Capital city rental rate growth the slowest in over a decade

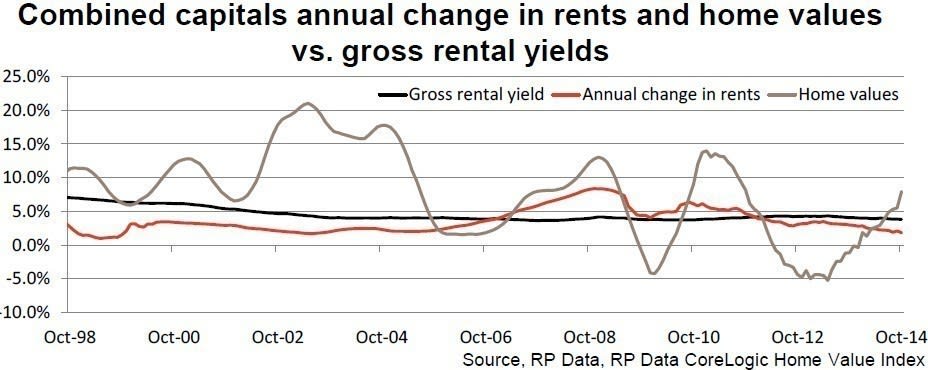

Capital city rental performance data shows that across Australia’s combined capital cities rents are rising at a pace slower than inflation and recorded an annual growth rate of 1.8%.

With rental yields at such low levels it seems investors are firmly focussed on capital growth.

RP Data’s monthly combined capital city rental market analysis for the past 12 months, confirmed that this result was the slowest annual rate of rental growth since August 2003.

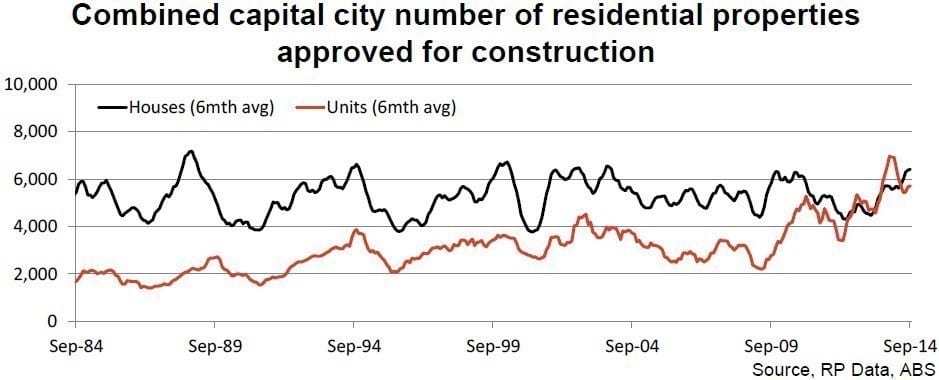

The rate of rental growth is easing on the back of a large rise in capital city home values and a strong rise in the supply of new homes being built. Added to this is the impact of record level investor buying which ultimately affects overall rental market supply. Slow rental growth rates have a knock on effect for rental yields.

Around the capital cities:

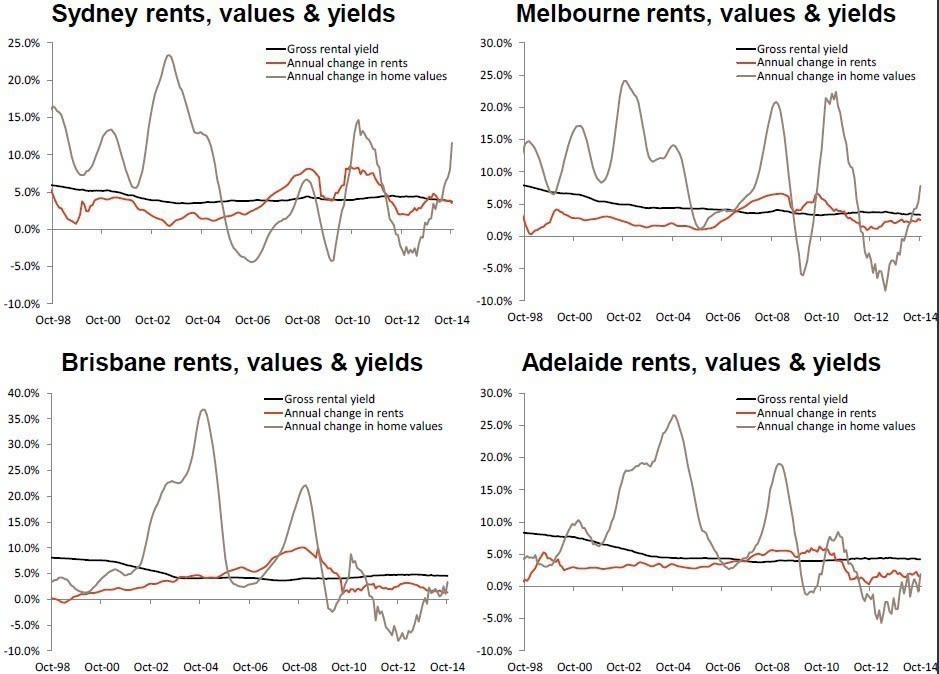

- Sydney rental rates increased by 3.5% over the past year while home values are up 13.1%. Subsequently yields are recorded at 3.7% the lowest reading since August 2005;

- Melbourne home values are 8.9% higher over the year while rents have increased by a much lower 2.5%. Gross rental yields are recorded at 3.3% which is the lowest gross yield across the capitals and equivalent to the lowest yield on record;

- With a gross rental yield of 4.5%, yields in Brisbane are at their lowest level since September 2011. Brisbane rents have increased by just 1.3% over the past year compared to home value growth of 5.6%;

- Adelaide home values have increased by 4.3% over the past year while rental rates have increased by 1.5%. Rental yields currently sit at 4.2%, their lowest level since September 2012;

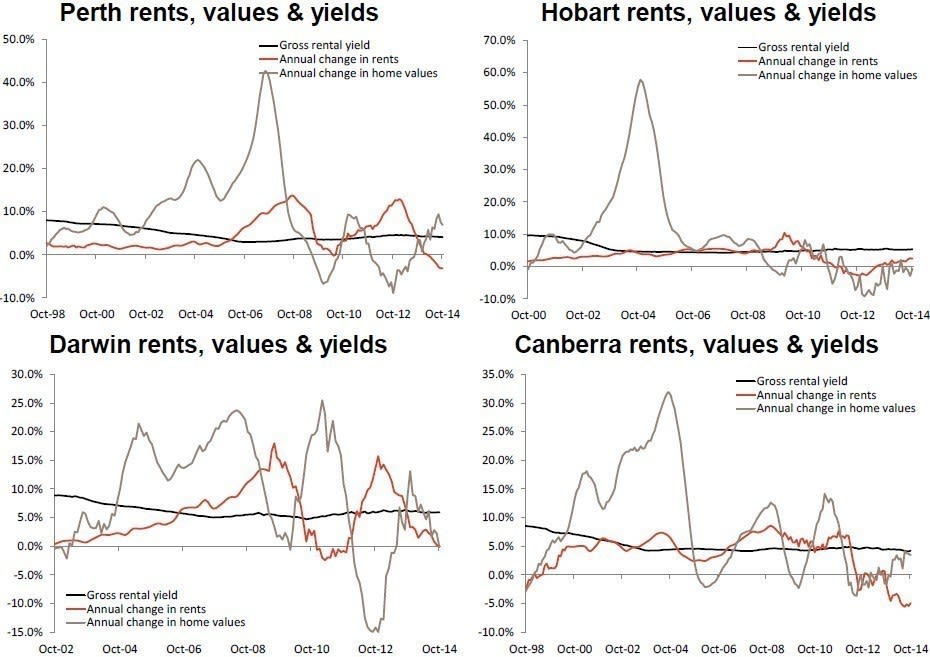

- Rental rates in Perth have fallen by -3.1% over the past year while home value have increased by 3.4%. As a result, rental yields are recorded at 4.1% their lowest level since January 2012;

- Hobart rental yields currently sit at 5.4% their highest level since November 2013. Over the past year Hobart rents have increased by 2.4% and home values are 4.4% higher;

- Darwin home values increased by 5.0% over the past year while rents fell by -0.1%. As a result, yields have been relatively steady at 5.9% over recent months;

- Canberra rental rates have fallen by -4.9% over the past year while home values have increased by 0.9%. Gross rental yields in Canberra increased over the month to 4.2%.

Looking at all dwelling results at a combined capital city level, gross rental yields were recorded at 3.8% in October 2014 which is the lowest reading since January 2011.

With the rate of capital gains outpacing rental growth we are seeing rental returns reduce across all capital cities. In fact, over the past year gross rental yields have fallen across each capital city.

RP Data research suggests that a surge in building approvals over the past 18 months is a likely contributor to slower rental growth rates.

With rental yields at such low levels it seems investors are firmly focussed on capital growth.

With the number of home sales rising as a result of new supply, more investor-owned properties and population growth slowing, renters now have comparatively more choice when it comes to housing options and as result the owners of investment properties have less scope to increase weekly rents given the large supply of alternate accommodation options.

With a larger supply of new housing and low interest rates likely to drive further growth in home values we anticipate that rental growth will remain subdued over the coming year. In fact we may see the rate of rental growth slow further as renters see more and more accommodation options being built.

With such tepid growth in rents and such a high level of investment activity it is clear that most investors are buying residential property with a view to capital growth rather than rental returns.

Click to open in new window: