Current oversupply in Melbourne? SQM's Luca Simms

Jonathan ChancellorFebruary 6, 2021

GUEST OBSERVER

What’s happening with the residential apartment market in Melbourne today? There appears to be a lot of concern regarding oversupply of unit stock with localities such as the city centre, Docklands and Southbank predominantly under the spotlight.

Another concern appears to be the quality and aesthetic appeal of new developments, or rather lack thereof.

This morning I read that the Victorian Government will legislate new measures to control Melbourne’s future apartment developments by introducing restricted controls on setbacks, building height and space between neighbouring buildings.

The plot ratio of all new developments is to be lowered from the previous 24:1 to 18:1. For those not familiar with plot ratios, it basically means that any new development can’t exceed a total floor space 18 times the size of the site it’s proposed to be constructed on. These controls coincide with a time where Melbourne leads the nation’s count of new high-rise buildings both under construction and in the pipeline (111).

Furthermore, concern has also been raised regarding the provision of ventilation and natural light as well as apartment size in Victoria, where no minimum size requirements have previously seen some developments offer apartments as small as 24 square metres. It is proposed that Victoria follow New South Wales’s existing building standards that state one-bed apartments in Sydney must be at least 50 m2 in size.

Some may argue that these measures may decrease affordability for the Melbourne apartment market, however, they may also see an introduction of stock that is more tailored to owner occupiers rather than investors, which may not only decrease vacancy but also be easier to sell due to the market favouring owner occupiers as a result of APRA implementing its strict measures on investor lending late last year. Arguably, future apartments may also have a better resale figure down the line if the ratio of owner occupiers in a development outweighed investors.

Another measure to be introduced for Victoria is the increase in tax for foreign purchasers of residential property from the existing 3% to 7%. The new measure will be introduced in this week’s state budget and aims to raise local revenue and ensure that foreign purchasers who experience capital growth in Victoria contribute to the state. This may also slow the rate of foreign investment to combat affordability for Australian residents whilst also decreasing vacancy rates from offshore purchasers who wish to park their money in investment properties that may lay dormant.

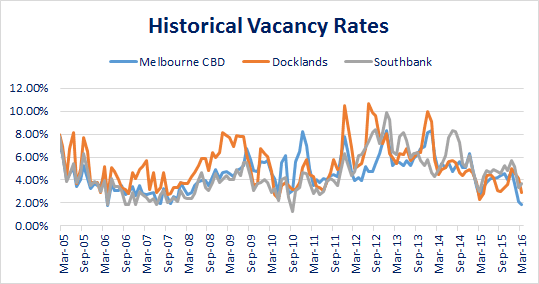

Vacancy rates are considered to be one of the best indicators of a market oversupply, however, amongst all the chat and hype of a potential oversupply has anyone really looked at the vacancy rate figures for these localities? As stated in last week’s newsletter, SQM Research data shows that vacancy rates for Melbourne have actually been in a downtrend since 2014 and are now below 2%. Those main areas of concern, CBD, Docklands and Southbank, show that the numbers have actually been falling to levels below their long term average.

I’m not saying that Melbourne’s apartment market won’t be subjected to an oversupply in coming years, I’m not saying it will either, however, if I were asked to comment on whether or not Melbourne is currently over supplied, I would have to say no as the vacancy figures continue to show that the absorption rate of new product placed on the market continues to be steady.

Click to enlarge

Furthermore, concern has also been raised regarding the provision of ventilation and natural light as well as apartment size in Victoria, where no minimum size requirements have previously seen some developments offer apartments as small as 24 square metres. It is proposed that Victoria follow New South Wales’s existing building standards that state one-bed apartments in Sydney must be at least 50 m2 in size.

Some may argue that these measures may decrease affordability for the Melbourne apartment market, however, they may also see an introduction of stock that is more tailored to owner occupiers rather than investors, which may not only decrease vacancy but also be easier to sell due to the market favouring owner occupiers as a result of APRA implementing its strict measures on investor lending late last year. Arguably, future apartments may also have a better resale figure down the line if the ratio of owner occupiers in a development outweighed investors.

Another measure to be introduced for Victoria is the increase in tax for foreign purchasers of residential property from the existing 3% to 7%. The new measure will be introduced in this week’s state budget and aims to raise local revenue and ensure that foreign purchasers who experience capital growth in Victoria contribute to the state. This may also slow the rate of foreign investment to combat affordability for Australian residents whilst also decreasing vacancy rates from offshore purchasers who wish to park their money in investment properties that may lay dormant.

Vacancy rates are considered to be one of the best indicators of a market oversupply, however, amongst all the chat and hype of a potential oversupply has anyone really looked at the vacancy rate figures for these localities? As stated in last week’s newsletter, SQM Research data shows that vacancy rates for Melbourne have actually been in a downtrend since 2014 and are now below 2%. Those main areas of concern, CBD, Docklands and Southbank, show that the numbers have actually been falling to levels below their long term average.

I’m not saying that Melbourne’s apartment market won’t be subjected to an oversupply in coming years, I’m not saying it will either, however, if I were asked to comment on whether or not Melbourne is currently over supplied, I would have to say no as the vacancy figures continue to show that the absorption rate of new product placed on the market continues to be steady.

Click to enlarge

Luca Simms is senior investment analyst at SQM Research and can be contacted here.

Jonathan Chancellor

Jonathan Chancellor is one of Australia's most respected property journalists, having been at the top of the game since the early 1980s. Jonathan co-founded the property industry website Property Observer and has written for national and international publications.