Changes to FHOGs pushing buyers towards new houses: QBE

Changes to government grants are leading to first home buyers increasingly targeting new houses, research from QBE reveals.

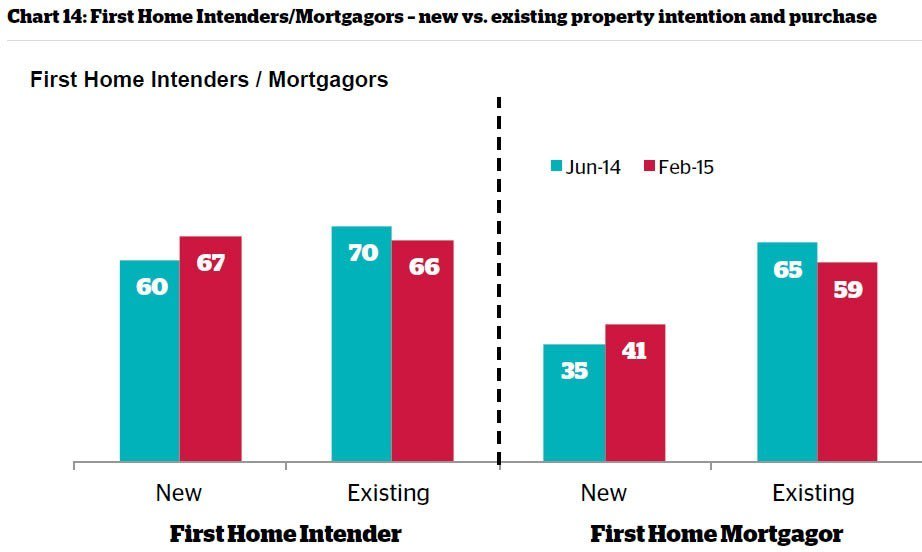

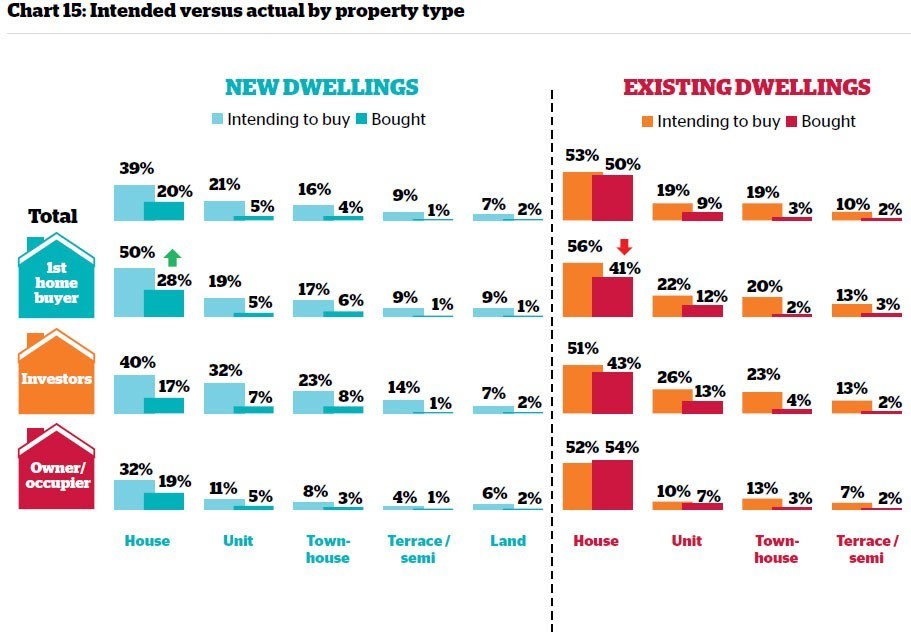

The amount of first home buyers intending to buy a newly constructed home rose in February 2015 from June 2014 (from 44% to 50%), while the amount intending to purchase an existing house fell (from 60% to 56%), according to QBE’s Barometer Report 2015.

However, the proportion of first home buyers who ended up purchasing a newly constructed house increased to 28% from 18%, while existing home purchases fell from 56% to 41%.

The report posited changes to first home owner grants (FHOG) requirements were likely to be an influential factor. NSW, the NT and Queensland have all reported declines in loans to first home buyers, which QBE claims is linked to the loss of incentives to purchase existing homes in these states.

The report also noted that low interest rates “may have encouraged the idea first home buyers have increased borrowing capacity and can afford a new property”.

The survey covered 701 people intending to buy in the next five years, including 176 first home buyers, as well as an extra 656 mortgagors, of which 95 were first home buyers.