Property taxation revenue continues to rise: CoreLogic RP Data

State and local government taxation revenue from property increased by 10.5 percent for the 2014-2015 according to the Australian Bureau of Statistics.

The Australian Bureau of Statistics (ABS) has just released government taxation for the 2014-15 financial year which shows that a majority of state and local government taxation revenue comes from property.

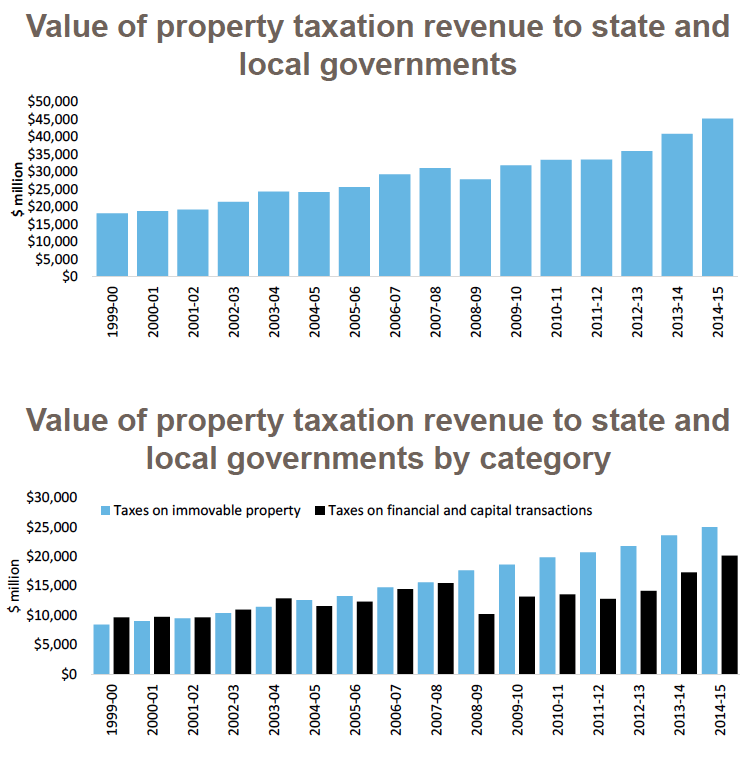

Throughout the 2014-15 financial year, state and local government taxation revenue was recorded at $89.278 billion, up 7.0 percent over the year with $45.203 billion or 50.6 percent from property.

According to the latest Property Pulse report by CoreLogic RP Data, property tax revenue increased by 10.5 percent for the period and said since the 1999-00 financial year, total state and local government taxation revenue has increased by 103% compared to a 150% increase in property taxation.

"Taxes on property are split into two broad categories, taxes on immovable properties which includes the following sub-categories: land tax, rates and other, and taxes on financial and capital transactions which includes: financial institutions transaction taxes, government borrowing guarantee levies, stamp duty on conveyances and other stamp duties," the report said.

"The chart shows the value of taxation revenue from the two broad categories over time. In 2008-09, taxes on financial and capital transactions fell away dramatically while taxes on immovable property continued to rise. More recently taxes on immovable property have continued to steadily increase while taxes on financial and capital transactions have also ramped up significantly.

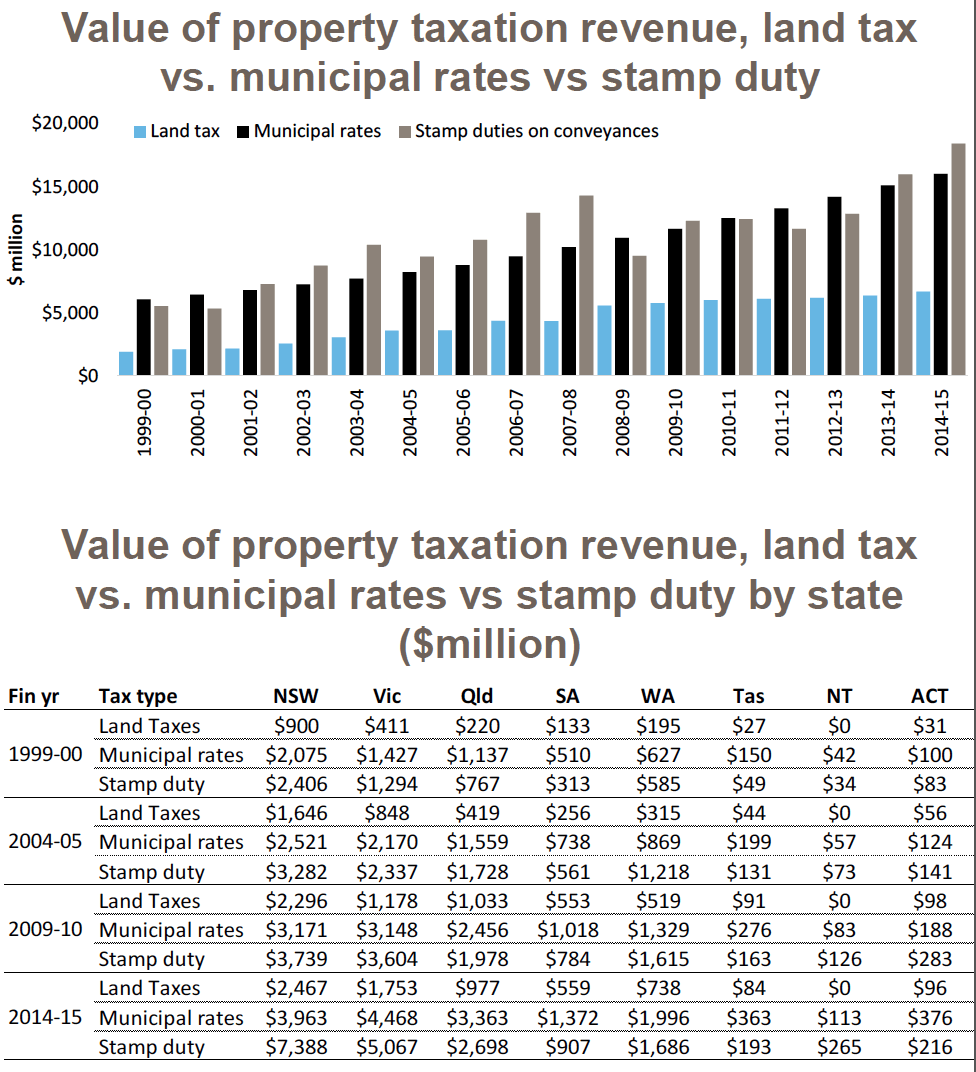

"The two largest sources of tax are: stamp duties on conveyances and municipal rates which account for 40.8 percent and 35.4 percent of total tax revenue respectively.

"The only other significant source of tax revenue is land tax accounting for 14.8 percent of revenue. Over recent years the value of taxation revenue from municipal rates and stamp duty has increased substantially while land tax increases have been limited. The fact that stamp duty is now the greatest source of tax revenue for state and local governments must be of some concern. This is due to the fact that it is a tax on transactions unlike municipal rates and land tax which are taxes on the property. Transaction taxes are entirely reliant on the market and while they surge when values and transactions are rising, when either or both fall this source of revenue drops significantly (see 2008-09).

"Over the most recent financial year, stamp duty has been the largest source of tax revenue in NSW, Vic and NT while in all other states municipal rates is the largest source of tax. For NSW and Vic in particular it highlights the strong increases in home values across those states throughout 2014-15. NSW is experiencing the largest surge in stamp duty revenue, up 98 percent over the five years to 2014-15."

"Property taxes are the most important sources of revenue for state and local governments however, the reliance on volatile stamp duty revenue provides challenges for these governments. This is a good reason to advocate for the replacement of stamp duty with universal land taxes. Although no one likes a new tax, it provides more revenue certainty to local and state government and it doesn’t deter the buying and selling of properties like stamp duty’s impost can."