Seven reasons why the Sydney inner ring market may continue to fire: Pete Wargent

Way back in 2013 there were a slew of articles doing the rounds warning us that Sydney's housing market was set to slow imminently.

Some commentators were wrong-footed by the regular mid-year falls in CoreLogic RP-Data's home value index.

Others felt banks would be unable to fund further growth due to inadequate deposit growth leading to a dearth of credit availability.

As I noted back at that time, you can study charts until the ink falls off the page, but unless you are in the market buying properties, there is always a risk that you will miss a key intangible - sentiment - and as noted on this blog I felt that 2013 and 2014 would be very strong years for Sydney property.

December 2013 was perhaps the most marked month of buyer mania that I experienced - with fear of missing out abounding - but generally the market has remained very robust throughout.

Sydney's home values have been rising at a rate of well over $2,000 per week for more than 18 months.

Will the market stall?

It's a truism, of course, to say that the market will stall eventually, for trees don't grow to the sky.

But will this eventuate this year?

Two main reasons have been given by commentators as to why the market Sydney's market may now stall.

Firstly, market regulators might stamp on lending practices, killing off demand.

And secondly, it has been said that there aren't enough owner-occupiers in the market to keep upwards pressure on prices.

It is certainly the case that the monthly number of owner-occupier loans being written in the Sydney market has been looking peaky for a long time - since Q2 2013.

However, movements in dwelling prices are set at the margin, and both average mortgage values written and the price that home buyers are prepared to pay for Sydney dwellings have been soaring since around February 2012.

Markets are forever granular. I feel that 2015 will be a bumper year for Sydney's inner ring suburbs where investors are running riot; the outer suburbs it's more difficult to say, for I have less first-hand evidence with which to work.

Below are seven other reasons why the Sydney inner ring market may continue to fire through this calendar year.

Reserve needs a consumption boom

Reserve needs a consumption boom

In its Statement on Monetary Policy (SOMP) released on Friday, the Reserve Bank of Australia (RBA) detailed its latest growth forecasts.

The growth forecasts seem remarkably optimistic, with GDP growth expected to rebound quickly towards 4% by 2017.

These forecasts seem particularly upbeat when one considers the component parts of demand and output growth as at the end of Q3 2014.

Although exports are clearly ramping up at speed and housing construction activity is solid, mining investment had collapsed by more than 15% over the preceding year, and 5% in the latest quarter alone.

Our chart packs show that this will continue through 2015.

How then, is the RBA hoping to restore growth to the economy aside from rising export volumes and hopefully a spurt in non-mining capex?

Two of the planned drivers of growth feature house prices implicitly.

Firstly, rising house prices are expected to keep the residential construction boom ("dwelling investment") running stronger for longer, although this alone will only comprise perhaps 3.5% of GDP.

And secondly wording of the SOMP is quite explicit in that the Reserve Bank expects rising house prices "should provide further support to consumption growth" via the associated wealth effect.

In fact, the SOMP notes that investor credit growth is likely to continue at its current pace, while also highlighting that mortgage prepayments "are at a high level".

Realsitically, the RBA needs a consumption boom, and the desire to constrain mortgage lending appears very muted, almost an after-thought.

Interest rates have been falling anyway

Interest rates have been falling anyway

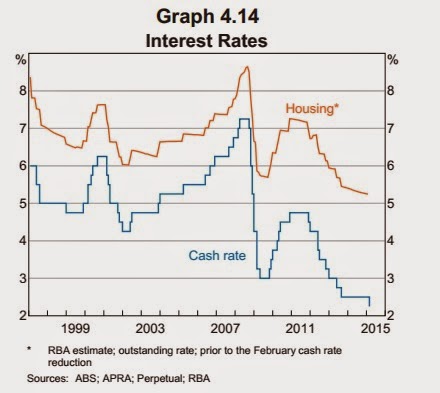

Mortgage rates are not set by the RBA, but by lenders, and funding costs for Australia's banks fell through 2014.

The average interest rate on outstanding housing loans has continued to slide over recent months - even prior to the February cash rate reduction.

This trend has largely been driven by the replacement of more expensive pre-existing fixed rate loans written prior to 2013.

Over the past year there also have been reductions in advertised interest rates on fixed rate and variable rate loans, in particular the 5 year fixed rates on offer from the majors.

Competition for lending is clearly very strong and both interest rate discounting and broker commissions have increased over the past year.

On top of this, less than a week ago, the cash rate was cut to just 2.25%.

Major lenders passed on the full 25bps cut, while Westpac passed on 28bps on its standard variable mortgage rates.

Moreover, analysis of averages often leads to average conclusions. Remember, housing markets are frequently driven by trends at the margin.

By way of an example of products available to new market entrants, U-Bank announced that it had cut its variable rate to just 4.68%, with a 0.33% discount for new customers.

If variable mortgage rates from 4.29% don't light a fire under Sydney's housing market I don't know what will.

Interest rates will fall even further

Interest rates will fall even further

One thing we can be certain of is that the RBA would not have cut interest rates in the past week had it felt that only one cut was needed - rate cuts tend to come in pairs.

In fact, for those paying close attention, the SOMP signalled loud and clear the RBA's intention to cut rates further.

The key wording is here:

"In preparing the domestic forecasts, a number of technical assumptions have been employed.

"The forecasts are conditioned on the assumption that the cash rate moves broadly in line with market pricing as at the time of writing."

In short, GDP growth is expected to rebound, but with the help of a cash rate falling to 2% or lower.

Markets are pricing in another interest rate cut in the first half of 2015, with implied yields on January 2016 cash rate futures contracts dipping as low as 1.88%, representing some 37bps of further cuts priced in.

Just in case this wasn't clarity enough, the RBA even marked a line on its cash rate chart to match what cash rate futures markets have already been foretelling - that interest rates are likely to be cut again in due course to 2%.

Article continues on the next page. Please click below.

Investor loans are exploding

Investor loans are exploding

The potential peak in the number of owner-occupier loans written is one thing - what is happening with Sydney's property investors is quite another.

The $5.26 billion of loans written in the last month of available data was by some margin the greatest month of investor lending in any state in Australia's history.

Cheaper lending rates are only set to be more fuel for the bonfire. Nobody's leaving Sydney any more

Nobody's leaving Sydney any more

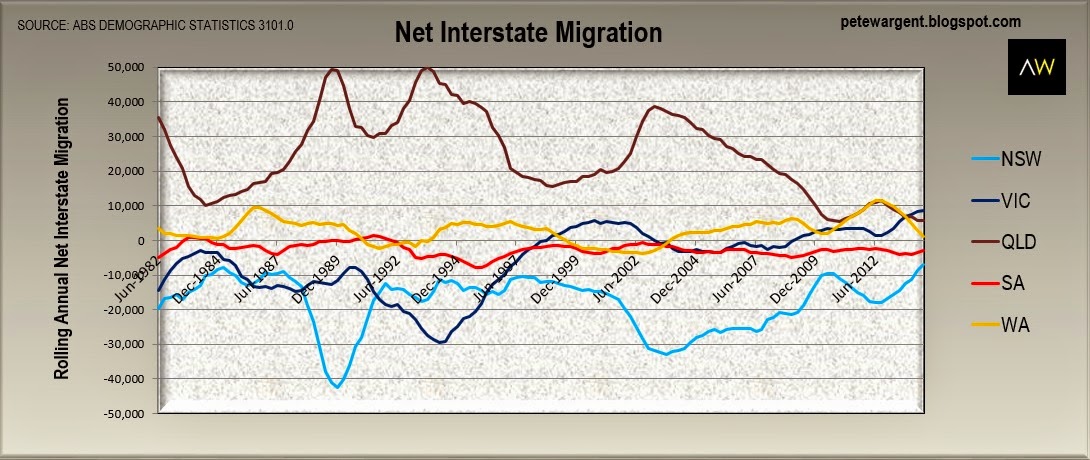

Sydney's housing market has just about gotten away without building very much for the best part of a decade because in years gone by 20,000 to 30,000 persons per annum typically departed the state, bound for cheaper or sunnier climes.

Not any more.

Net interstate migration from New South Wales has fallen to the lowest level on record as Sydneysiders opt to stay put for superior employment prospects.

There's no stock overhang

There's no stock overhang

Vendors in Melbourne sensing a market peak have been ploughing stock onto the market for some time now, and with an inherent stock overhang 2015 appears likely to be a slower year for dwelling price growth in the Victorian capital.

However, SQM Research's figures show that Sydney's stock on market has tightened yet further, falling below 20,000 in January 2015.

6 - Foreign buyer 'crackdown'?

What about the mooted foreign buyer 'crackdown'?

Mr Hockey has noted that: "We are actually delivering tougher laws on foreign investment at the same time as ensuring we continue to welcome record levels of foreign investment into Australia”.

Hardly convincing, and the kind of double-speak that would make even Winston Smith blanch - and it's been three decades since 1984.

Hockey has also pointed out that he will soon announce the introduction of an agricultural land register, and a requirement for all purchases of such to be subject to "approval over a certain financial point".

Ditto.

Risk on

Risk on

Finally, term deposit rates are now at previously unthinkably low levels in Australia, with most products featuring a "three handle" and deposit rates looking set to decline yet further.

If you're looking for a bellwether for risk asset appetite, check out the share price performance of Commonwealth Bank (CBA) or other yield plays over the past three weeks.

Meanwhile the ASX 200 (XJO) has recorded 12 positive trades on the bounce, the longest such run in its history.

Inner suburban rents have continued to rise in Sydney, and investors do not need to look too hard to find gross yields of 4.5% on attached dwellings.

The Wrap

Commentators have been calling a slowdown in Sydney's markets for at least 18 months now, but it looks more than likely that 2015 will be another year of strong capital growth in the inner ring suburbs.

Expect Sydney auction clearance rates to kick off in the high 70% range in 2015 as the market finds its feet.

Consistent readings of above 80% are typically indicative of boom-like growth.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His new book 'Four Green Houses and a Red Hotel' is out now.