First home buyers turning to personal debt to fund deposits: Genworth

First home buyers are increasingly resorting to personal debt to fund their home deposits, according to the 10th edition of the Genworth's Streets Ahead Homebuyer Confidence Index.

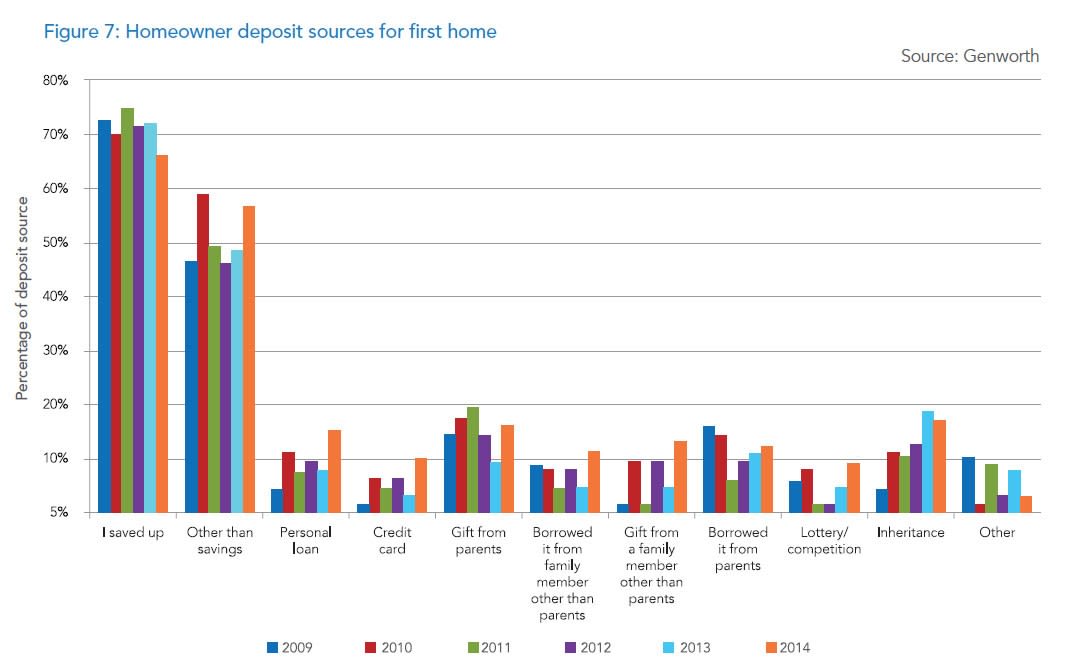

Of those surveyed by Genworth, 46% of first home buyers who took out their loan in 2009 used sources other than savings for their deposit. In 2014, that figure had risen to 57%.

Genworth research shows that average deposit sizes for first home buyers has remained stable from 2009 to 2014, but the proportion of first home buyers who took more than three years to save their deposit decreased, from 36% in 2009 to 27% in 2014.

While a greater proportion of first home buyers are now relying on inheritances to fund their first home deposit than they did, more first home buyers are also relying on personal loans or credit card debt, as shown in the chart below.

Click to open in new window

In the five years to 2014, the proportion of first home buyers who used personal loans for their deposit increased from 4% to 15%, while the use of credit cards for deposits rose from 1% to 10%.

"This combination of reduced time spent acquiring deposits and an increased proportion of non-savings sources suggests that house price appreciation over the past few years may have driven an increasing number of FHBs to abandon their goal of saving a deposit and look to alternative sources of funding," the report reads.

Genworth also noted that first home buyers are generally more willing to pay lenders mortgage insurance (LMI) and take on greater loan to value ratios for their first purchase.

Only quarter of today's first home buyers surveyed by Genworth have deposits of more than 20%, while 33% of current mortgagors had a 20% or higher deposit when they bought their first home.

"This is indicative of a trend towards accumulating lower deposit sizes as property prices rise," reads the report. As such, Lenders Mortgage Insurance (LMI) plays an important role for FHBs struggling to save a 20% deposit. Of respondents surveyed in March 2015, 61% of FHBs used LMI compared to 40% of Mortgagors."