Melbourne's "drastic" house price jump, but Sydney leads nations still: Onthehouse/Residex

Sydney is still leading national quarterly growth with a further 3.18% rise in the March quarter, with its median house at $929,000.

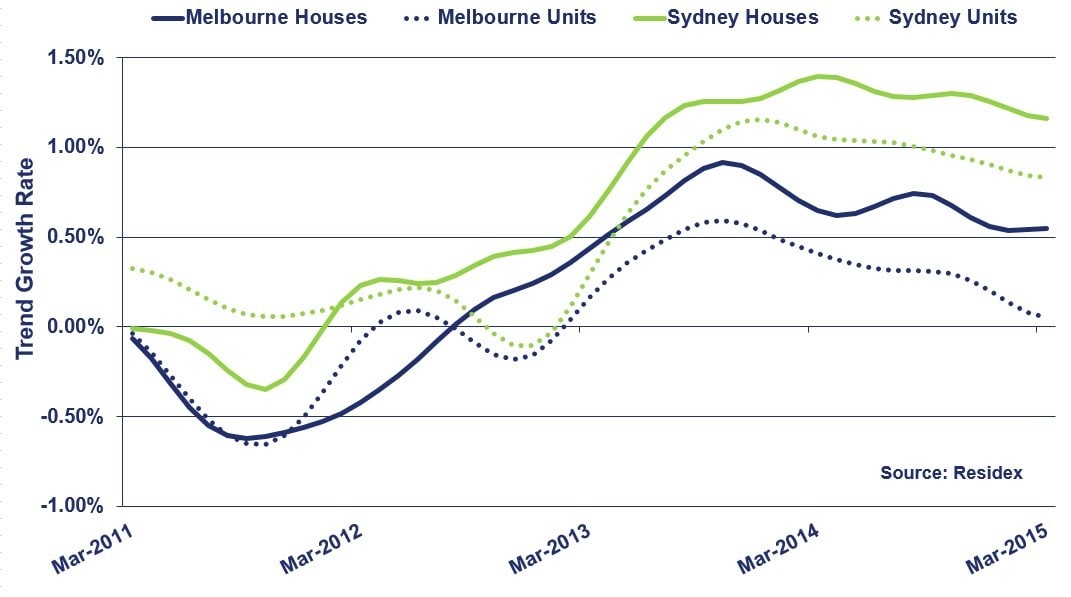

The trend data released by property analyst Eliza Owen at onthehouse.com.au highlights the divergence in the growth between Sydney houses and units, with units up 2.21% to $620,000.

It is also obvious in the growth in value of Melbourne houses increased, while units have been trending down to almost 0%, the Residex data showed.

This month has seen a "drastic change" in Melbourne house growth, which shot up 2.27% in March to $672,500 median, bringing the annual growth rate to 8.68%.

Melbourne units declined 0.08% in value last quarter to $470,000.

Eliza Owen noted it was understandable that investors have been tempted into the high returns of the Sydney property market.

"However, I would say that continued investment in units is not favourable," she said.

"Historically, houses have outperformed units, and have suffered less in periods of correction.

"Well built houses on large blocks of land will retain value because they come with land and present all sorts of potential for development, extensions and spacious living."

She also commend on the "unusual volatility" in this boom.

"Property is a long term investment that has historically trended upwards, but the increase in the range of returns in the last 20 years suggests they are becoming less safe," said Owen.

"For example, in the period 1990 to 1995, the Sydney market saw losses of 1% per annum and highs of 10% per annum.

"The range of returns in this period is 11 percentage points. Between 1995 and 2000, this range widened to 15 percentage points, and between 2000 and 2005 it widened further to 29 percentage points.

"Over the past five years, the range of returns has remained at 23 percentage points with growth ranging between minus 3% and 20%.

"These sustained, higher ranges point to larger volatility in housing returns.

"Furthermore, household debt is at record highs, and growth in the New South Wales and Victorian economies are currently heavily reliant on continued construction of infrastructure and dwellings.

"Such growth is not sustainable, and should be kept in mind as we cautiously move forward over the next few months."