My first property, a renovation and what I learnt: Rhys Roberts

Buying a home is tough work for those doing it for the first time, and with low numbers of first home buyers being reported it’s not surprising that many think it’s beyond their grasp.

To provide readers some inspiration, Property Observer will regularly be sharing stories of first time property buyers, and discussing their motivations. If you want to be involved, email jduke@propertyobserver.com.au.

Our first new buyer is 25 year old Rhys Roberts. Employed full-time in human resources with the state government in Tasmania, he disclosed that his salary is $70,000 a year.

Last year, he purchased a house in Lindisfarne, Tasmania for $340,000 with an 80% LVR. Lindisfarne has a median house price of $370,000, and rental income just shy of $350 per week, according to RP Data. It's a 10 to 15 minute drive to Hobart.

THE PROPERTY

Lindisfarne, Tasmania

PURCHASE PRICE: $340,000

LVR: 80%

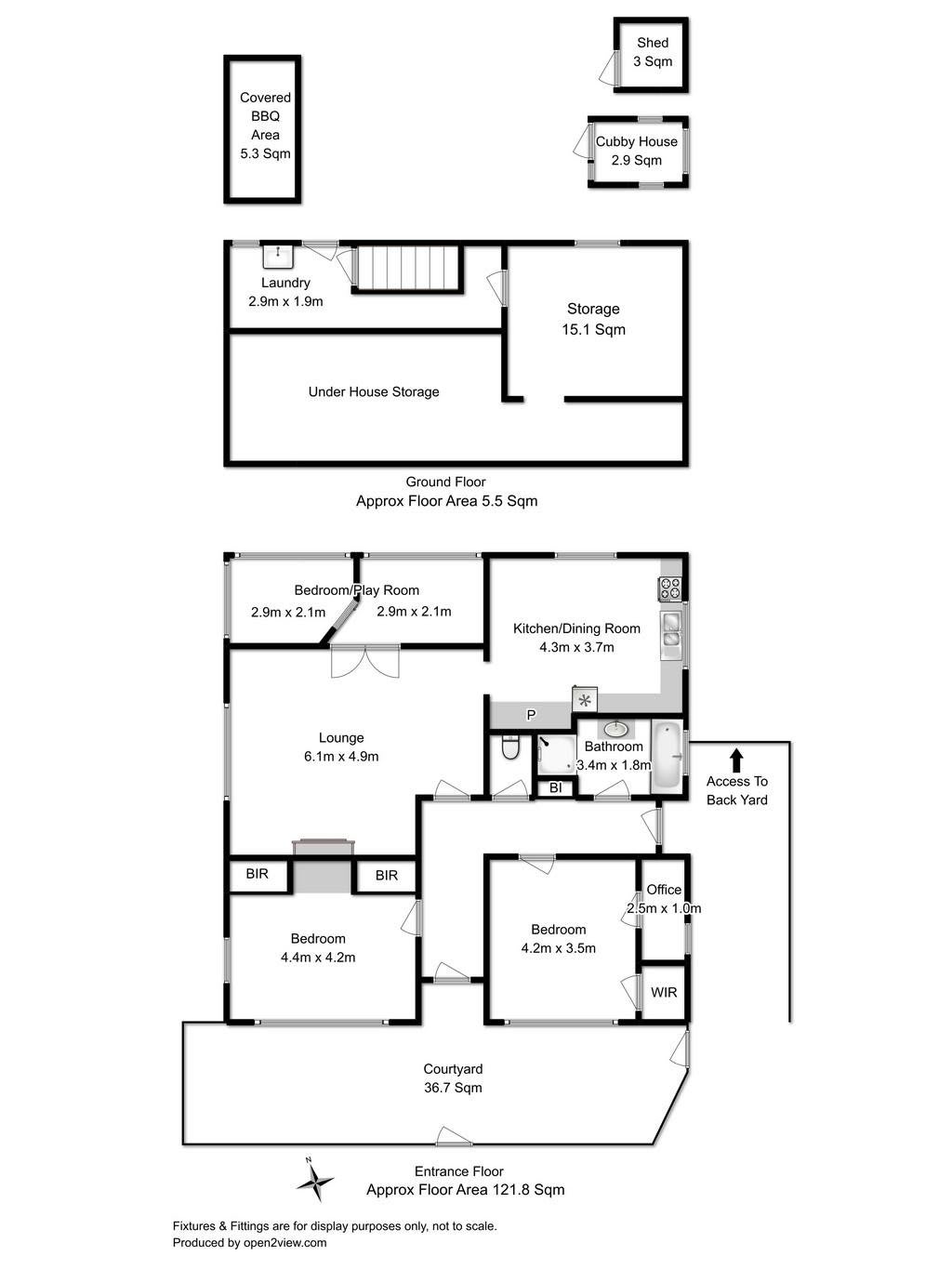

He describes the property as built over two levels, with the top level including two-bedrooms and one bathroom, and a kitchen. The kitchen and bathroom had both been renovated six months before purchase; however, the bottom level was unfinished with dirt floors and exposed concrete, including existing rooms that has been used as a laundry and a workshop.

Part of purchasing this property was renovating it. Roberts notes that to date the costs have been minimal as an outlay for fixing it up, and with the help of his father to cut down labour costs they have done most of the preparation for the unfinished rooms downstairs. The costs, including planning, which involves an architect, engineer and draftsmen, total $4,500 at present.

When asked to project the costs to complete the renovation of the property, he admitted this was a little tricker.

"Initially, the renovation encompassed turning the existing rooms on the bottom level into usable spaces,” he said. However, very recently he has taken the decision to expand the project and include an extension from the back of the house.

He noted this was due to previously unidentified issues, but said that his hopes were for additional equity to be unlocked by adding this part to the project. While his initial cost project for the renovation were at $25,000, the extension as pushed this up to somewhere between $60,000 and $70,000, yet to be finalised.

"When I was buying my first property, I found that there was a huge amount of information out there, but very little aimed at a novice."

The initial plans included an added bedroom and bathroom downstairs and a cosmetic fix. The new extension will be another bedroom and bathroom in the extension, a deck at the back of the house, a study/gym and large laundry/storage room in one of the pre-existing rooms.

“As this was my first property it was important to get it right,” Roberts explained of his investment strategy for the property.

“So while it had to have good capital growth prospects, the Tasmanian property market had been slow and showed little signs of picking up in the short [to] medium term. Therefore, the most important aspect was the ability to create equity through a renovation,” he said. This equity would then help fund future investments.

Q&A with Rhys on the next page. Please click below.

Property Observer asked Rhys Roberts some questions about his thoughts on investing, property and why he bought in the first place.

Where did your interest in property come from?

Basically from my parents. They had held rental properties in the past, and as Dad was a builder they had built or renovated properties throughout my childhood.

How have you educated yourself about property?

In my late teens I started to develop a keener interest in property (which stemmed from my first real job, and the realisation that I didn’t want to work for someone my whole life!). I read as many books and articles as I could get my hands on, and this continued into my early twenties, by which stage I began saving for my first property. At the time I bought it I thought I was pretty knowledgeable with property, but the buying process just highlighted how little I really knew. It was from there that I dug deeper and started reaching out to other likeminded people.

What was the journey to finding your first property?

I’d describe it as “long” (well it seemed it to me!). I first became serious about buying a property at 20, but at the time I was at University and working part-time, so saving was fairly difficult. At around 22 I decided to hit the saving hard, and I was lucky to have a pretty well-paying job and few expenses, so I could save up quickly. Looking back at it now, it only took around 3 years of serious saving to achieve a deposit, which in the scheme of things isn’t long, but at the time it seemed like forever!

As for finding the right place… once I was ready financially, it took around 6 months to find the one. I was pretty set on what I wanted, though. I knew that given the market in Tasmania was going nowhere fast, I had to create equity in another way. I didn’t have the capital to undertake a development (and the risk was too high for a first home buyer), so a renovation was the chosen method! It can be pretty disheartening looking at property after property, but in the end it was worth it, as the perfect property eventually came up.

What has been your biggest pitfall and your biggest highlight in property to date?

Biggest pitfall is the same as any first home buyer: lack of experience. There’s some things that research just can’t compensate for, especially given the depth and complexity of most property info out there. I’ve made mistakes, numerous ones in fact, but none of them have been disastrous, and I’ve learnt invaluable lessons from them.

Given that I don’t have a shiny portfolio property to brag about, I’d say my biggest highlight in property has simply been sticking to my goals and finding the perfect property. It would have been a lot easier to go with a 95% lend and buy a normal house, but I knew that wouldn’t get me where I wanted to be. Also, it’s not easy to be a first home buyer these days. Prices can be a barrier depending on where you live, and Gen Y have different priorities these days. When your friends are out partying and travelling the world, it can be tough to be working and saving… but I know it will pay off in the long run.

Have you had any hiccups in the renovation process so far?

The biggest hiccup was when I found out I couldn’t renovate on the bottom level to the extent I wanted. There were issues with the foundations that would have required a very expensive solution to fix if I wanted to continue with the original plan. The issues weren’t picked up by three builders, an architect or a draftsman, so they came as a surprise when the structural engineer identified them. Moral of the story is to involve the experts as soon as possible. Even if it costs a few hundred dollars to get someone along to give an opinion, it will pay off in the long run.

The Tasmanian property market had been slow, therefore the most important aspect was that he was able to to create equity through renovation.

In the end, however, it will work out better than previously. The renovation will work out better financially (and that’s the only result that matters to me), even if it takes a little longer. The number one thing I’ve learnt so far, and from my parents, is that you have to be flexible, able to problem solve quickly, and have endless amounts of determination and persistence.

What is the financial plan at the end of the renovation?

I sincerely hope to never a sell a property I buy, as I don’t see the point. Property is a long-term investment, and barring a true property dud, selling negates future growth opportunities.

Once the renovation is complete I will achieve around $100,000 in equity. This is enough to give me options, which is the name of the game!

Would you renovate again?

Definitely reno again. In fact, I aim to reno all investment properties I own. Even if it’s just a pure rental, a cheap and quick reno can add $10 or $20 onto the weekly rent, which adds up over the long-term.

What is the vision for the end of your property investing?

My end goal is to be completely financially independent by 40. I classify ‘financially independent’ as never having to work another day in my life for another person, unless I choose to. I don’t like to use the word retire, as I’ll hardly be sitting on a beach for the rest of my life. There is a very long list of things I want to achieve!

As for specifics… My goal is for $1.5 million in net assets that are wholly income producing. Given likely returns this will be enough to give me a very comfortable yearly income to live off. To achieve this in 10-15 years I estimate I will need around $6 million in total assets by then. These figures will be adjusted all the time, though. I expect that by the time I get close to it, my goals will have completely changed!

What is your back up plan for if things go wrong?

All of my investment properties will be under a discretionary trust and/or company arrangement (yet to be determined). In addition to this, I aim to always hold my first property in my name. Given the asset protection given by company and discretionary trusts, if everything were to go completely pear shaped, I would still have a property and my job to fall back on. Where possible, however, I aim to have an 80% LVR for all properties, as this provides a significant buffer, and also assists in keeping in the good books with lenders.

What advice do you have for other first timers?

Know what you want, and then work out the best way to get there. So many first home buyers rush into what is going to be the biggest financial decision of their lives so far (by a big stretch). Take the time to work out why you want to buy, because unless you know that, you’re opening yourself up for trouble. Maybe you’ll reach the conclusion that buying isn’t right for you, that renting suits your lifestyle needs better, and that’s fantastic! Decide what it is you want most, and pursue it with everything you’ve got.

It sounds like an intense plan, and Property Observer is keen to see how it pans out.

In the meantime, Roberts started up a site called The Property Dream to share information he had found and chat with other likeminded young investors.

“When I was buying my first property, I found that there was a huge amount of information out there, but very little aimed at a novice, and none that covered the buying process from start to finish for first home buyers,” he said.

“There were some resources that were close, but they always involved payment of some sort, and I think that such information should be freely available. It’s not a state secret, it’s basic information that everyone should know.”

He explains that given time he’d like to see a community of new buyers using the site, and sharing their own thoughts and information.

Are you a new buyer that would like to be profiled, or know someone who should be? Email jduke@propertyobserver.com.au