Rental growth easing but house prices are rising practically everywhere

While the real estate headlines are excitedly focusing on booming Sydney property prices let's instead take a look at what is happening to rents across Australia.

It is rare to see rents and dwelling prices firing at the same time or rising in concert strongly, and sure enough the June quarter inflation (CPI) data released this week revealed the trend in rental growth to be easing back across every Australian capital city.

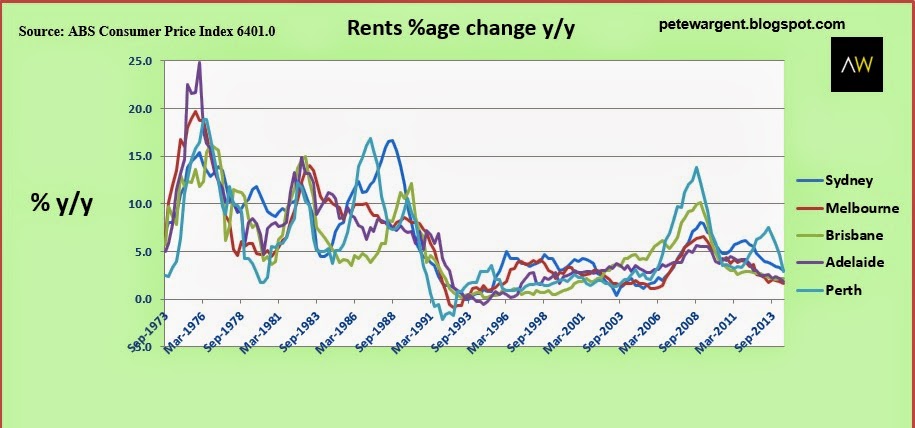

The long run inflation data shows how on a national basis rents have never fallen in Australia.

Rents did fall slightly for several consecutive quarters in Perth (cumulatively by 8%) and Melbourne (3%) following the onset of the early 1990s recession.

And around the turn of the century rents fell by 8% over a period of more than a year in volatile Darwin, before then booming outrageously from 2005 to 2010 to levels that could not have been predicted by even the most wildly bullish of analysts.

The above instances aside, nationally rents have risen relentlessly for more than 40 years:

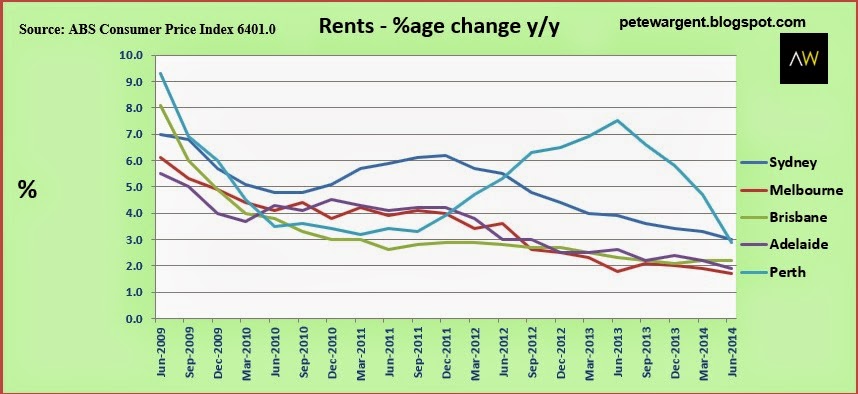

Zooming in the chart to cover the last five years in the major capital cities shows that rental growth is presently strongest in Sydney (+3.0% y/y) and Perth (+2.9%), but both cities have eased back after a strong half decade:

Rental growth is now quite weak in Melbourne (+1.7%) as an oversupply of certain property types begins to bite.

The fundamentals of the Melbourne property market now appear relatively soft, but the market environment needs a trigger to expose them such as rising unemployment or higher interest rates.

According to the CPI data, Brisbane and Adelaide have recorded year-on-year rental growth of +2.2% and +2.9% respectively.

However, it is abundantly clear from the above chart that the trend is now down in all cases.

For the purposes of completeness, below is what has been happening of late in the other capital cities:

Darwin continues to march to its own drum to some extent with some exceptionally strong rental growth over the past ten years due to its incredibly tight real estate market.

As at June 2014 Darwin's rents are still tracking at +4.8% year on year, although even in the Top End the trend is quite clearly now down.

Rental growth has been weak and has hit a prolonged plateau in Hobart (+1.2%), while Canberra is the most troubled of Australia's capital city housing markets.

With the labour market in mild disarray rents are sliding into negative territory in Canberra following on from negative house price growth over the past 12 months.

The Australian Capital Territory is the one location is been far better to be a tenant than a landlord over the last year.

Summary

In summary, rental growth is easing back or has eased back across all eight capital cities, but the compensating good news for property owners is that with fixed mortgage rates being slashed independently by the major banks, house prices are rising practically everywhere.

In Sydney's case, the market continues to boom, with house prices up by 17% in the last year and more than 25% since the market's most recent trough in 2012.

Spring will soon enough be upon us agai,n so it will be interesting to see how much of that price momentum can be maintained into the traditionally more active time of year.

Renting v buying in Sydney on the next page. Please click below.

Robust inner Sydney rental growth

One of the factors which can begin to put downward pressure on dwelling prices is when renting property becomes comparatively more attractive than buying it.

A few commentators dropped the ball last week when the Reserve Bank released a conveniently-timed research paper discussing just that point: whether folk may sometimes be better to rent property than buy it in the absence of accelerating dwelling price growth.

In doing so pundits perhaps missed the underlying point that the Reserve Banks is likely attempting to jawbone some speculative heat out of the market ahead of a now likely further interest rate cut.

Futures markets are seeing a rate cut to just 2.25% as increasingly likely, and, frankly, so am I.

Rents and prices rising

The stark reality for Sydneysiders over the past half decade is that life has been easier for property owners because while dwelling prices in the inner suburbs have been rising strongly, so too have rents.

As the RBA itself noted recently, the inner and middle ring suburbs are adding jobs and are seeing population growth rates well in excess of the state average...and New South Wales is also now adding the greatest number of heads per annum, notching up a massive +110,300 in 2013.

Over the past year, while pockets always exist where rents have overshot and are now falling back into line, rents in many inner suburb locations are continuing to rise well ahead of income growth and the inflation rate.

This is true both for inner Sydney units and apartments:

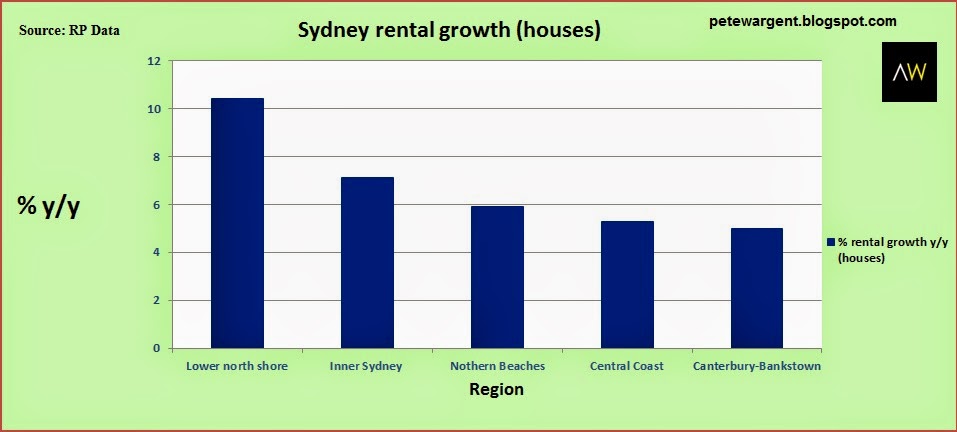

...and for inner Sydney houses:

The rental growth, like price growth, has largely been focused on suburbs closer to the Central Business District.

The RBA's research showed that a near identical trend has played out across every capital city over the past decade.

Renting has not become comparatively more attractive than owning over the past five years or so as borrowing rates continue to decline, dwelling prices are rising and so too are median rents.

In the inner suburbs of Sydney in particular, there is continuing upwards pressure on the housing market.

And, for the reasons noted by the Reserve Bank in their detailed research, this is set to continue due to dramatic demographic shifts towards inner city living.

You can visit AllenWargent property buyers (London, Sydney) or Pete's blog.

His latest book is 'Four Green Houses and a Red Hotel' .