia. If average household income increases by 5%, the percentage of household income needed to meet mortgage repayments decreases by 1.3 percentage point.

In Sydney, a 5% decrease in household income results in a 1.7 percentage point increase in the percentage of household income needed to meet mortgage repayments, the most of any Australian city. A 5% increase in household income in Sydney results in a 1.6 percentage-point decrease in the percentage of household income needed to meet mortgage repayments.

Exhibit 4 shows the impact on housing affordability of (1) a 5% decrease in household income and (2) a 5% increase in household income.

Click here to enlarge:

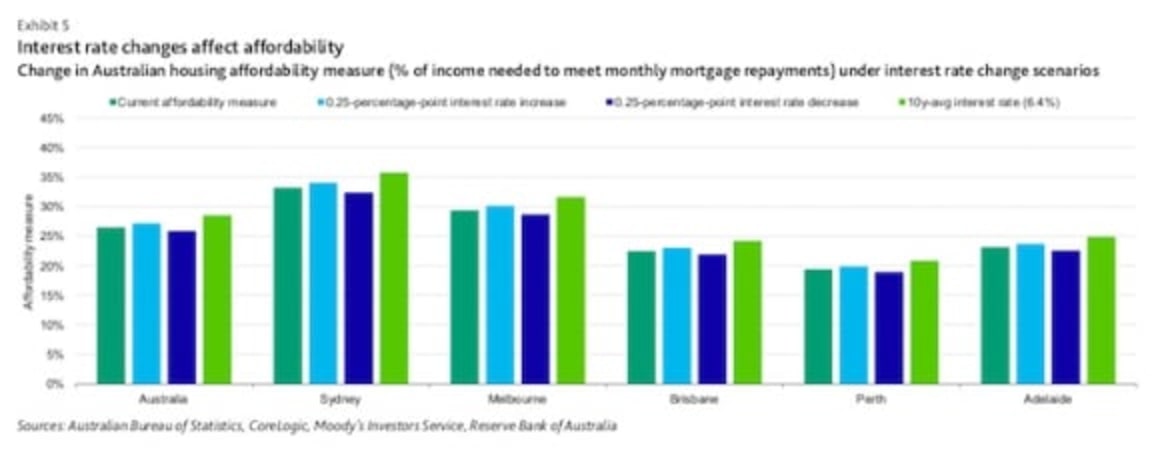

Sensitivity test 3: Interest rate changes

Our sensitivity test shows that for every 0.25 percentage point change in mortgage interest rates, the percentage of household income needed to meet mortgage repayments changes by 0.7 percentage point on average across Australia.

In Sydney, a 0.25 percentage point change in interest rates results in a 0.8 percentage point change in the percentage of household income needed to meet repayments, the most of any Australian city.

Exhibit 5 shows the impact on affordability of (1) a 0.25 percentage point interest rate increase, (2) a 0.25 percentage point interest rate decrease and (3) mortgage interest rates rising to the 10-year average of 6.1%.

Click here to enlarge:

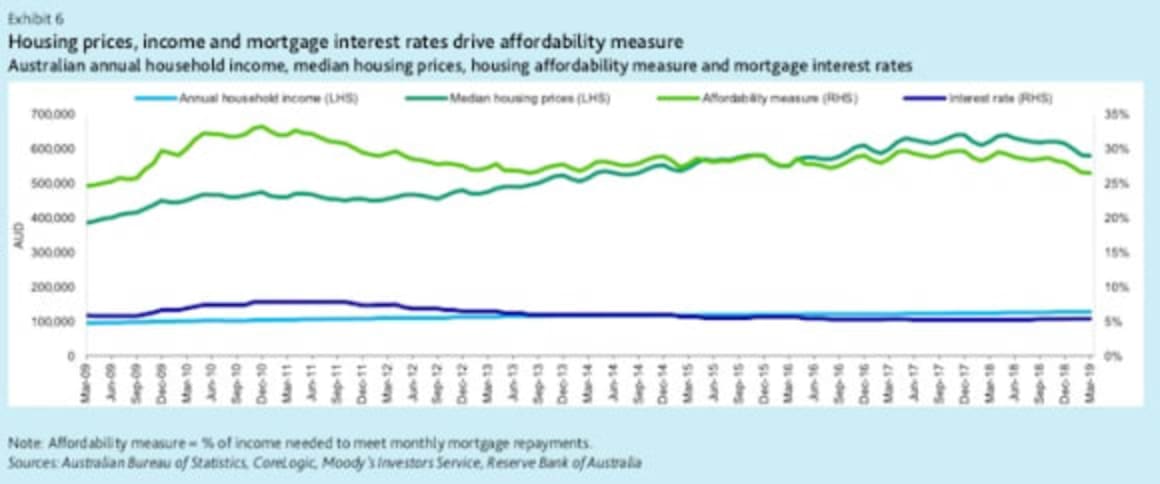

Housing prices, income and interest rates drive affordability

We measure housing affordability based on three inputs — median housing prices, average household income and standard variable mortgage interest rates (Exhibit 6).

Click here to enlarge:

Median housing sales prices decreased

Median housing prices decreased by 6.5% on average across Australia over the year to March 2019 (Exhibit 7). Median prices declined in Sydney (-10.7%), Melbourne (-5.3%), Perth (-5.3%) and Brisbane (-1.2%). Median prices increased in Adelaide (+4.6%).

Click here to enlarge:

Household income increased

Average weekly incomes increased moderately by 2.8% on average across Australia over the year to November 2018 (Exhibit 8).2 Incomes increased in all cities except Perth.

Click here to enlarge:

Alena Chen is Vice President at Moody’s.