Melbourne's apartment oversupply to impact on entire housing market: QBE Housing Outlook

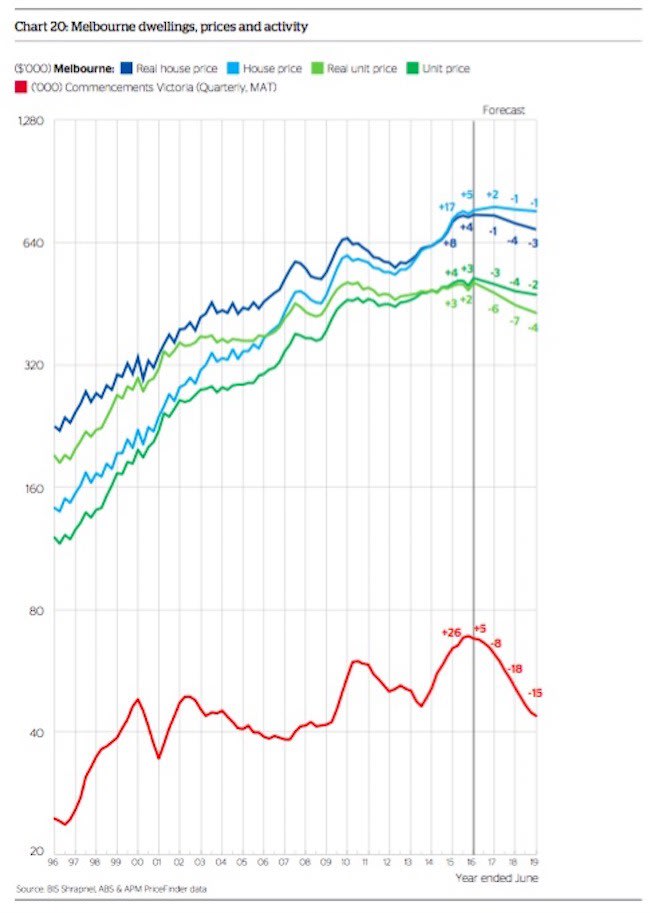

The Melbourne house market saw significant growth in the two years to 2014/15, with the median house price growing by 11.4% and 16.9% in 2013/14 and 2014/15 respectively, according to QBE's latest housing report.

Underlying demand has been underpinned by strong population growth over this period.

Net overseas migration into Victoria has averaged 55,400 persons per annum in the four years to 2015/16; above its 15–year average of 49,200 per annum. Net interstate migration has also been improving. Based on published data to December 2015, Victoria is on track to experience a record net inflow of 11,000 persons in 2015/16.

This population growth has continued to maintain a deficiency of dwellings in the Melbourne market despite continued growth in new dwelling supply. This deficiency, together with low interest rates, has driven purchaser demand.

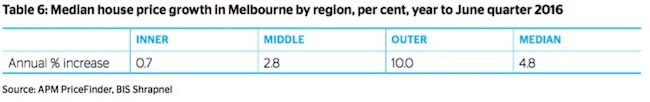

However, median house price growth has slowed in 2015/16 to 4.8%. Further rises in new dwelling supply have taken the market almost back into balance, reducing the pressure on prices. Investor demand has also weakened in 2015/16 due to regulatory pressures, and the net result has been slowing price growth.

The slowing market has been most felt in the Inner and Middle rings of Melbourne, where median house price growth was a minimal 0.7% and 2.8% respectively in 2015/16. In contrast, median house price growth in Outer Melbourne was 10% in 2015/16 as stronger price growth moved into the more affordable regions of Melbourne.

Without experiencing a large benefit in economic activity from the boom in resource sector investment in the prior years, Victoria has been relatively insulated from the tapering off in mining investment compared to the resource– driven states. This should sustain an elevated migration inflow, although the net inflow is forecast to nevertheless weaken.

Many of Victoria’s trade exposed and service industries have benefited from a lower Australian dollar over the past two to three years. However, the dollar has been creeping upwards again through 2016, maintaining pressure on these sectors and preventing further investment.

Moreover, further headwinds will emerge in the short term as the automotive manufacturing sector sees all three remaining locally based car manufacturers close their production facilities across 2016 and 2017. Negative impact on employment across the entire supply chain is likely to weigh heavily on the local economies focused in the outer suburbs.

Melbourne also faces a significant supply pipeline that will see dwelling completions peak in 2016/17 and tip the market into oversupply. With population growth also expected to ease through the forecast period and lead to weaker underlying demand, this oversupply is forecast to steadily increase through to 2018/19.

While expected to be mainly in the unit sector, there is likely to still be flow on impact in the housing market.

Rising vacancy rates are expected to result in a further retreat from the market by investors, who were already declining in demand due to tightening lending policies by the banks. While there is expected to be enough momentum in the market to drive limited median house price growth of 2% in 2016/17, price growth is forecast to be negative in 2017/18 and 2018/19 as Victoria’s oversupply continues to increase, with a cumulative fall of 3% over the two years resulting in an aggregate 0.6% decline over the forecast period.

The unit market has underperformed in comparison to the house market with median unit prices growing 13% compared to median house price growth of 36% over the three years to June 2016. This reflects the growth in new supply with unit completions far surpassing completions in houses over the same period.

The high levels of unit construction have added significant supply to the market. While a modest aggregate dwelling deficiency is estimated at June 2016, the unit market is estimated to be in oversupply.

Record levels of apartment completions, as well as a strong project pipeline expected though to 2017/18, is likely to continue to impact vacancy rates, rental growth and unit prices. At the state level, the oversupply in dwellings is expected to grow through to 2019 with the excess concentrated in the unit sector.

This excess is also expected to be compounded by changes to investor lending guidelines which have already started to impact investor demand. Melbourne’s median unit price is forecast to decline by a total of 9% over the three year period to $480,000 by June 2019.