Four major housing market trends for this decade

At times it is possible to become so engrossed in analysing weekly data series concerning the Australian economy and housing markets that we neglect to recap on the bigger trends unfolding over the years ahead. Here are four of them...

Trend #1 – Rebalancing: The “Great Rotation” is well underway

The Reserve Bank’s best laid plans to rebalance the Australian economy away from mining construction and towards a residential construction boom have been vigorously denigrated at almost every step along the way.

Variously it has been argued that credit growth was too low, land prices too high and that a sharp property market correction was assured.

And yet while the transition has by no means been perfectly engineered, dwelling prices have recovered fairly robustly in most cities, supply has begun to follow accordingly, and 2015 is shaping up to be a prodigious year for dwelling construction.

Building activity has already scaled levels not seen for two decades, while dwelling approvals are all but brushing around 200,000 on a rolling annual basis, reflecting a substantial volume of supply in the pipeline as the market responds.

From an economic perspective this is a welcome result, especially since previous research has proven residential construction to unfurl a strong multiplier effect.

Of course, there are always weak links in the economic data.

Major renovation activity is moribund, which has continued to shave irritating fractions from housing investment’s quarterly contribution to GDP growth.

The dearth of renovation activity is no doubt partly a result of the structural shift towards apartment dwelling, and to some degree it reflects the expensive nature of detached housing stock in the capital cities.

There is also a generational factor at play, with younger family buyers having used first home owner grants to buy new properties or in some cases being priced out of the detached housing sector entirely.

In the UK Homebase announced this week that it would close a quarter of its 323 stores as Brits also fall out of love with renovating and DIY.

Paradoxically, while Australian television viewers are bombarded by an artillery of cookery and renovation shows, official ABS data continues to show retail turnover for takeaway and café meals booming to unprecedented levels and renovation activity in most states dying a slow death.

We seem to enjoy watching others rustle up fancy meals and renovating houses; actually doing the stuff ourselves, not so much.

If capital growth in earlier property market cycles was once in part illusory, driven by improvements to the existing stock of dwellings, this is not so much the case today.

Overall, though, the picture is strong for residential construction activity – for units and apartments in particular - and the aggregate new capex volumes in 2015 will not represent anything like the disaster that had been feared as the resources-driven engineering construction boom unwinds.

The above having been said, dwelling investment alone can only bridge so much of the gap.

As has been well documented previously, residential construction activity represents only a relatively small percentage of GDP and itself cannot offset the forthcoming plunge in mining capital investment.

More heavy lifting will be required from other sectors of the economy, and the net result of this is that the official cash rate will be lower for longer, with perhaps up to 18 months or more of uncommonly low interest rates ahead.

Article continues on the next page. Please click below.

Trend #2 – Real rental growth is dead

It is often said that a “quest for yield” is dramatically altering investment decisions, wrenching savers out of cash into the risk asset classes in a search for acceptable returns above the rate of inflation.

While this may be true of the equity markets, net yields in residential property are in fact low and heading lower, and the incentives to invest in residential real estate are largely centred upon expectations of reliable future price growth as an inflation hedge.

One of the most notable trends playing out through this cycle is that levels of investor activity are set to break through unparalleled levels, with the Reserve Bank’s own financial aggregates data showing that the gradient of credit growth relating to investment housing continues to rise more steeply than that associated with owner occupiers.

The inescapable conclusion of this is that property buyers seeking capital growth must anticipate the locations investor funds will flow to, which research has shown are very heavily concentrated in the inner and middle ring suburbs of the large capital cities.

As each month passes further evidence also gradually comes to light that the official data may be materially understating the role of foreign investment in the capital cities, particularly from Asia, and the real level of investor activity could be significantly higher still if offshore funds were to be captured effectively.

While these trends are doubtless pushing inner city dwelling prices higher, the corollary is that with greater volumes of supply coming online - a high proportion of which is investor owned – real rental growth is declining.

While the rate of rental inflation has held up reasonably well in supply-constrained Greater Sydney to date, where the population is also booming, the risks for most cities are to the downside (and in some smaller cities such as Canberra, nominal rents have already turned alarmingly negative).

Article continues on the next page. Please click below.

Trend #3 – At long last…it’s time for Brisbane to shine

Sydney has become the Antipodean equivalent of London and the residential property market just keeps on keeping on.

An imperiously strong FY14 will be followed by more of the same in FY15, with SQM Research forecasting a further 8 to 12% growth for the harbour city.

The supply versus demand imbalance in Sydney has been well known about by those close to the market for half a decade, and dwelling price growth continues to respond accordingly.

Variously Australian cities face considerable challenges. Adelaide’s labour market and economy are lacklustre, Melbourne has a surfeit of supply and of sellers, while Perth is juggling an awkward transition from mining construction to production in concert with a decline in Australia's terms of trade.

Queensland aside, full-time employment in regional Australia has stalled completely and is actually lower now in the major states than it was way back in 2006, as I analysed here.

We have taken great care to analyse the Brisbane data for false dawns and have refrained from calling prematurely for a marked uplift in prices, but the data suggests that at long last it is time for the maroon of Queensland to have some time in the sun.

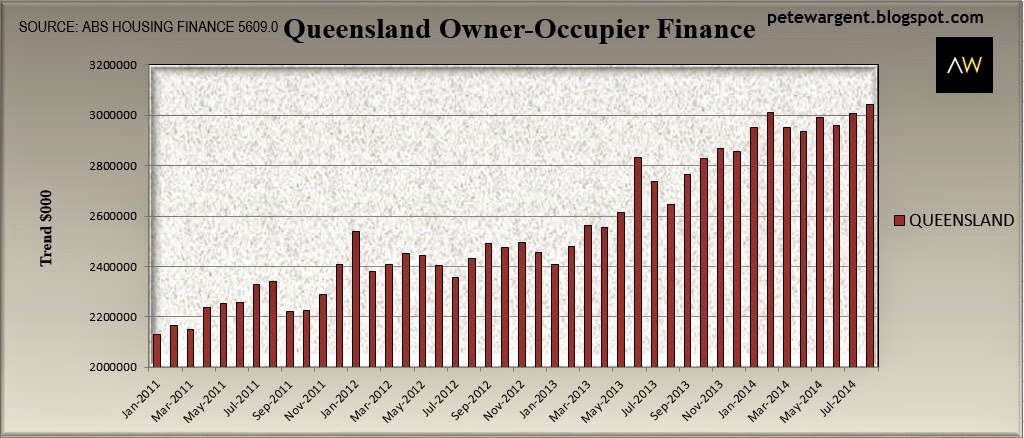

The recovery in Brisbane housing finance to date has been studious rather than explosive, but upon closer inspection of the figures we see that while most states have recorded seasonally weak mortgage finance data since June, Queensland is going from strength to strength, with owner occupier commitments increasing by another 15% over the past year.

It has been a significant bounce back for Queensland owner occupier finance activity and dwelling transaction levels since 2011, and more timely data from mortgage aggregators suggests that there has been further strength through to October 2014.

We called the Sydney property investor boom long ago and took action accordingly - you would have to be living under a rock not have heard about it by now.

However the ABS Lending Finance activity data that investors have not yet fully come to the party in Brisbane - at least, not domestically.

Enquiries and mortgage broker data have indicated that a steady rotation towards Queensland is taking place, with interstate investors enticed by stronger yields and considerably more attractive entry prices.

Article continues on the next page. Please click below.

Trend #4 – Asset selection will be critical in this cycle

For all the above, buyers in Brisbane need to undertake more educated investment decisions than in cycles past, and asset selection will be critical to a successful outcome.

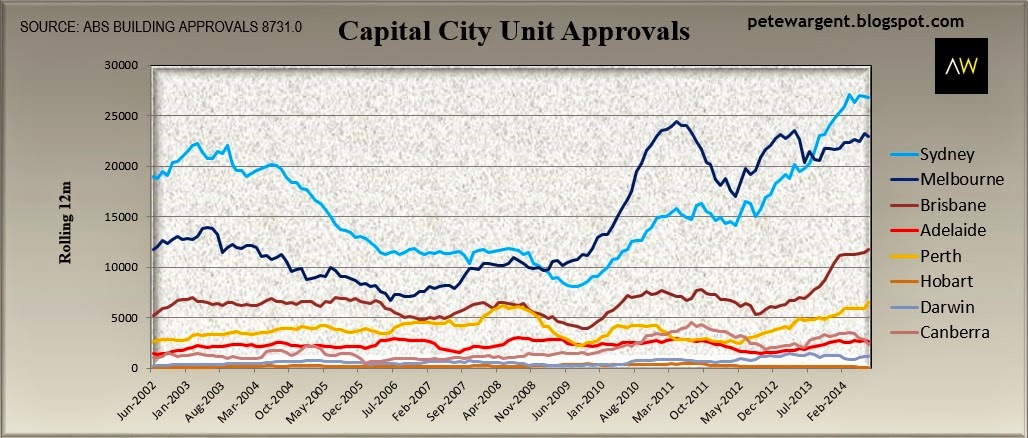

The coming upturn in Brisbane is not resultant from a chronic undersupply such as was the case in Sydney, with more attached housing stock (units and apartments) approved in Brisbane on a rolling annual basis than we have previously seen.

The clear implication of this is buying generic, off the plan city apartment stock is an almost guaranteed route to a sub-optimal investment outcome, and the return on investment from such a strategy could easily be negative.

Not only do investors need to steer clear of the standout pockets of looming apartment oversupply and elevated vacancy rates, they must look to source stock which will retain a level of scarcity value through the cycle.

For units this can mean boutique blocks, river views or district views which will not be subsequently built out.

The apartment construction boom will be effectively absorbed by population growth in due course and over time, yet Brisbane will not any time soon see a repeat of the dramatic boom in interstate migration which played out in previous cycles.

Population growth in Queensland remains very strong, but in common with other mining states, the pace of growth is presently declining.

As the mining construction boom begins to unwind net interstate migration to Queensland has slowed, and it will be natural increase combined with net overseas migration which drives Brisbane forward in the immediate future.

Informed investors will take note of the property types favoured by immigrants, leaning towards favoured modern types of investment housing (ideally, as noted, with water or district views which will not be built out).

Headwinds and challenges persist in the local economy in Brisbane, as indeed is the case in most Australian capital cities.

Previously encouraging labour force growth appears to have hit something of a plateau lately, and while strong construction employment is a welcome start, Australia needs to stimulate a broad-based recovery in the services sector and encourage household consumption.

Price growth for Brisbane and Sydney ahead

Dwelling price growth in Brisbane has been weak for more than half a decade with prices having declined from peak to trough by close to a fifth in real terms, which, with interest rates at exceptionally low level might give an indication as to the potential quantum of a successful rebound.

After a prolonged hiatus, sentiment has turned a corner and improved prospects lie ahead.

BIS Shrapnel forecasts capital growth in Brisbane of 17% over the next three years, while SQM Research’s forecast of 8 to 12% capital growth in Sydney will continue to attract investors in the harbour city.

Over the longer term Residex forecasts capital growth tracking at 5 to 6% per annum in Sydney and Brisbane.

We will be buying investment outstanding properties for clients in both cities in 2015.

You can visit AllenWargent property buyers (London, Sydney) or Pete's blog.

His latest book is 'Four Green Houses and a Red Hotel' .