State of the market report – 2014 in review

GUEST OBSERVATION

As 2014 has just drawn to a close it is a good time to reflect on the events of the past, and especially the last 12 months, to prepare for what to expect in the Australian property market in 2015 and beyond.

Let me begin with this absolute gem of a quote:

“At last we anchored within Sydney Cove;… it is a good town; the streets are regular, broad, clean & kept in excellent order; the houses are of a good size & the Shops well furnished. — It may be faithfully compared to the large suburbs which stretch out from London & a few other great towns… the number of large houses just finished & other building is truly surprising; nevertheless every one complains of the high rents & difficulty in procuring a house…”

- Charles Darwin's Beagle Diary, 12 January, 1836, Sydney.

It looks that Sydney property market had not changed much in 179 years - the same issues were widely debated in 2014 and they will continued to be debated in 2015. The chances are that another few generations will hear the same old complaints over and over again.

At the beginning of 2014 there were many sceptics about the uplift in property prices, clinging instead to the previous media propaganda favourite – an imminent price collapse.

However, dwelling prices increased across the country in 2014. In some places very modestly, at a level that could be considered just noise in the data, but in other parts of Australia, like Sydney or Melbourne, quite noticeably (12.4% and 7.6% respectively according to Core Logic RP Data Home Value Index).

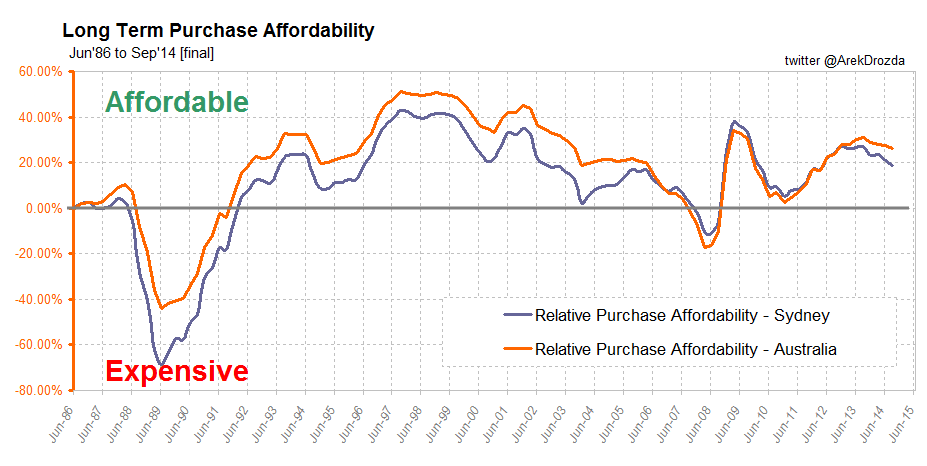

As I outlined last year, price growth should have been expected considering the historically high purchase affordability.

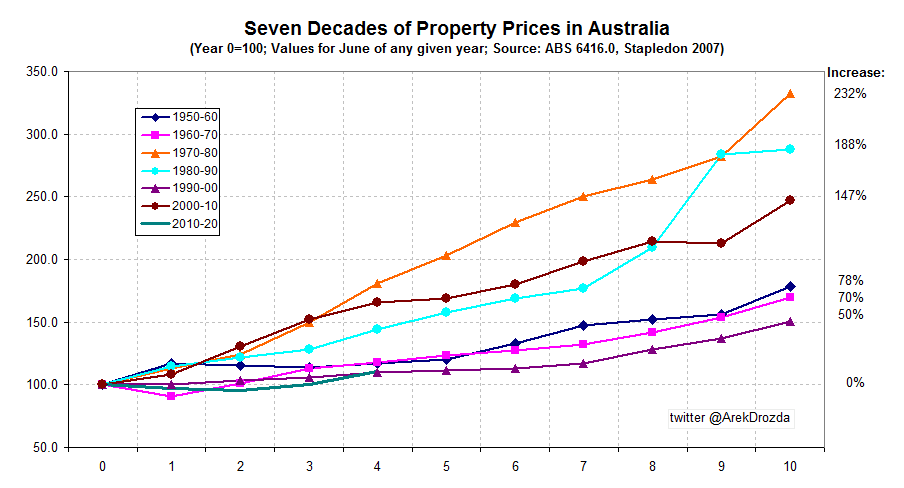

Price advances in 2014 put Australia well on track to record another decade of growth - the seventh consecutive decade of growth since World War II.

However, you would not know from news headlines that our property market is as expected since 2014 was another year of media beat up about property bubbles fuelled by negative gearing, housing affordability crisis, foreigners and investors stealing houses from first home buyers, and baby boomers eating their young.

As many Property Observer readers already know, these are just overblown exploits by attention seeking media outlets and not the real issues, as I have previously highlighted in my feature article: Crisis of confidence or crisis of affordability?

In 2014 the supply of new dwellings started to increase as a response to rising prices. At the same time, increased participation of property investors led to increases in supply of rental accommodation. Rents held well in larger capital cities in 2014 but declined in Canberra, Darwin and Perth (as per Residex November 2014 results).

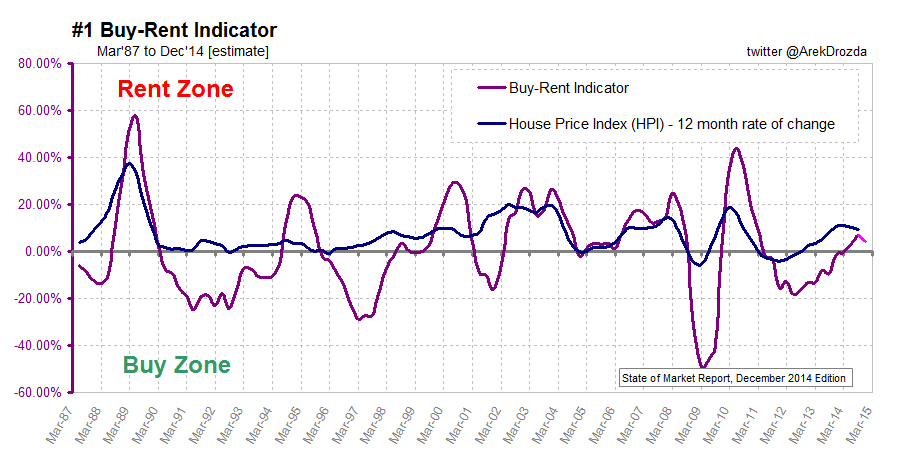

The cost of buying Australian property is now considered expensive in comparison to rents. The pendulum swung in favour of rents in March and the changeover was reported in May’s state of the market report.

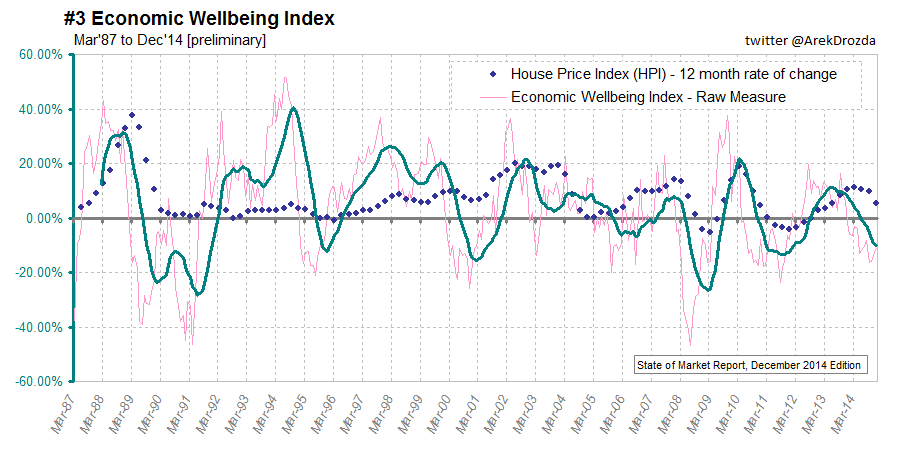

The December preliminary analysis indicates that the peak in this cycle might have been reached but we will have to wait for a confirmation in the coming months.

However, in historical terms, residential property remains well within the financial means of working Australians, despite substantial price rises in 2013 and 2014. Even in Sydney.

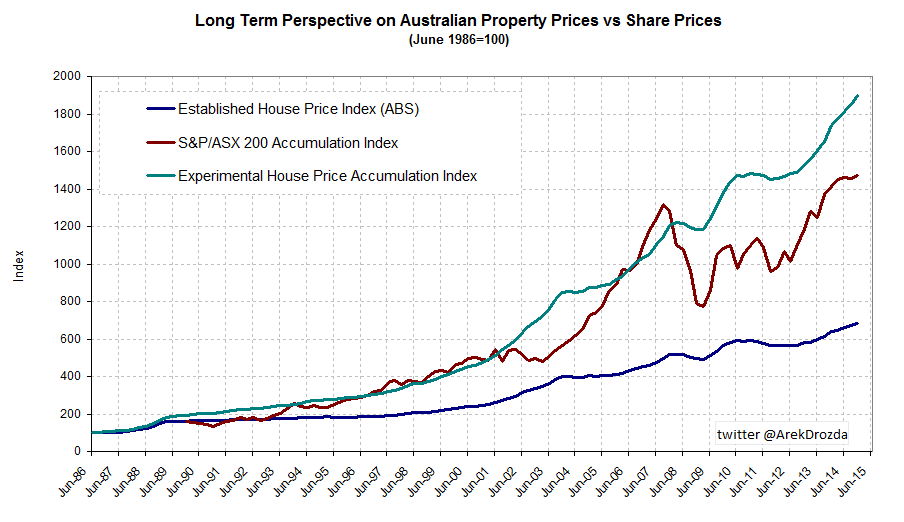

The property market in Australia fared well in 2014 in comparison to the stock market but, as noted earlier, returns varied across the country.

The best capital gains were recorded in Sydney and Melbourne, and Canberra and Darwin were the worst performing markets in 2014 (as per CoreLogic RP Data Home Value Index).

It is therefore not a coincidence that the security and relatively low volatility of residential property is very attractive at the moment.

Also see: An investment or just a roof over your head: How should we treat residential property?

Article continues on the next page. Please click below.

The Australian dollar fell at the end of the year, making our property market cheaper for expats and international buyers.

As far as market intervention goes, we had two property related Senate inquiries in 2014: one into housing affordability and the other into foreign investment in residential property. And there was the financial system inquiry, the so called Murray Review. Government policy responses are expected to have some impact on the property market but the magnitude and timing of eventual actions is uncertain.

There were also strong calls during the year for the implementation of micro prudential regulations to curb property investment growth, as well for the removal of negative gearing provisions, but the probability of any actions by the authorities remains rather low at this point in time.

Besides, the likelihood of any negative impact stemming from these actions on the property prices is minimal if we consider New Zealand experiences with micro prudential controls and the true role negative gearing plays in property investment (as explained in Negative gearing: The three facts that will challenge your assumptions and Putting property investment losses into perspective).

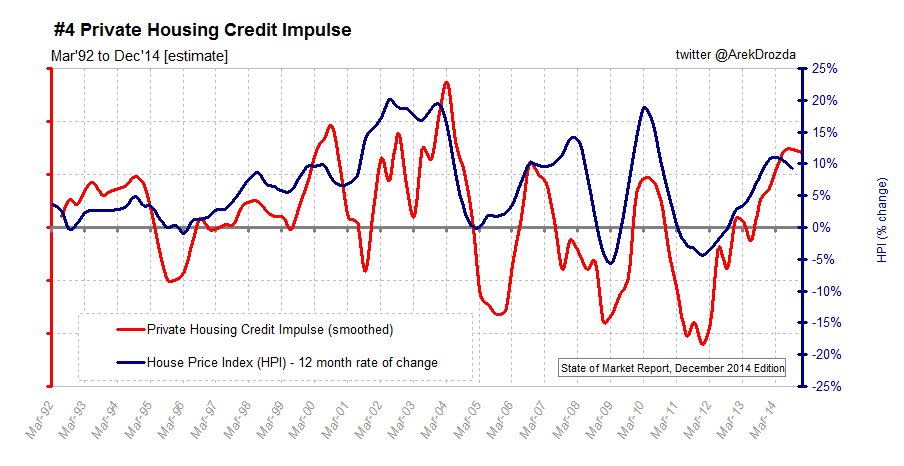

Money has flowed strongly into the property market throughout 2014 but that flow has potentially reached its peak in the December quarter. We will have to wait until March 2015 for a confirmation of change in trends, but a pull back in demand in autumn is very probable.

Transaction volumes remained subdued in 2014 in historical terms. With consumer confidence down for the year, unemployment on the rise and general expectations of low growth in wages, and tough economic conditions ahead, the demand for property has been weakening throughout 2014 and can be expected to decline further.

Price growth started to decelerate in mid 2014 – the outlook for the market was downgraded to neutral in June, and again in July to neutral with negative bias, to reflect deteriorating conditions.

In the last 12 months, the Australian property market has followed a slow growth scenario, as outlined in Australian property prices in 2014 and beyond.

All in all, at the end of 2014 the property market in Australia remains strong but there are signs it is ready to take a breather.

Jitters in international financial markets and the constant worries about the domestic and the world economy (China in particular), negatively influenced the confidence of market participants. Prices cannot advance strongly in such an environment so we may have already seen the peak activity in this cycle.

If confidence in the domestic economy improves significantly in 2015, it could put a rocket under prices because property in Australia is still relatively cheap. With the expectation of interest rates on hold throughout 2015 and only moderate wage growth, the key to the Australian property market fortunes is employment.

Arek Drozda is an independent property market analyst.

Caveat - The information is provided in good faith and does not constitute financial advice. Use with caution and at own risk.

Background information - For more extended description of individual measures and how to apply this information please refer to the first report in this series: State of the Property Market, April 2014.