How assets performed in 2014 and what to expect this year

2014 was an interesting year for investors.

In an era when fixed interest investments have been widely expected to be dud performers, returns on Aussie government bonds delivered surprisingly strong returns of around 10% over the calendar year with interest rate expectations imploding as the calendar year progressed.

The Australian share market seemed to be tracking solidly as expected but then nosedived at the end of the third quarter to relinquish all of its previously garnered capital gains before a face-saving rally in December left the chart in positive territory for the year.

In terms of global shares the Dow Jones yet again performed very well in 2014 and the S&P 500 even better, thereby further proving the folly of trying to predict short-term market gyrations.

Commodities generally had a rough ride last year with both copper and gold again finishing the year lower than where they began it, although in truth returns on gold often reflect a currency hedge as much as they do the quoted US dollar return.

Meanwhile 2014 was also a year during which commodities such as iron ore and crude oil were obliterated.

Residential property

"Total returns" from residential property came in at an uncommonly strong 12%.

How returns are measured from residential property for individual investors are largely relevant to how assets are financed - total returns may be a useful measure for those of us who have owned property since the mid 1990s or earlier, but for more recent buyers using higher leverage capital growth is the metric of interest.

In terms of growth capital city dwelling prices rose by a further 8% in 2014 following on from 10% growth in 2013.

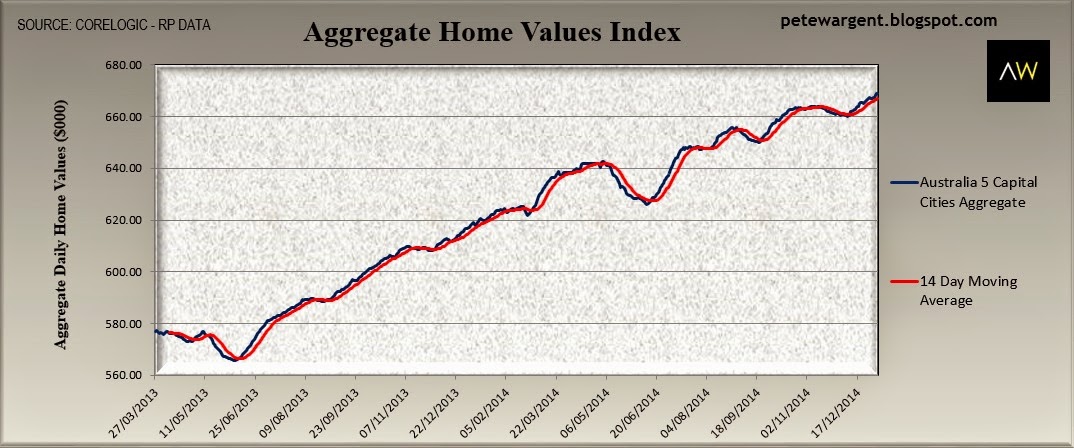

Historically the Core Logic RP Data Home Values Index - which is not seasonally adjusted - tends to produce a dip in valuations around the middle of the year as can be seen in the above chart, but has continued to record solid gains over time.

Over the last two calendar year capital city home values have increased by 18% - the equivalent of an $90,000 price increase on a $500,000 property.

Post GFC Returns

Since December 2008 capital city home values have increased by more than 36% reflecting a solid 5.3% compounding annual return.

For those using leverage returns have been potentially outstanding - the use of 80% leverage can magnify returns (both positive and negative) by five times before transaction and holding costs, thus reflecting gross capital returns of more than 180% over that time - returns that are rarely matched easily in other asset classes.

In reality the home values index return is heavily tilted by the outstanding performance of Sydney which has recorded prodigious returns since December 2008 of 55%, or a compounding annual return of 7.5%.

Melbourne aside, returns elsewhere have been relatively muted over the past six years.

On the plus side for home owners there is scant evidence to be found here of the widely predicted sharp property correction.

Best prospective performers

With massive population growth continuing to swell Greater Sydney combined with presently the strongest economy in the nation, the harbour city is expected to continue forging ahead to record the strongest capital gains in 2015.

Just as we have seen in London over the long-term, the sheer weight of increasing demand for a genuinely scarce supply of land in Sydney appears likely to continue delivering the most consistent compounding returns.

Those who prefer to invest counter-cyclically face a more demanding decision.

The southern state capitals of Adelaide and Hobart have been hampered by grievously weakened economies and an utter dearth of employment growth, while Adelaide faces the additional hurdle of the shuttering of its automobile manufacturing industry which will contribute to concerningly elevated levels of unemployment in the outer.

Canberra and Darwin must adjust to the twin spectres of a labour market rationalisation and a resources construction pullback respectively.

Melbourne's housing market has been on an outstanding run in recent years but is now confronted by a number of challenges related to both the local economy and to overbuilding in some areas that has resulted in a glut of stock on the market.

The best risk-adjusted bet for counter-cyclical investors is on balance likely to be Brisbane.

The Queensland capital has been struck by a number of setbacks to housing market confidence over recent years, but housing finance data for both owner-occupiers and investors suggests that the market has decisively turned a corner and the strongest three year returns are thus projected for Brisbane.

However, there is certain to be an oversupply of new units in a number of suburbs and skilful asset selection will to a great extent determine results.

You can visit AllenWargent property buyers (London, Sydney) or Pete's blog.

His latest book is 'Four Green Houses and a Red Hotel' .